Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Andra

Embrace Sustainability in Business 🗝💡Innovate boldly to Raise meaningful capital 📈Deliver positive Impact in Society, in the World 🌎 💯

Memberships

12 contributions to Has2BGreen

Diagrams and checklists

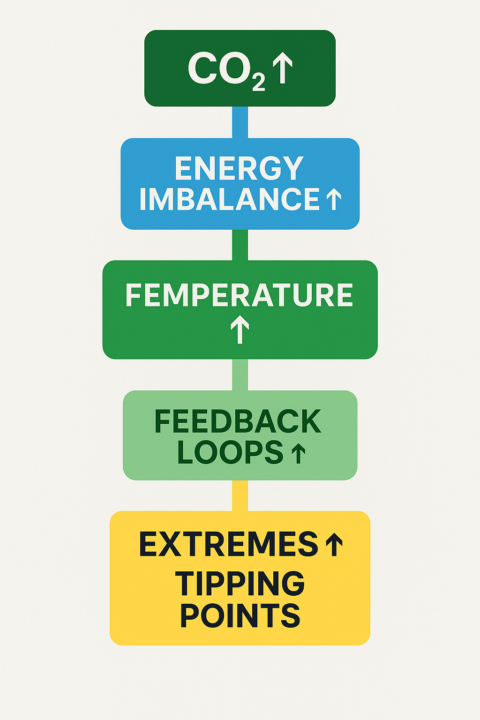

I do love a good diagram - but they can take ages to create. Here are four that all tell the same story - which one do you prefer? 1. ChatGPTs version 2. My version - Midjourney and Canva 3. Notebook LM V1 4. Notbook LM V2

First youtube video uploaded to Youtube!

To make an impact, people need to know you exist. To do that, you have to put yourself out here - not just out there within Skool, which feels like a friendly kind of place - but out there in the wider world. So these last two weeks have been about writing scripts, recording videos, making thumbnails and uploading files to YouTube. Here is the link to the first one! The plan is to post one a week for the next 12 weeks. Since they are all already created, it is simply about posting them. Tomorrow, they will all be uploaded to YouTube and scheduled for release.

📢 New Lesson: 10. What This Means for Climate

Today we’re releasing the final lesson in the main billionaire–climate series: What This Means for Climate — how all nine mechanisms shape the world we are now living in. This lesson pulls everything together. It shows how billionaire wealth doesn’t just coexist with the climate crisis — it requires and accelerates it. Not through individual intent, but through the structure of the system. If you’ve felt the pieces building across the last nine days, today they click into place. 👉 Start the lesson here 🔥 What you’ll learn today This lesson ties all nine mechanisms back to climate action and climate risk. You’ll learn how: 1. Extreme wealth requires extreme extraction More materials, more energy, more emissions. 2. Cost externalisation pushes climate costs onto the public Floods, fires, pollution, health impacts — all shifted outward. 3. Market dominance slows the clean-energy transition Monopolies protect the status quo. 4. Shareholder pressure intensifies environmental harm Short-term wins trump long-term climate stability. 5. Tax avoidance weakens society’s ability to prepare and adapt Less money for resilience, protection, infrastructure, and justice. 6. Lobbying shapes the rules that shape the climate Regulation is slowed, watered down, or blocked entirely. 7. Debt leverage fuels expansion of high-emission industries More drilling, more extraction, more global supply chains. 8. Public subsidies keep harmful sectors alive Fossil fuels, aviation, shipping, and industrial agriculture. 9. The billionaire feedback loop accelerates everything More wealth → more influence → more extraction → more emissions. This 10th lesson shows the full picture: billionaire wealth and climate justice are structurally incompatible. Not because billionaires are bad people. But because the system demands behaviours that harm the climate. 💬 Your Activity for Today Question:

1 like • 18d

When there's a lack in political decisions that protect the public, the entire list of costs arive to be transfered to the public, in time; But how we can see, people can walk even through waters 🤷♀️ ; One of the only few things that can change this context, is what is in my purpose, to develop conscious leadership ⚙️

📢 New Lesson: 3. Shareholder Pressure

Today’s release is Lesson 3 in our billionaire–climate series: Shareholder Pressure — the hidden engine behind “growth at any cost.” This is one of the most important mechanisms in the entire system. It explains why companies: - cut wages - externalise costs - underinvest in safety - resist climate action - favour short-term profit over long-term stability And why CEOs can’t — even if they wanted to — simply “do better.” Shareholder pressure makes everything else in the system more intense. 👉 Start the lesson here 🔥 What you’ll learn today This lesson walks through the real cycle behind corporate behaviour: 1. Shareholders demand rising quarterly profits 2. Companies cut costs and increase extraction 3. Short-term profits rise 4. Share price goes up 5. CEO compensation rises with it 6. Pressure increases → and the cycle repeats This loop pushes companies toward behaviour that harms: - workers - communities - ecosystems - climate - long-term resilience It’s not an accident — it’s the structure. 💬 Your Activity for Today Question: Where have you seen signs of this shareholder pressure cycle in companies you interact with? Examples might include: - sudden cost-cutting - reduced quality - mass layoffs - price rises after mergers - “efficiencies” that look like corner-cutting - products designed to fail sooner - environmental shortcuts - Even a small example helps people connect the dots. 🌱 Tomorrow’s Drop Lesson 4: How CEOs Build Massive Wealth — and why it’s tied to the system, not personal genius.

1 like • 22d

Actually, prices rises after mergers happen, and it's not positive to happen especially in a host country; where companies are based on foreign investments; and more of that, happen in industries where companies transfer any inflation, directly to consumers; to change these practices, it needs changes in economical systems and in how things work for decades; so it needs political leadership!

📢 New Lesson: The Monopoly Pathway

Today we’re releasing Lesson 2 in our billionaire–climate series: The Monopoly Pathway — how companies quietly move from competition to control. This lesson shows how monopolies don’t usually happen with big dramatic takeovers. They grow through a predictable, almost invisible sequence that slowly removes choice, raises prices, and locks entire industries into high-carbon systems. 👉 Start the lesson here 🔥 What you’ll learn today We walk through the progression from: 1. Low prices 2. Undercutting rivals 3. Buying competitors 4. Market dominance 5. Higher prices & reduced quality 6. Once a monopoly forms, that power is used to: - influence policy - block climate action - control supply chains - maintain harmful systems 💬 Your Activity for Today Question: Where do you see signs of monopoly behaviour in your day-to-day life? It might be: - tech platforms - supermarkets - energy suppliers - delivery companies - finance - media - agriculture - transport - Even a small example helps others see the pattern. 🌱 Tomorrow’s Drop Lesson 3: Shareholder Pressure — why “growth at any cost” has become the default.

1 like • 26d

When you are inside systems, it's difficult to find your way and keep your values at the same time; you must play a role; and try to find logical and fair systems as much as possible; it's difficult to win than you understand patterns; but, the "winners never quite" ; But, when you are outside the systems, money faucet is almost closed; this is what I know

1-10 of 12

@andra-cretu-4886

I believe Businesses can truly Make This World To Be Better🌏I can train you to implement Sustainability in your Business to Increase Revenue & Impact

Active 21m ago

Joined Oct 17, 2025