Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by David

Master DeFi from beginner to advanced. Security-first curriculum, live mentorship, gamified learning. Join us and build DeFi expertise safely.

Memberships

361 contributions to DeFi University

📊 BTC x Software: The Correlation You Can't Ignore

Quick observation from the charts: Bitcoin and IGV (iShares Expanded Tech-Software ETF) have been moving in near-lockstep since 2023. What we're seeing: - Both assets rallied hard through 2024, peaking around the same time - The recent pullback? Nearly identical trajectory - BTC currently at ~$69.9k, IGV at $82.46 - both down from recent highs Why this matters: This tight correlation tells us Bitcoin is still trading as a risk-on tech asset, not the "digital gold" narrative many hoped for. When software stocks sneeze, BTC catches a cold. For DeFi investors: - Macro tech sentiment matters MORE than you think - Fed policy, tech earnings, and Nasdaq movements should be on your radar - Diversification within crypto alone isn't true diversification if you're ignoring the tech correlation The days of "BTC is uncorrelated" are behind us. We're in the institutional era now - which means macro matters. What are you watching to gauge risk sentiment? Drop your thoughts below. 👇 Not financial advice. Chart analysis for educational purposes.

3

0

📈 The Art of Pyramiding: How Legendary Traders Build Massive Positions Without Blowing Up

What's good, traders! 🎯 Today we're diving into one of the most powerful—and most dangerous—position sizing techniques in trading: Pyramiding. This is how Jesse Livermore, Nicolas Darvas, and the Turtle Traders built positions that turned small accounts into fortunes. It's also how countless traders have blown up their accounts by doing it wrong. The difference? Systematic execution and rigid risk control. This post breaks down the math, the methods, and the mechanisms that separate the legends from the liquidated. Let's get into it! 🚀 🎯 What Is Pyramiding? Pyramiding is the practice of adding to winning positions as they move in your favor. Instead of entering your full position at once, you: Start with a small "probe" position Add to it ONLY if it's profitable Use unrealized profits to finance additional risk Build a massive position while keeping realized risk minimal The Core Principle: Anti-Martingale 🎲 This is the OPPOSITE of Martingale (doubling down on losses). Martingale (Bad): Lose → Double position size Lose → Double again Eventually you run out of capital Statistical ruin is inevitable Anti-Martingale (Good): Win → Increase position size Lose → Decrease position size Losses stay linear, gains become exponential Captures "fat tail" positive events (massive runs) The Philosophy: When you're winning, the market is telling you something. The trend is real. The momentum is there. The "line of least resistance" is in your direction. So you lean into it. When you're losing, you get small. When you're winning, you get BIG. 💪 💰 The "House Money" Concept Here's the brilliant part: once your initial position is profitable, you're playing with "house money" (unrealized profits). Example: Initial Position: Buy 100 shares at $100 Risk per share: $5 (stop at $95) Total risk: $500 Price moves to $110: Your position is up $1,000 (unrealized profit) You have "house money" of $1,000 Add to Position: Buy 50 more shares at $110 Move stop on ALL shares to $105 (your AEP)

0

0

🛠️ Behind the Scenes: How to Deploy a $XXM Private Credit Facility (Technical Deep-Dive)

Hey builders! 👨💻 Most of you have seen the previous post about the Euler Private Credit Facility and how it's generating 20-33% APY for whitelisted participants. But today we're going DEEP on the technical implementation—how you actually DEPLOY one of these things. This is for: 🏗️ Protocol developers building similar systems 🔧 DevOps engineers managing DeFi infrastructure 🧠 Technical enthusiasts who want to understand how institutional DeFi actually works 📊 Risk managers who need to audit these systems If you're not technical, this might be dense. But stick around—understanding the deployment process reveals a lot about the security and risk management involved. Let's build! 🚀 🎯 What We're Actually Deploying The Euler Private Credit Facility isn't just "one smart contract." It's an orchestrated system of multiple components working together: The Core Stack: ✅ EulerRouter: Oracle routing and configuration manager ✅ HookTargetAccessControl: The whitelist bouncer + emergency pause system ✅ FixedRateIRM: The interest rate model (that magical 0.25% APY) ✅ EVault: The actual lending vault (deployed via factory) ✅ PendlePtOracleAdapter: Connects Pendle markets to Euler ecosystem Think of it like deploying a bank, except it's all code and one mistake could drain millions. No pressure! 😅 📋 The Four-Phase Deployment Process Professional DeFi deployments follow a RIGOROUS process. You don't just "yeet contracts to mainnet and hope for the best." Here's how it actually works: 🔬 Phase 1: Pre-Deployment Validation (The "Please God Don't Get Rekt" Phase) Before touching mainnet, you validate EVERYTHING in a controlled environment. Step 1: Unit Testing with Foundry bashforge test This runs your entire test suite. You're checking: ✅ Hook configurations work correctly ✅ IRM (Interest Rate Model) calculates rates properly ✅ Oracle wiring is correct ✅ Access control logic functions as expected ✅ Edge cases don't cause reverts If ANY test fails, you do NOT proceed. Period. 🛑

0

0

🏦 The Private Credit Facility That's Printing 25-90% APY (And Why You Can't Access It... Yet)

