Before funding it starts Here!

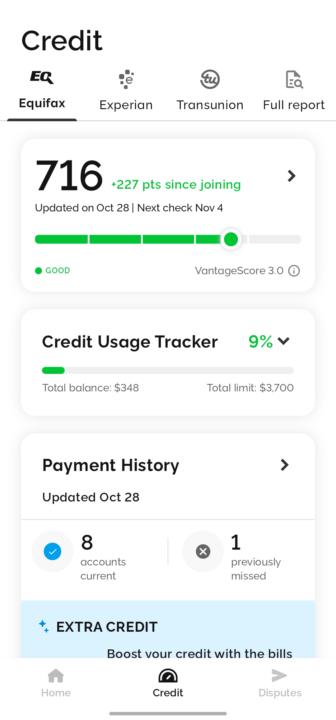

Equifax update, 50+ point increase in 30 days. Keep up the good work guys. If you need any assistance feel free to reach out to me at [email protected]

1

0

3 key reasons why many people fail to achieve financial freedom:

- Lack of Financial Literacy Without a solid understanding of how money works — including budgeting, saving, investing, and debt management — it's easy to make poor financial decisions that keep you in a cycle of struggle. - Living Beyond Your Means: Overspending on lifestyle upgrades, buying things to impress others, or relying on credit to fund daily expenses can quickly lead to debt accumulation and financial instability. - No Clear Plan or Discipline. Financial freedom requires planning — setting goals, creating a budget, and sticking to it. Without discipline and a long-term vision, it's hard to stay consistent or build wealth over time.

LexisNexis and why it’s critical to opt out —

LexisNexis and why it’s critical to opt out — especially if you’re working to protect your privacy, repair your credit, or prepare for funding and identity-based verification systems: --- Why You Need to Opt Out of LexisNexis — Especially if You’re Building or Repairing Credit LexisNexis may sound like a legal research platform (and it is), but it's also one of the most powerful data aggregators in the world. If you're serious about protecting your identity, getting funding, or repairing your credit, **opting out of LexisNexis is a critical step. What Is LexisNexis? LexisNexis started in the 1970s as a way to digitize legal documents. But over the decades, it evolved into something much larger: - A global provider of legal, regulatory, and business data, - With access to over 45,000 data sources, - And billions of public and private records tied to individuals and businesses. Today, their Risk Solutions division is used by: - Credit bureaus - Insurance companies - Lenders and banks - Law enforcement agencies - Government departments - And even background check services That means LexisNexis is likely holding your entire life in its system—addresses, vehicles, loan history, liens, relatives, phone numbers, even legal activity or judgments. --- Why Opting Out Matters 1. Credit Repair & Funding: When applying for loans, credit, or grants, your data is being verified not just through the major credit bureaus (Experian, Equifax, TransUnion) but also through data brokers like LexisNexis. If there's incorrect or outdated information, your approvals can be delayed or denied, even if your credit score is solid. 2. Identity Protection: LexisNexis gathers and sells detailed personal data—including data from public records and private sources. Opting out limits who can access your data and lowers your exposure to fraud, identity theft, or predatory lending. 3. Funding Structure: If you're building business credit or applying for high-limit lines under your EIN, data brokers like LexisNexis are often pulled for verification.

Start Fixing Your Credit Today—Ask Away!

"Got questions about repairing your credit? 🤔 You’re in the right place! This group is here to help you tackle credit challenges, share progress, and learn proven strategies to boost your scores. Let’s kick things off: - What’s one thing about credit repair that confuses you? - Or share your biggest credit win so far! We’re all here to help each other succeed—drop your questions or tips below!"

2

0

1-4 of 4

powered by

skool.com/scoreup-riseup-8242

Join Scoreup Riseup—tools, courses, and a thriving community to build credit, start/grow your business, and create wealth. Start NOW and rise today!

Suggested communities

Powered by