Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Your First Salon Suite

1.1k members • Free

Retirement CASH FLOW

503 members • Free

Flip Flop Flipper Real-Estate

4k members • Free

Apex Real Estate

227 members • $127/m

Multifamily Wealth Skool

15.1k members • Free

22 contributions to Retirement CASH FLOW

Read this book

Die with Zero You will live a different life when you get into it! Link to the book Get it

Welcome New Members! Please introduce yourself Drop your "My Story" Below

New users WELCOME! Please let us know what you have been doing and what you want for your future! Also go to the "Classroom" and enter Start Here Course

4 likes • Jun '25

Hello, I’ve been educating myself for a few years, on RE investing, I am ready to buy a multifamily in PR to start. I retired this past December. I love multiple streams of income, worked well when I was a hairstylist. Looking for other way but not standing all day! Thanks Mike for putting this together and sharing your knowledge. Would like to meet others.

January Wins

What is your win or wins for the first month of the new year? 🏆

2 likes • 19d

@Mike Ruscica It was lessons and homework how to go through all the steps to acquire your first or next investment property. Being prepared when your offer does get accepted. Having your team in place, your financing in place, we were given a deal analysis sheet to help us decide if the deal made sense. How to make offers. By the end of the 90 days we should have a property in the works. Working in a group of women we encouraged each other and nice to have the support. As you know this was and in some ways still is a man’s world!

Straight from Rich Dad Poor Dad

Asset or Liability? 🤔 Most people never get this one simple idea: An asset puts money in your pocket.A liability takes money OUT of your pocket. That’s it. That’s the whole game. 👇 1️⃣ Your house - If it costs you money every month (mortgage, taxes, repairs) and doesn’t pay you… it’s a Liability. - If it’s a rental that sends you cash flow every month after all expenses… it’s an Asset. 2️⃣ Your car - Car payment, insurance, gas, repairs = money leaving your pocket every month 🚗💸 - Unless that car is being used to produce income (delivery, Turo, business vehicle that nets profit), it’s a liability. 3️⃣ Your credit cards - If you’re using them to buy stuff that doesn’t pay you back… that balance is a liability. - Debt tied to cash-flowing assets (notes, rentals, etc.) can be good if the cash flow > payment. 4️⃣ Investments - Stocks that don’t pay you? You hope they go up. That’s speculation. - Notes, rentals, private lending, cash-flow deals? They PAY YOU while you sleep. That’s an asset. 5️⃣ Retirement accounts - A 401(k) sitting in mutual funds, praying the market behaves = 🚩 - A self-directed account owning notes, rentals, private deals spitting out cash flow = real assets. If you look at your life right now… Are you stacking assets or collecting liabilities with fancy names? 👇 Drop one thing in your life that you thought was an asset… but now realize is actually a liability.

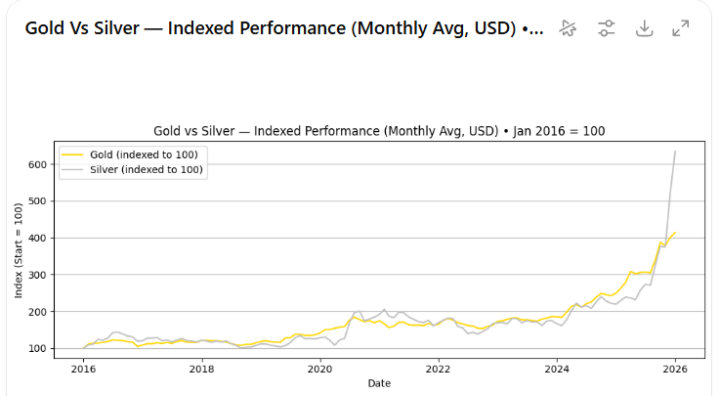

Thread on physical Silver

We have a very interesting thing happening in the silver market. You will want to pay close attention to this thread in the next few weeks. Please comment "I want to be notified" below. We will create a private classroom. This is Huge!

1-10 of 22

@nancy-torres-2032

Real Estate Investor, wife, mother of 3 sons. Hairstylist 43 yrs.

Active 1h ago

Joined Jun 6, 2025

Powered by