Activity

Mon

Wed

Fri

Sun

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Owned by Alex

Memberships

Four Weeks To Profit

464 members • Free

Skoolers

174.9k members • Free

DeFi University

147 members • $97/m

AI Mastermind

3k members • $49/m

5 contributions to DeFi University

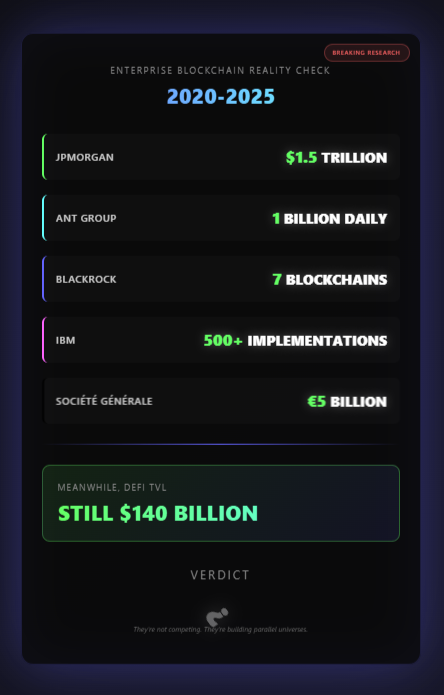

Enterprise Blockchain - Research Aug 2025

I just finished analyzing EVERY major bank and tech giant's blockchain strategy from 2020-2025. JPMorgan: $1.5T processed. Ant Group: 1B daily transactions. BlackRock: $1B across 7 chains. IBM: 500+ implementations. The verdict? Enterprise blockchain isn't killing DeFi—it's creating a $213B parallel universe by 2031. But here's what nobody's talking about: Which European bank has already issued €5B in digital bonds? Why is Société Générale experimenting with actual DeFi? And how is Sony about to bridge 100M+ consumers to Ethereum? This research answers 30+ critical questions every DeFi investor needs to know. Including the one that matters most: Where's the opportunity in this massive shift? So... WDYT? (Full research breakdown below - 15 min read)

Going Offline for a while: Whats your strategy?

Hey Team. I'm planning to bounce out for a week or so, and I won't have access to my computer to monitor my positions. My current portfolio is simple: 1. Leveraged LP on Defi Tuna. Upper and Lower limits are set to stop me out at the edges of both ranges should there be a major swing. 2. Regular LPs on Orca. Wide range is set on a SOL/USDC pool which has been in range for several weeks now. 3. Small Position on Aerodrome: WETH/USDC I'm interested in learning how y'all handle your positions while you're out of pocket (1-2 weeks). Do you close all your LPs and go spot or are you comfortable keeping your positions open. Considering current market conditions what do you think? Thanks for the discussion.

0 likes • Aug 27

For LPs, just like Jiri said. Another option is to leave them as is or to set wider ranges if you want fees. Out of range means you wait until price comes back in range. Leveraged positions, that’s risky. I typically close or reduce size or liquidation risk. Or monitor once a day, or once a week depending on your strategy and habits around this

ETH Bull Flag on the Hourly? New ATH's This Week?

At all time highs, ETH pulling back and putting in a nice bull flag. Think we break out and push to above $5k this week?

Live Call today

Is the live at this time? Or Am I the only one in the waiting room?

Live Sessions - Subscribe to All

Is there a way to subscribe to all of the live sessions at one time vs one at a time?

1 like • Aug 4

But in my calendar, I just check the option 'repeat every week' 1. Since the link to the Zoom room is the same fro each and every call, you can totally do that. 2. Since the meeting times are now at the same time, fixed times as of August 2025, we don't need to make any changes to the repeat meetings / events. Hope that helps, Dan. :

1-5 of 5