1031 Time!

Hey guys, quick update for everyone kicking off the year strong! I'm right in the trenches with you—doing a 1031 exchange on a timeline. Guns blazing out here, pushing my marketing extra hard to snag deals. If you're curious how I'm sourcing them, drop a comment. Enough interest and I'll carve out time to break it down.

🎙️ GOING LIVE AGAIN! Cody Hofhine | Co-founder of Joe Homebuyer

Jumping on a live podcast recording with Cody Hofhine and you're invited to watch! Cody is a multiple Inc 5000 business owner, co-founder of Wholesaling Inc. (the #1 real estate coaching program in the nation), and co-founder of Joe Homebuyer — a nationwide real estate franchise. He built a 7-figure wholesaling business from scratch after going from broke and selling insurance to closing his first deal and making $24,000 in just 39 days. 🤯 He's coached thousands of students on how to find deeply discounted off-market properties, build systems that run without them, and create real financial freedom — not just more hustle. If you've ever wanted to learn wholesaling from one of the best in the game, this is your chance! Come hang, drop your questions in the chat, and let's learn together! 🔥 🔴 Watch Live Here: 👉 https://riverside.com/studio/gabriel-petersens-studio-z8nSs Learn more about Cody: 🌐 https://www.codyhofhine.com

🔴 Going LIVE on the podcast

I'm going live soon with Mike Zlotnik from Tempo Funding and we're diving deep into real estate investing strategies you need to hear! If you'd like to watch, here's the exclusive Skool community link to join the viewing room: https://riverside.com/studio/gabriel-petersens-studio-z8nSs Mike is a seasoned fund manager and real estate investor who's helped countless people grow their wealth through smart investing. This is going to be a value-packed conversation you don't want to miss. 🔴 Tune in live and drop your questions in the chat — I'll ask Mike directly! Learn more about Mike: 🌐 https://bigmikefund.com 🏢 https://tempofunding.com WATCH HERE: https://riverside.com/studio/gabriel-petersens-studio-z8nSs

1

0

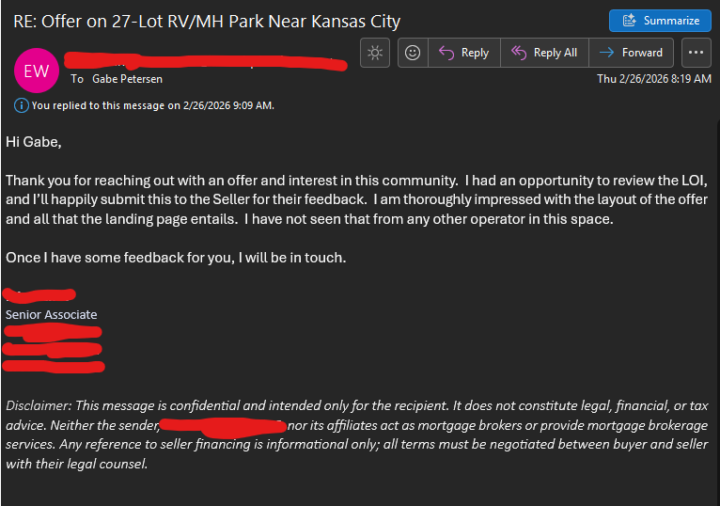

Brokers keep commenting on our AI-powered LOI approach 🚀

As you guys know, I've been experimenting with something new in how we submit offers. Instead of sending a standard LOI as a PDF or email, we've started building mini landing page websites for each deal we're pursuing. The idea is that when a broker or seller reviews our offer, they're not just reading a document — they're walking through a professionally designed page that lays out our offer, our background, and our vision for the property in a way that stands out. Here's the LOI website I built for a 27-Lot RV/MH Park deal near Kansas City: https://hamilton-rv-park-acq-dt46.bolt.host This morning the broker responded with this (paraphrasing): "I am thoroughly impressed with the layout of the offer and all that the landing page entails. I have not seen that from any other operator in this space." And this isn't a one-off. We've now had 4 or 5 different brokers reach out specifically to comment on how impressed they were with the format. In a world where brokers are reviewing offers all day long, standing out is everything — and this approach is clearly doing that. We're using AI tools to build these pages quickly — it's not as complicated as it sounds, and the results speak for themselves. I'll be putting together a full breakdown of exactly how we build these LOI landing pages so you can start doing the same thing on your deals. Stay tuned. In the meantime, check out the example above and let me know what questions you have 👇

Underwrite Deals as Quick as Lightning!

Most investors are still underwriting deals the hard way. I’m not. 😄 Lately, when I get an Offering Memorandum (OM) for a self-storage facility, mobile home park, RV park (and sometimes multi-tenant industrial or multifamily), I run it through a single “battle-tested” AI prompt that forces the underwriting to be conservative and buyer-favorable—the way it should be if you actually want to protect your downside and still hit strong returns. ✅ What this prompt does (in plain English) It tells the AI to act like a seasoned commercial underwriter + transaction specialist and produce exactly 3 deliverables: 1. A full internal underwriting report (risk-adjusted assumptions, pro forma NOI, DSCR targets, realistic rent growth, expense inflation, capex reserves, etc.) 2. A buyer-favorable LOI at the suggested price (clean, professional, credible — not some lowball mess) 3. A respectful email to the broker explaining the rationale and asking the 3–5 biggest questions we need answered 🔒 The secret sauce: conservative assumptions Most OMs are optimistic. My prompt automatically “stress tests” the deal by default, like: - bumping expenses - limiting rent growth - baking in vacancy - adding real capex/reserves - using higher exit cap rates than the OM wants you to believe In other words: it underwrites like a buyer who plans to own the asset through real-world problems, not spreadsheet fantasy land. Why this matters Even if you don’t use the AI’s numbers verbatim, it gives you: - a fast first-pass underwriting - a negotiation-ready offer package - a broker email that keeps relationships strong (while still being firm on price) If you want the exact prompt… Comment “PROMPT” and I’ll paste it in here (or DM it to you). 👇

1-30 of 63

skool.com/the-real-estate-investing-club

Don't buy houses. Buy commercial real estate. Get proven systems, live coaching, and a network of investors replacing their income with commercial.

Powered by