Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Options

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Memberships

OptionMasters

8 members • Free

Option4All

60 members • Free

Imperium Academy™

49.1k members • Free

Risk Management

9 members • Free

Skoolers

190.3k members • Free

University Of Traders

83 members • Free

PainlessTrader

375 members • $12/year

AI Stock Investing

677 members • Free

HYROS Ads Hall Of Justice

4.7k members • Free

65 contributions to Trading Growth Engine

Amazon After Earnings: When Ratio Risk Beats Naked Risk

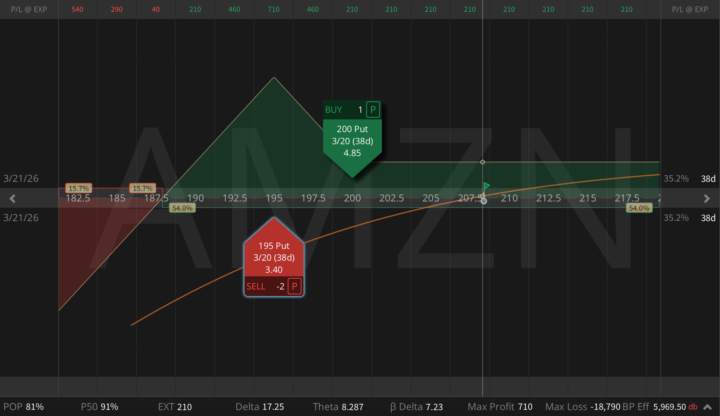

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

2

0

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

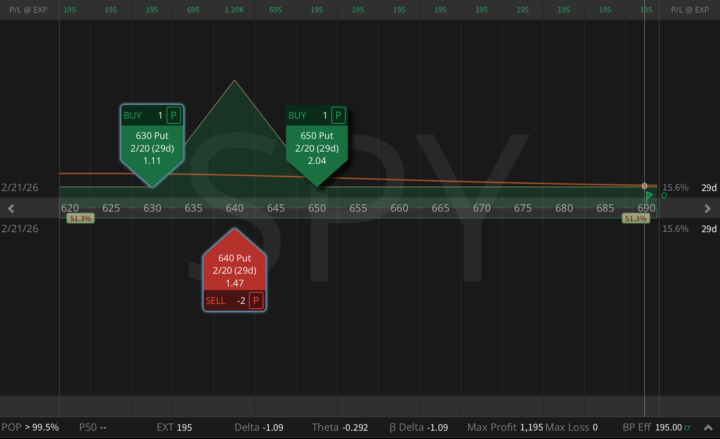

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

2

0

My Personal 2026 Market Playbook as an Options Seller and Hedge Fund Manager

Hey! As we start 2026, I want to share a few very personal market views and investment ideas I'm going to actively explore this year. This is not a recommendation and not a directional forecast. It's simply how I currently see market structure, volatility, and opportunity from the perspective of an active options seller and short-volatility hedge fund advisor. 1) Metals: the parabolic move may be behind, but volatility lingers Gold and silver already had their most emotional, parabolic phase. The important nuance is that implied volatility rarely normalizes as fast as price action does, and that lag is where options sellers get paid. So, I'll be very active in GLD, SLV, PALL, and URA, both in my personal portfolio and in our hedge fund. The specific edge I'm watching is post-spike IV that stays sticky after the trend fades, especially when the surface flips into volatility backwardation. That's a perfect setup for short-dated and 0-DTE premium harvesting. 2) Crypto: stagnation is the edge My base case for crypto is not another explosive trend, but prolonged consolidation. That's exactly why IBIT, the iShares Bitcoin Trust ETF with liquid options, is so interesting. Implied volatility remains structurally rich, often well above realized volatility. I don't trade crypto directionally, but I sell premium strategically. Compared to the industry's obsession with upside narratives, this approach is far less exciting, but it creates a much more consistent income engine. 3) Rate cuts shift income opportunities If rate cuts continue, my famous "yield engineering" trades like SPX box spreads and risk-free butterflies become less attractive. At the same time, they open a different door. Lower rates support REITs (Realty Income - O - remains my personal favorite), utilities (XLU), healthcare (XLV, UNH), and dividend growth ETFs (SCHD). I consistently combine these with aggressive call writing, creating my Triple Income Strategy. This approach targets an additional 11-18% per annum, with extremely low volatility and zero vega risk!

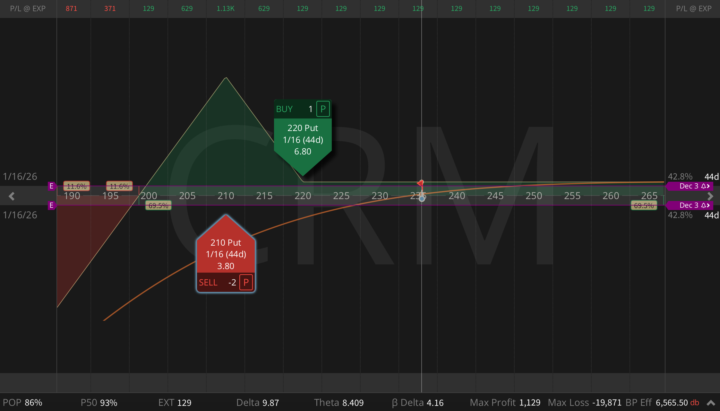

CRM Earnings Put Ratio Into Agentforce Test

CRM reports after the bell, and the setup is actually fascinating. The stock sits around $235, down 36% from highs and 30% YTD. Growth has slowed, but fundamentals aren't broken. They're just… less sexy. IV is pricing a 7-8% move, skew is modest, and this is exactly the type of environment where I want to be slightly long CRM and short rich downside vol, with a wide cushion if we get a controlled pullback. Let's see what Marc Benioff brings us tonight!

3

0

77% Returns in 2024 with Very Conservative Options Strategies

In 2024, I achieved 77% returns with a very conservative options portfolio, focusing on strategic setups and managing risk through asymmetric opportunities. No speculation, just disciplined and calculated trades. In my latest video, I break down: - My annual performance and how it compared to the market - The trades that worked (and the ones that didn't!) - Key lessons from navigating a volatile year You can watch the full breakdown and see how a strategic, conservative approach can deliver results: https://youtu.be/RJChiEsGClA?si=vaH2CRwZvCkHy1pS What's your biggest trading goal this year?

1 like • Nov '25

7 months. That's how long it took me to recover after the April Tariffs crash, even with a diversified short-volatility portfolio. And honestly, it came down to one mistake I made. One decision that probably stretched my recovery by months. Just uploaded the November 2025 portfolio update on YouTube. I walk through exactly what happened, what worked, what didn't, and why a Black Swan Hedge is something you only question until the moment you desperately need it. If you sell premium, you'll want to hear this part. Watch here: https://www.youtube.com/watch?v=TyWEAUgtOoY

1-10 of 65

Active 10h ago

Joined Nov 18, 2024

Powered by