Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Land Conquest - Land Investing

5.9k members • Free

Wholesaling Real Estate

3.2k members • Free

REVENUE REVOLUTION

4.2k members • Free

Ninjas AI Automation

1.5k members • $9/month

Preforeclosure Real Estate

3k members • Free

R.E. DEALMAKERS

14 members • Free

Wholesaling Houses 101

994 members • Free

Main Way to Wealth

17k members • Free

Tradeline Secrets

1.3k members • Free

30 contributions to Retirement CASH FLOW

January Wins

What is your win or wins for the first month of the new year? 🏆

What are you working on?

What are you working on for your Wealthy Retirement? Maybe it's 10 years from now or 2 years from now.

Challenge Part 1

If you were offered $5 million today and had to pick an asset class to invest in, what would your choice be? Even if you have never invested before , what would you choose? Examples: Land, Apartment buildings, Commercial property, Tech Stock, Notes, Precious metals, Crypto, Trailer parks etc. No wrong answers. If you don't pick today, you lose the opportunity! You don't need to invest today you just need to chose. Let's Hear It!

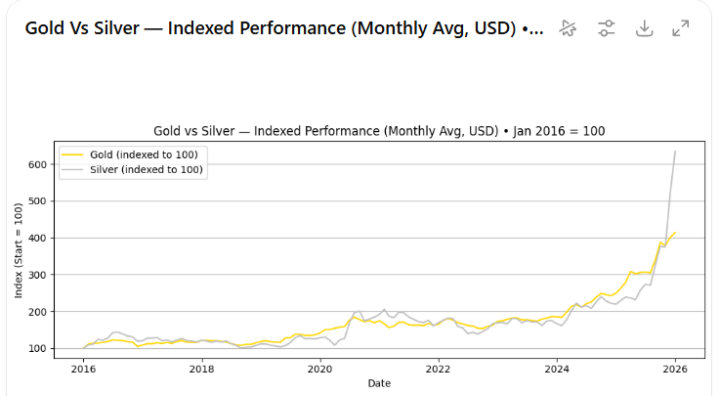

Thread on physical Silver

We have a very interesting thing happening in the silver market. You will want to pay close attention to this thread in the next few weeks. Please comment "I want to be notified" below. We will create a private classroom. This is Huge!

1-10 of 30

@ivan-terrero-9128

Note investor, creative finance connector.

Active 14m ago

Joined Dec 7, 2025

Florida

Powered by