Be a Bank or Be a borrower?

We are holding an event Wednesday February 18th 8PM Eastern. Advanced Note Investing Strategies. Register here You must pre-register to attend Advanced Note Investing is where real estate meets banking. Instead of owning property, we acquire mortgage debt and get paid like the lender. This strategy focuses on buying performing and non-performing notes at a discount, restructuring deals, and creating consistent cash flow while reducing the headaches of traditional landlording. Whether you're looking to build passive income, understand distressed debt, or move beyond basic real estate investing, this is where you learn to think like the bank — not as the borrower. Get on the right side of the desk!

Who was it that said...

...buy your kids' a multifamily instead of a college education? Don't google it Ha!

Before I ever had an “investment portfolio” 👇

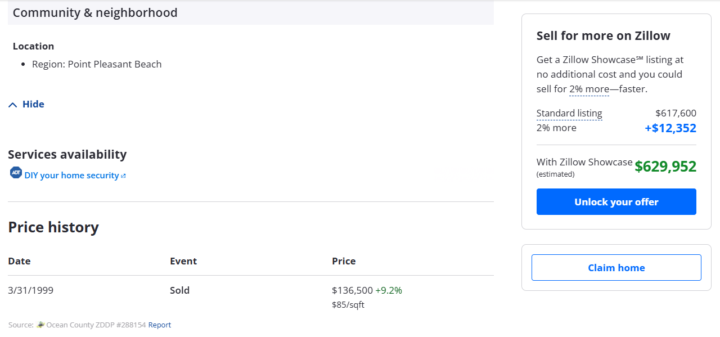

I didn’t even know what that phrase meant. Portfolio was a word rich Wall Street people used on TV. I was just trying to keep the lights on and be happy I could at least make enough salary to allow my wife to be a stay at home Mom. Here’s what actually changed for me 1️⃣ I started looking for things that made sense to me. I bought a study course on late night Infomercial How to buy your first Investment Property with No Money Down Carlton Sheets. 4 Payments of $74.99 2️⃣ That was it I poured over this material and did what he said. I got my team together and looked at as many properties as my Realtor would take me to. I still have that Study course and in that book I wrote April 1 1999 I bought my first rental income property following the magic 1% rule. Rents must be greater than 1% of the purchase price. Rent = $1,400 and the purchase price was $136,500 💬 Your turn:Where are you right now? - “No portfolio, no clue (that was me).” - “Just getting started.” - “Already building, want to go bigger.” Does this get you excited? Let's jump on a call Use this link https://calendly.com/mike-2347/30min Drop it in the comments so I know who I’m talking to 👇

Wealthy Cash Poor Retirement💲

How in the World can you have a Wealthy Cash Poor Retirement? * I want no money in my bank or retirement accounts. I want all money out working. Just made a loan this morning for $25k that will come back in 30 days looking like $27,500. I just had $15,000 out, 30 days later $16,500 came back. Another deal, loans out on 2 property flips in Puerto Rico. One is under contract to pay us off and the other is under re-construction. Also another loan out on a rehab property that will payoff in April. I really just started making these types of loans in the last 4 months. It seems easy enough to make a substantial passive income. When I get equity build up on one of my rental properties, I take out equity loans or cash out refinances. Equity is dead money. As long as I can find deals like the ones above, I'll just keep rolling in and out until a Killer deal comes along. I believe the deal of a lifetime comes along about every 4 months. Which would you want, a paid off house or cash out on the street? * other than emergency funds

Stream of Income Saturday

What can you work on Today that can bring in another form of income? Here's an example. I lent out $15,000 to a house flipper for an earnest money deposit (EMD). I will get back $16,500 Monday for a 10% return on investment. I did the loan 3 weeks ago. 💰 How Fast Money Works So what does that look like annualized? Let’s do the math - 3 weeks = about 17.33 periods per year (52 ÷ 3 = 17.33) - 10% × 17.33 = 173% simple annual return ⚡ Cash flow beats saving every time. You got the whole day to find a stream of Income!

1-14 of 14

skool.com/retirement-cash-flow-

Retire wealthy with multiple streams of income! Build these streams one by one. Get one going then work on the next. NO: stocks bonds mutual funds!

Powered by