Write something

Quarterly price targets matter

Stocks moves in 3-month cycles. That cycle ends on earnings day and starts again right after the report. As soon as earnings are over, it’s important to mark the quarterly price targets in Gextron. Why? Because the market is forward-looking. Prices move based on expectations for the next quarter, not the last one. Gextron makes this extremely easy. How to find the Quarterly Price Targets: 1. Go to the Price Targets tab 2. Look for the expiration nearest to the next earnings date 3. That gives you the quarterly top and bottom targets You can click the Top or Bottom number to copy it and paste it straight into your charting platform. that's it. You can find your favorite stock quarterly price targets here: https://gextron.com/

1

0

lotto fRIDAY

TRADE PLAN for Lotto Friday SPX massive sell off today. SPX dropped 130 points from the highs. Possible we see more downside tomorrow if SPX fails to reclaim 6870. SPX needs through that 7k level to trigger a run to 7400+. QQQ dropped from 616 premarket to 601 at the lows. QQQ under 600 can test 589 again. I'd wait for 607 to consider calls. Mag7 price action has also been very weak. AAPL is down 20 points since yesterday, AMZN is down 50 points the past 2 weeks, NFLX is a long downtrend, NVDA having a hard time holding above 190. There's still no reason to take any aggressive risk with calls until we see the price action change in the market. Be patient and be careful this month.

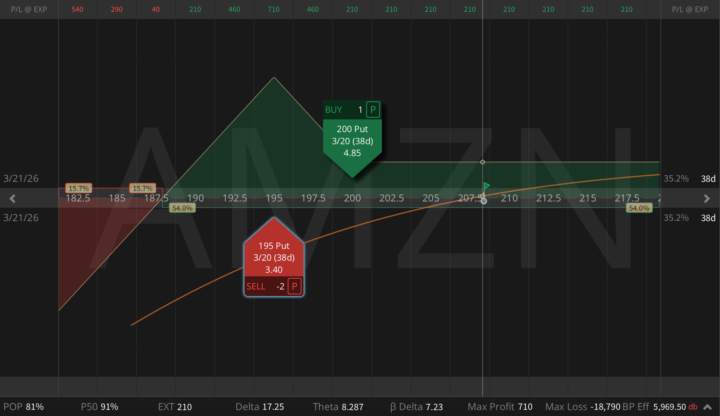

Amazon After Earnings: When Ratio Risk Beats Naked Risk

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

2

0

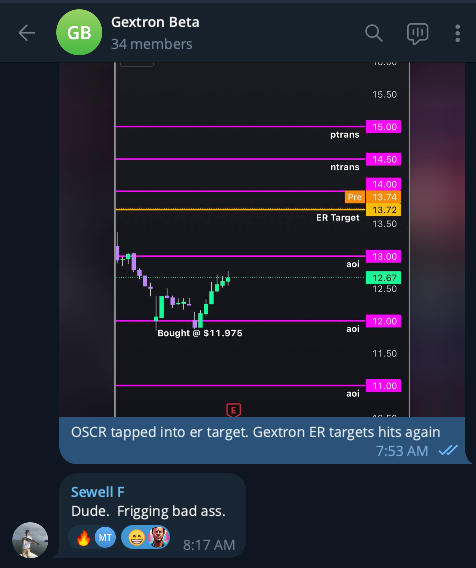

How to set ER price targets on ER day

earnings day is one my favorite days to make money. the moves can move +14% on stocks. about an hour ago, $OSCR had earnings and I got in shares. But I needed to find out what is the potential target range. So this was simple with Gextron: 1. Click on the price target tab 2. Found the expiration closest to the earnings date 3. Clicked on the top and bottom price targets that's it. 3 easy steps to identify high probability price targets without predicting or guessing. if you're looking for accurate price targets, seriously try Gextron: https://gextron.com/

1

0

1-30 of 1,136

skool.com/tge-free-4382

A community for serious traders who want to learn how to be profitable trading stocks/options

Powered by