Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

804 contributions to Invest & Retire Community

Congrats to the Top 10 Contributors for Feb 2026 and announcing March 2026 Prize

In Investing Accelerator, we are starting a new monthly prize pool for top 10 most active members Congratulations to the following 10 people for being the most contributing members of the community: 1) @Rong Zhou 2) @Leon K 3) @Lindsay Talbot 4) @Sharon Yuen 5) @Monica Bernard 6) @Kim Huynh 7) @Cris Bob 8) @Sukhwinder Dhanoa 9) @Kevin Esmati 10) @Sandra Van Den Ham I (Michael) will contact you in the chat to provide you with the gifts. You will receive: 1 share of IBIT $37 USD To show proof of purchase, you must post in the community that you received the share. For next month March, the prizes will be: 1 share of IBIT (iShare Bitcoin Trust by BlackRock) (https://www.skool.com/investing-accelerator/-/leaderboards) Investing Accelerator Incentives: Get Richer by Helping Others Succeed 1. 🎁 Join Investing Accelerator for Free: Share the "How to Join Investing Accelerator for Free" guide with a friend. If they join, you both earn the referral fee. Learn More (https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free) 2. ⏱️ Speed & Success Bonus: Complete the program within 90 days and pay off the remaining balance to get 10% off the balance. 3. 📈 Trading Milestone Rewards: - First 30% Return from a Single Trade: Share your success in the community to receive a free stock. - 30% Portfolio Return in One Year: Achieve a 30% annual return to earn another free stock (once per year). 4. Student Referral Program: Refer a friend to join Investing Accelerator and you both earn $1,000 USD + a free stock each. Learn More (https://5mininvesting.com/free-case-study/)

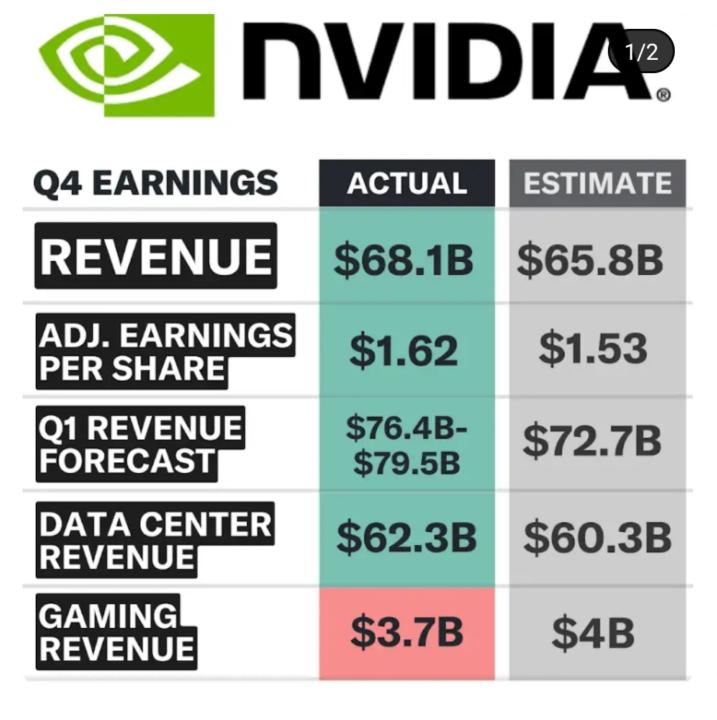

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

AMD clinches second mega chip supply deal, this time with Meta

Advanced Micro Devices said on Tuesday it has agreed to sell up to $60 billion worth of artificial intelligence chips to Meta Platforms over five years in a deal that allows the Facebook owner to purchase as much as 10% of the chip firm. AMD is up 15% pre market.

1-10 of 804

@sukhwinder-dhanoa-4450

I am an engineer, who loves to try new hand on stuff. I live spending time with nature.

Active 12h ago

Joined Jan 3, 2023

Powered by