Write something

FundedAlgo Elite is officially live 🚀

Happy Tuesday Traders! FundedAlgo Elite is officially live! Both the Backtester and Indicator are now available to claim here via Whop: https://whop.com/tradealgorithm/elite-program/ This is a fully equipped algorithm combining advanced algorithmic logic with many new features. To get started, we've released a complete guide inside the classroom here: Quick Summary: The Indicator is the tool used to set alert notifications for your strategy. The Backtester allows you to test different setting and feature combinations across various markets and timeframes. Strategy templates are coming soon, but these tools have everything you need to start building your setups now. Plus, you'll soon be able to automate your own strategy via our new platform. More info coming soon. If you have any questions, drop them below and we'll be happy to help! Click for the guide on new FundedAlgo Elite indicator.

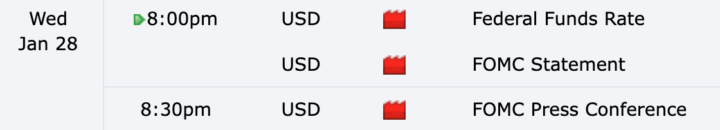

FOMC&Federals Funds Rate soon.

Heads-up team: FOMC news events ahead. Expect elevated volatility, sharp spikes, and unpredictable whipsaws. This event has a significantly high level of importance, and most probably will show the further direction of markets. To avoid unnecessary risk during the event window, all Automation trades are closed before the news (20.00 CET) and new entries will be paused around the release. This is a protective measure to prevent spread widening, slippage, and sudden liquidity gaps from impacting results. Trade safe and manage risk accordingly.

7

0

🚀 New Elite Tool Coming Soon: FundedAlgo Elite Indicator & Backtester

Hello team, Great news, we've been hard at work behind the scenes developing the FundedAlgo Elite indicator & Backtester, launching in the coming days. What this means for you: You'll have a powerful new algorithm alongside TradeAlgo that lets you manually backtest and trade - plus verified strategies will be added over time. Even better, when our new platform launches, you'll be able to automate your own custom strategies using tools you create yourself. What's inside: Every parameter is built with logic designed to deliver signals at optimal setups and market conditions: • VWAP & Volume Filter — Adds a cleaner "fair value" zone filter to reduce noise and improve trade selection during sideways price action. • Trend Efficiency Filter — Measures how clean the move is (trend vs. chop), keeping you out of messy, unreliable price action where execution and follow-through suffer. • HTF MA Confirmation — Aligns entries with higher-timeframe moving averages, so you're trading with the broader trend instead of reacting to short-term noise. What's next: • FundedAlgo Elite — Releasing in the coming days • All-in-One Automation & Trading Dashboard — Rolling out shortly after Stay tuned for updates. We're excited to get these tools in your hands! — The TradeAlgo Team

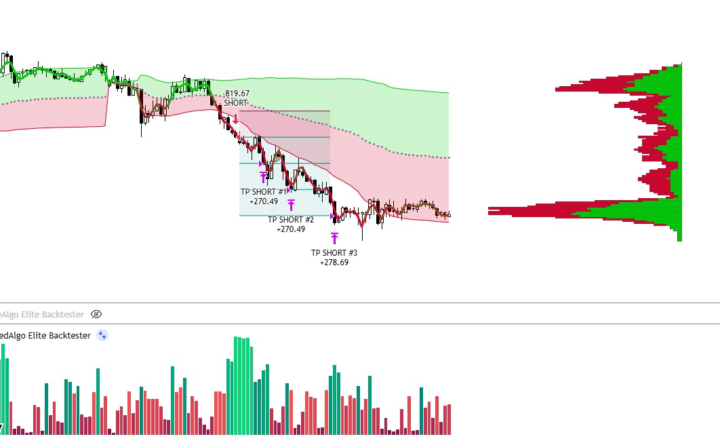

XAU/USD (Gold) choppy market conditions

Hi team, we’ve received a number of questions about why the XAU/USD automation hasn’t taken a position in the past 10+ days. As you can see from the attached chart, the market has been extremely range-bound, with low-quality structure and no sustained directional flow. These conditions are not optimal for a trend-based system, and this is exactly where our filters do their job. Instead of forcing trades in a choppy environment and accumulating unnecessary drawdown, the algorithm stays defensive and waits for clean momentum and validated structure before entering the market. This is a feature, not a bug. Our priority is long-term consistency, stable equity curves, and minimal drawdown. The system is designed to trade only when probabilities are in our favor, and avoid environments that historically produce poor performance. Once the market transitions out of this sideways phase and valid signals appear, the algo will re-engage automatically. Patience is part of the edge.

🎄 Merry Christmas, everyone! 🎄

Wishing you and your loved ones a warm, peaceful holiday, good health, great energy, and a fresh, profitable start to the new year. Thank you for being part of this community and keeping the standard high. Holiday schedule: Dec 24–26: the algo will be paused Most major assets are closed or running with limited liquidity, so we’re avoiding unnecessary risk and “holiday randomness”. We’ll be back to normal operation right after the holidays. Enjoy the time off, recharge, and see you on the charts soon.

1-30 of 45