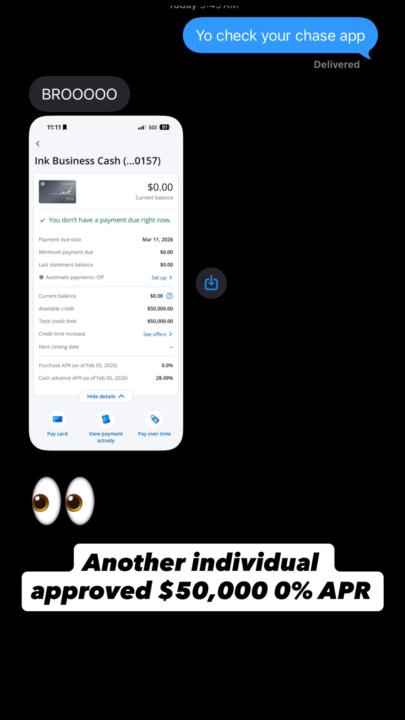

Client approved for $50,000 in business funding 0% APR

Trust the process ⛹🏽♂️

Why Collections Hurt More Than People Realize

Collections don’t just impact your credit score — they change how lenders perceive risk. When a collection appears on a credit report, it signals unresolved obligations, even if the amount is small or years old. What most people don’t understand is that collections must meet strict reporting requirements to remain valid. Many are reported with incorrect balances, missing dates, or incomplete verification. Credit repair involves carefully reviewing these details instead of assuming every collection is accurate by default.

0

0

Why Income Is Not the Main Factor in Business Funding

Many people assume that business funding is based primarily on income, but income is often a secondary factor. Lenders focus heavily on credit alignment, business credibility, and financial behavior. A business that looks structured and disciplined is far more attractive than one with high income but poor organization. This is why some entrepreneurs secure funding early while others struggle despite earning more. Preparation, not income, determines access. Funding is granted to profiles that demonstrate control, not desperation.

1

0

Credit Repair is a Process, Not A Singular Action

Credit repair does not happen overnight because credit reporting itself does not operate instantly. Accounts update on monthly cycles, disputes follow legal timelines, and positive history compounds gradually. Anyone promising instant results is either misinformed or intentionally misleading. Real improvement comes from stacking small, correct actions consistently. Lowering balances, correcting inaccuracies, and maintaining on-time payments over time creates momentum. Credit is forgiving when behavior improves, but it requires patience and consistency to see lasting results.

0

0

Why “Good Credit” Still Gets Declined for Funding

One of the most frustrating experiences people face is getting denied for funding despite having what they consider “good credit.” This usually happens because lenders are evaluating risk layering, not just scores. Risk layering includes high balances, frequent applications, thin credit history, or inconsistent account management. A person with a slightly lower score but strong structure often looks safer than someone with a higher score and unstable behavior. Funding decisions are about minimizing lender risk, not rewarding effort. When you understand what lenders actually see, approvals begin to make sense.

0

0

1-30 of 40

powered by

skool.com/rans-free-community-1257

What’s good everyone!? Pleasure to have you here I'm Ran. I am a 21yo entrepreneur and master in STR's, Business Funding, and Credit. See you inside!

Suggested communities

Powered by