Write something

Freight is Fast. Cash is Slow.

I'm a big fan of the TV series "Narcos". In one episode, Pacho Herrera of the Cali cartel (that guy in the photo) explains to his Mexican counterpart the problem with the business. "Cocaine is fast. Cash is slow" (Bear with me, there's an announcement coming. 🧐) His problem was the logistics. A kilo of cocaine was easy to move. But for every kilo, there was a mountain of heavy banknotes to move back to Colombia. For the Mexican intermediary, this caused a delay in getting paid and a cash-flow squeeze. Freight brokers have a similar problem. No, not one that will put them behind bars for the rest of their lives 🤪 Carriers will pick up your shipper's load tomorrow. They'll move it fast. But they then expect to be paid in maybe 7 or 14 days. If your authority is brand new, they might even want cash up front. Your shipper, on the other hand, will take their time and pay you in 30, 45 or even 60 days. This is a hard, hard fact about brokering. It's immovable and unchangeable, and one of the reasons brokers charge the margins they do. Over-simplified calculation: 20 loads a week at $2300 per load to the shipper and $2000 to the carrier means a profit margin of $300 per load and $ 6,000 per week, or $24,000 per month. All good? Not quite. I pay carriers net 7 and my average shipper pays in net 30. I have a 23-day gap during which I have to carry the receivables. In week1 , no cash moves, but in week 2, I have to start paying the carriers. $40,000. In week 3, another $40,000 and another $40k. Only in week 4 does cash finally start coming in from the shippers. By this stage there is a hole in my bank account of over $130,000! Because I've got to keep paying carriers, it only comes down slowly. Missed payments to shippers will get you a bad reputation faster than cockroaches in your kitchen. **Brokers without a float can go out of business as a result of their own success.** This is why most brokers use factoring. Factors pay you an advance on your invoices, so you can pay your shippers on time.

1

0

What Kind of Mindset Wins in Brokering?

1. Don’t wait for the right moment The right moment rarely shows up on its own. Action creates clarity. Action creates energy. Strong people don’t wait for momentum. They build it. 2. Aim higher with your effort Low-value tasks steal time and attention. High-value opportunities move your business forward. If everything feels urgent, nothing is important. Protect your time so bigger wins can happen. 3. Decide who you are Growth is hard. Setbacks happen. That part doesn’t change. What changes is how you see yourself. When your identity is “I can handle this,” obstacles lose their weight and progress speeds up. ❓ What's on your agenda today ❓

1

0

We Just Hit 200 members

Very excited at hitting another milestone. Thanks to you all for being a part of this.

1

0

Should You Really Be Thinking About Starting Your Own Brokerage?

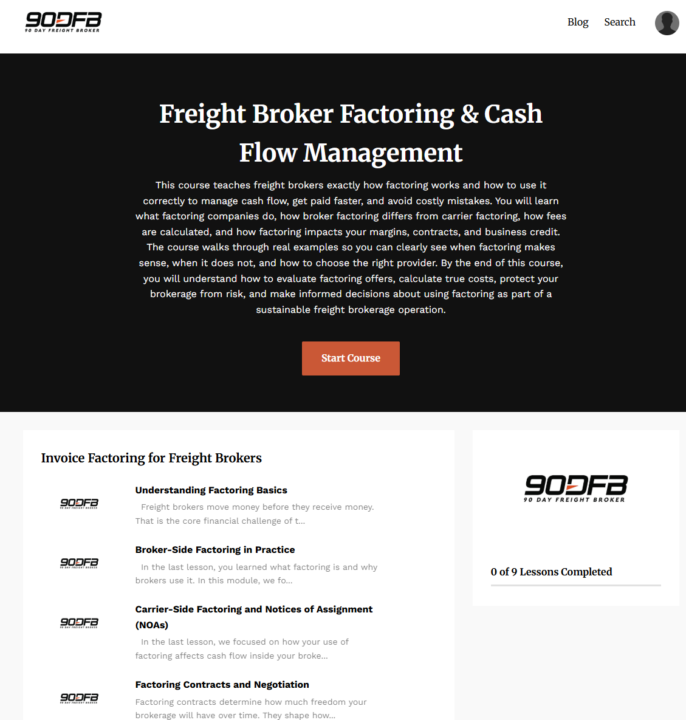

The short answer is absolutely "yes". If you're committed, you can do this. The slightly longer answer might be "not yet". Even though freight brokering can be a low-cost start-up home business, it's not nothing. At a minimum to start, you're going to need: - A good enough credit score to get a surety bond, and cash to pay that bond. (Or $75k in cash in trust fund). - Cash for insurance - A space to work that's equipped (Desk, PC, phone) - Cash for load board and software subscriptions Then, the next bit is tricky: a cash float. Why? Carriers want paid fast. Shippers pay slow. Sometimes, when you're new, carriers want 50% up front and 50% on delivery. The shipper might pay you in 30 days... or 45 ... or... So, to manage your cash flow, you need a cash float. You can handle this with: 1. Savings 2. A line of credit 3. Invoice factoring Most new brokers aim to rely on the last of these, factoring. But what happens if the factoring companies won't take you on board because a) you're new b) you're credit ain't good or c) they don't trust your customers? That takes you back to options 1 or 2. From next week, we'll be offering a new course "Freight Broker Factoring & Cash Flow Management". It includes a module "How to pay carriers as a new broker" This will be included as part of the full "90-Day Freight Broker" training program. (Just another reason to get the whole damn thing - BOOK A CALL). BUUUT, what happens if you're not ready to go all in, if you're not ready financially? We also have a new Freight Agent Training Program. This takes the best from the broker program and adds some agent-specific training at a lower price. You can get it today, right here

1

0

Burnt out at your brokerage… and thinking “I want my own thing”? Read this first.

If you’re feeling capped by the shop you’re at (hours, travel, pressure, constant fires)… you’re not alone. I see this exact sentiment all the time: “I was getting burnt out from the hours and travel, so I decided this would be the best time for me to try this on my own…” “…see if I could make it work without a large asset based transportation company supporting me.” You CAN build your own brokerage without a massive company behind you — but the way most people do it is backwards. The mistake I see over and over: People quit, file for authority, buy tools… and hope the customers show up. That’s not a plan. That’s a stress test. The better path (the “Exit Ramp” approach): If you’re serious about going independent, you need 3 things before you take the leap: 1) A runway plan (so you don’t panic-sell freight) - Know your monthly number - Know your minimum cash cushion - Know your “first 30 days” plan (daily actions, not wishful thinking) 2) A shipper acquisition system (not motivation) - Who you’re targeting (industry + lane + shipment type) - What you’re saying (script + email + follow-up cadence) - How you’ll keep your pipeline full even when you get ignored 3) An operations “back office” you can run lean - Carrier vetting + documentation standards - Rate confirmation + dispatch rhythm - Simple process for invoices / payables / visibility So you don’t drown in details while trying to sell. ✅ If you have those 3 pieces, you don’t need a giant asset-based company to “support you.” You just need a clear, repeatable system. What’s burning you out most right now?

Poll

Cast your vote

0

0

1-30 of 33

skool.com/90dfb

Learn to broker freight, get insider tips, ask real questions, and land your first shipper in 90 days or less—without making 150 cold calls a day.

Powered by