Write something

💥 Want My Credit Freedom Society Toolkit + Custom Content Hooks?

We’re almost at 200 members (currently at 163 🎉), and I want to celebrate with something special to help you grow your brand and boost your visibility. When we hit 200 members, I’ll choose 3 people to receive: 🧰 The Credit Freedom Society Toolkit — a downloadable bundle of plug-and-play business tools I personally use to grow, organize, and monetize 🧠 A Content Hook Reboot — I’ll personally rewrite 3 of your content ideas or posts with magnetic, scroll-stopping hooks to attract real engagement How to enter: 1. Drop a link to your About page (or introduce yourself!) in the comments 2. Like 3 other comments from members you vibe with 3. When we hit 200, the 3 comments with the most likes win both rewards! ✨ Want to help us grow faster? Invite someone who needs this community — or share the link in your own space. ➡️ Don’t have a community yet and want to start your own?Here’s the link to get started:👉 https://www.skool.com/signup?ref=79913951ff81459f81fdf8452c0c7973 Let’s grow together — smarter, stronger, and with support 💬🔥

What’s the invisible barrier nobody sees but you feel every day?

Sometimes the hardest obstacles aren’t external. They’re mental. Emotional. Internal. Self-doubt. Perfectionism. Fear of judgment. Burnout. Comparison. This community isn’t about pretending everything’s perfect. It’s about growth. So tell me: 👉 What’s the internal roadblock that’s holding you back right now? Your honesty might unlock someone else’s breakthrough.

More Story-Driven

I remember refreshing my store and seeing $0 days. Now I refresh and see 5-figure months. The difference, Skill stacking. Learning product research. Understanding marketing. Improving customer experience. E-commerce became the engine that fuels everything else I’m building. And the crazy part is it’s more accessible than people think. If you want to know how I approached it from scratch, I’m happy to connect.

0

0

Quick reflection post 🙏🏽

This time last year I was stressing about income. Today, my e-commerce store brings in consistent 5 figure months. The biggest shift wasn’t money it was mindset. I stopped looking for quick wins and started focusing on systems, data, and consistency. What I love most is that it gave me leverage. I’ve been able to invest into my other business ideas without touching personal savings. That freedom hits different. If you’re building right now and not seeing results yet keep going. The compound effect is real.

0

0

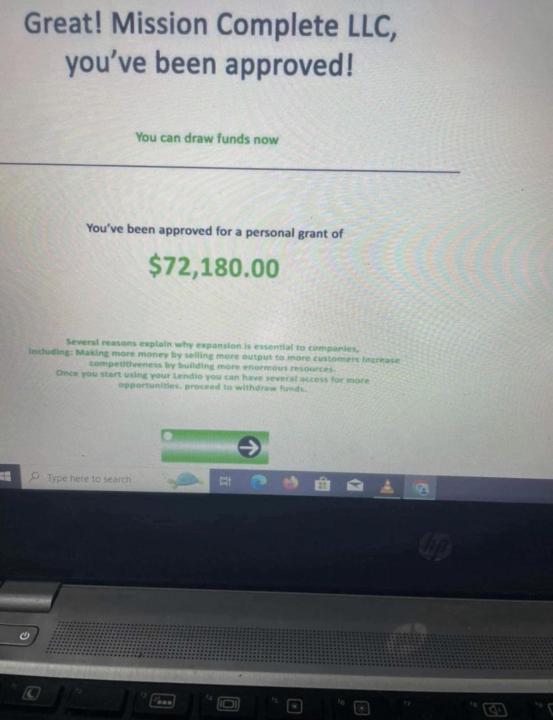

GRANT FUNDING

Who needs a List of grants to get their business off the ground ‼️😌guarantee approval within a week NO PAY BACK!! For more information, contact me directly via WhatsApp, or Telegram.👇 WhatsApp: +1 (409) 795-9595 📲 Telegram: +1 (404) 912-1126 or @kbsgrant Approval is guaranteed.

1-30 of 62

powered by

skool.com/credit-freedom-society-2939

Welcome to Credit Freedom Society™

This is your roadmap to fix, build, and master your personal credit along with building Digital Wealth

Suggested communities

Powered by