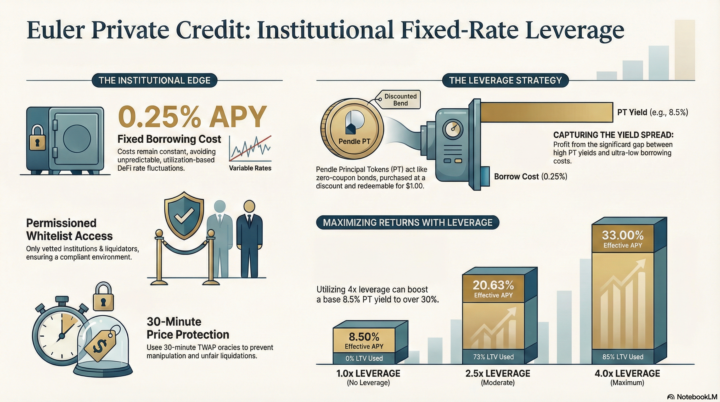

What's up DeFi degens! 💰 Today we're breaking down one of the most interesting institutional plays in DeFi right now—the Euler Private Credit Facility. This is essentially a "members-only lending club" built on Euler v2 that's allowing whitelisted participants to leverage Pendle Principal Tokens at a fixed 0.25% APY borrow rate to generate returns in the 20-33% range. Yeah, you read that right. 0.25% fixed borrow rate. And before you ask: no, you probably can't access it (it's permissioned/whitelisted). But understanding how it works is valuable because: (a) it shows where institutional DeFi is headed, and (b) similar opportunities might emerge in permissionless protocols soon. Let's dive into the mechanics! 🚀 🎯 What Even Is This Thing? The Euler Private Credit Facility is a permissioned lending protocol built on top of Euler v2's modular architecture. Think of it as a private lending club where only vetted/KYC'd institutions can participate. The Core Differentiators Regular DeFi (Aave, Compound, etc.): ✅ Open to anyone, fully anonymous 📊 Variable interest rates (based on utilization) 🤖 Open liquidation competition (MEV bots everywhere) 🗳️ Token-based governance Euler Private Credit Facility: 🔐 Whitelisted only (vetted participants) 📌 Fixed interest rates (0.25% APY) 👥 Whitelisted liquidators only 🏛️ Multisig controlled (3-of-5+) The game-changer here is that fixed 0.25% APY borrow rate. In normal DeFi, rates can spike from 3% to 15% overnight when utilization increases. This facility offers total predictability. 💎 The Secret Sauce: Pendle Principal Tokens (PT) To understand why this facility is so powerful, you need to understand what Principal Tokens are. Pendle Finance 101 Pendle splits yield-bearing assets into two components: YT (Yield Token): Claims the yield/interest PT (Principal Token): Claims the principal/face value at maturity PT tokens are basically zero-coupon bonds on-chain. 🎫 How PT Tokens Work Think of them like discounted gift cards:

1

0

💰 Cheat Looping: The DeFi Leverage Hack That Institutions Don't Want You to Know

Hey fam! 👋 Today we're diving into one of the most efficient leverage strategies in DeFi pioneered by Stephen TCG over at the DeFi Dojo—something that'll make you wonder why you've been doing manual loops like a caveman this whole time. This is Cheat Looping, and it's basically the difference between building IKEA furniture with a screwdriver vs. a power drill. Same result, WAY less pain. 🔧⚡ 🤔 The Problem: Traditional Looping is PAINFUL If you've ever tried to build a leveraged position in DeFi, you know the traditional method is brutal. The Traditional Loop Cycle: 1. Deposit collateral (let's say USDC) 2. Borrow against it (get ETH) 3. Swap the borrowed ETH back to USDC 4. Deposit that USDC as more collateral 5. Borrow more ETH 6. Swap again 7. Repeat... and repeat... and repeat... 😵💫 To hit 10x leverage? You're looking at 20+ transactions. The Hidden Costs That Destroy Your Returns Every single loop hits you with: - Swap fees (0.3% to 1% each time) - Slippage (especially painful in thin liquidity) - Price impact (moving the market against yourself) - Gas costs (not huge on L2s but still adds up) - Time (sitting there clicking buttons for 30 minutes) By the time you're done looping to 10x leverage, you might have burned 3-5% of your principal just on fees and slippage. That's months of yield you need to earn back just to break even! 📉 The Liquidity Death Spiral: Sure, there are automated looping tools like Contango or Oiler's multiply feature. But if you're working with anything except the deepest liquidity pairs, these tools can absolutely wreck you with price impact. You think you're getting 10x leverage but you're actually getting 8x leverage and a 15% haircut on entry. Not ideal. 🎯 Enter: The Cheat Loop Cheat Looping is a completely different approach. Instead of looping a small amount multiple times, you use your ENTIRE portfolio capital to open ONE position at maximum leverage, then use the borrowed funds to seed your other positions.

1-10 of 361

@david-zimmerman-7358

Professional DeFi Trader and Founder of DeFi University. Bought my first BTC in 2012.

Active 4h ago

Joined May 22, 2025

Powered by