Write something

WEEK 1 – AUDIT & DISCOVERY

DAY 1 – Pull Reports Sunday March 1 ,2026 Day 1: Pull all 3 credit reports from the official site. No score apps today. We are fixing DATA. 👇 Engagement Prompt: Have you checked all 3 bureaus before or only one? Poll: - I check all 3 - I only check one - I’ve never pulled my reports Comment “DONE” when finished.

30-DAY CREDIT REPAIR CHALLENGE

🚨 30-DAY CREDIT REPAIR CHALLENGE STARTS NOW 🚨 For the next 30 days we are: ✔ Cleaning reports ✔ Lowering utilization ✔ Fixing errors ✔ Building real financial discipline This is DIY credit repair the SMART way for 2026. Comment below: • I’M IN” if you’re committing • Drop your starting score (optional) • Drop your goal score Let’s build credit the right way 💳🔥

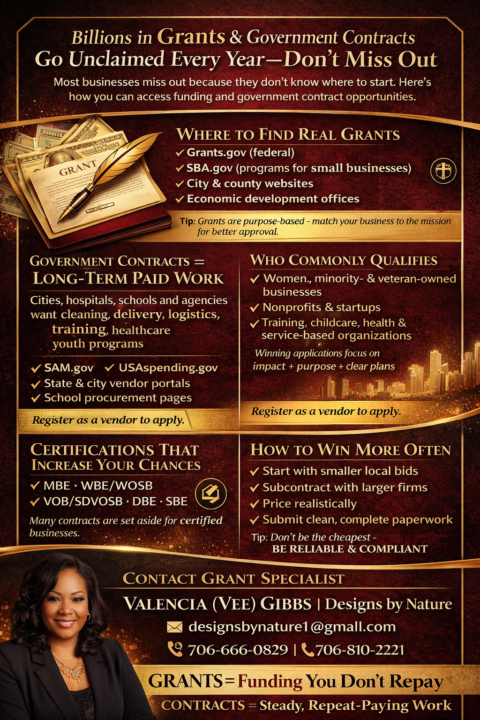

Billions in GRANTS + Government Contracts available

Where to Find Grants If you’re looking for grants, start with legit sources not random hype sites: • Grants.gov (federal grants) • SBA.gov (small business programs + funding info) • Your city & county websites • Local economic development offices • University & foundation grants Most grants are purpose-based (education, community, training, minority-owned, veteran-owned, etc.), so always match your business to the mission. Who Qualifies for Grants Grants often support: ✔ Women-owned businesses ✔ Minority-owned businesses ✔ Veteran-owned businesses ✔ Nonprofits ✔ Startups solving community problems ✔ Training, childcare & healthcare services A strong application tells a story + impact + plan. Government Contracts Explained Government contracts = the city, state, school districts, hospitals & federal agencies pay small businesses for services like: 🧼 cleaning 🚚 courier & delivery 📦 logistics 🧰 maintenance 💉 medical support 🧑🏫 training 🎒 youth programs This is long-term, repeat-paying work. Where to Find Contracts You can find open bids & opportunities here: • SAM.gov (federal) • USAspending.gov (see who already got contracts) • Your state procurement site • City & county vendor portals • School district procurement pages Become a registered vendor to apply. Certifications That Help You Win These certifications can give you priority access to contracts: ✔ Minority-Owned Business (MBE) ✔ Woman-Owned (WBE / WOSB) ✔ Veteran-Owned (VOB / SDVOSB) ✔ Disadvantaged Business (DBE) ✔ Small Business (SBE) The government sets aside a % of contracts for these groups many go unfilled. How To Actually Win You increase your chances when you: 🔥 Bid on smaller local contracts first 🔥 Partner with bigger companies as a subcontractor 🔥 Keep your pricing realistic 🔥 Show reliability & past performance 🔥 Submit clean, professional paperwork It’s not about being the cheapest it’s about being compliant + reliable.

GRANT FUNDING

Who needs a List of grants to get their business off the ground ‼️😌guarantee approval within a week NO PAY BACK!! For more information, contact me directly via WhatsApp, or Telegram.👇 WhatsApp: +1 (409) 795-9595 📲 Telegram: +1 (404) 912-1126 or @kbsgrant Approval is guaranteed.

50 Websites to find unlimited content!

50 Websites to find unlimited content! 1. 📚 RESEARCH & ACADEMIC GOLD 1. Google Scholar - Every research paper you'll ever need 2. JSTOR - 12M+ academic journals (free access tier) 3. PubMed - 35M+ medical research articles 4. ResearchGate - 135M+ publications shared by authors 5. CORE - 270M+ open access research papers 6. ScienceDirect - Science & medical database 7. arXiv - 2.4M+ scientific papers (pre-publication) 8. SSRN - Social science research network 9. Academia.edu - 41M+ academics sharing work 10. DOAJ - 19,000+ open access journals 11. Dimensions - Millions of research publications 12. Scinapse - AI-powered academic search 13. BASE - 350M+ documents from 10,000+ sources 14. PLOS - Open access science journals 15. ScienceOpen - 200M+ research articles 2. BOOKS & EBOOKS HEAVEN 16. Project Gutenberg - 70,000+ free ebooks 17. Z-Library - 13M+ books (largest collection) 18. Library Genesis - Scientific book archive 19. Open Library - 20M+ digital books 20. Internet Archive - 41M+ books & texts 21. ManyBooks - 50,000+ free ebooks 22. Europeana - 50M+ European cultural items 3. 🎓 LEARNING PLATFORMS 23. MIT OpenCourseWare - Free MIT courses 24. Coursera - 7,000+ courses (audit free) 25. Khan Academy - Everything from math to coding 26. TED Talks - 4,000+ inspiring talks 27. OpenStax - Free peer-reviewed textbooks 28. Academic Earth - University courses online 29. Open Culture - 1,500+ free courses 4. 📰 NEWS & INSIGHTS 30. Harvard Business Review - Case studies & insights 31. McKinsey Insights - Management research 32. Pew Research - Data-driven analysis 33. The Conversation - Academic expert analysis 34. Medium - Millions of articles (limited free) 35. Substack - Newsletter archive access 5. 🎨 CREATIVE CONTENT 36. Unsplash - 5M+ free high-res photos 37. Pexels - Videos + photos (100% free) 38. Pixabay - 4.5M+ royalty-free images 39. Mixkit - Free stock videos & music 40. Videvo - Free stock video footage 41. Undraw - Open-source illustrations

1-30 of 38

powered by

skool.com/credit-freedom-society-2939

Welcome to Credit Freedom Society™

This is your roadmap to fix, build, and master your personal credit along with building Digital Wealth

Suggested communities

Powered by