Taazluxe is Celebrating 2nd Anniversary !!!

Visit website www.taazluxe.com and avail 20% (anniversary discount) + 10% off (Subscribe to newsletter). Place your order online now!

2

0

Is British Pound Strong?

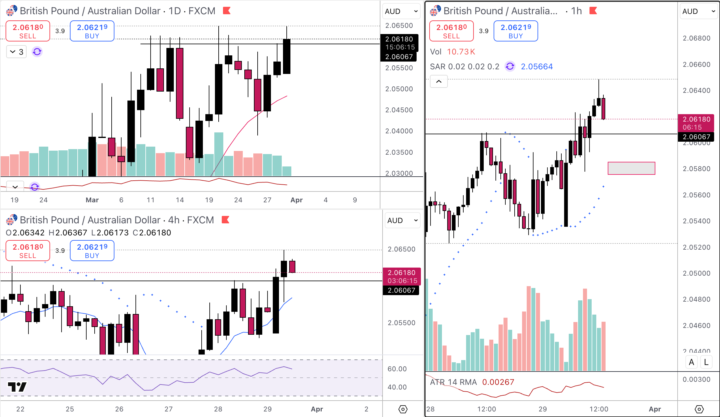

Below is what GBP.AUD currency pair looks like. At it's highs in a very long time. With nothing suggesting any signs of reversal yet. Does it continue getting stronger? If so, how much higher can it run? how much can you take advantage of this opportunity to fill up your pockets just a little bit?

1

0

Trade record

The red vertical line is my first position into this trade. I was aware of the immediate resistance on the 4hr. But if that broke, the upside risk reward was just too favourable to let go of. I added 3 positions of 0.5% risk each. SL set at the 1hr parabolic sar. 5.1k, 22k, 43k units of position size on each trade respectively. Total loss: 1.1% Self grading of my performance: Spotless performance, technicals solid, psychology solid. Current tweaks I am considering: Execution criteria like using ATR or SAR to determine initial stop loss. Both have advantages and disadvantages but I am noticing and building intuition of when to use which style of execution.

1

0

My only trades this week

I am proud of myself for simply just waiting on the daily timeframe to get the price position I want. A pullback trend setup And when things aligned, I did not second guess to execute. on entry, 4hr was giving all indications of a shift toward downward velocity. I was able to size in up to a 1% position on the first attempt. It was stopped out. On my second attempt, I took it at about 4am Thai time. This was a 0.5% position that got stopped for a little under because of trailing stop loss. Not the outcome one would like to have but I am proud of my execution as that's the real mover to the outcome I want.

1

0

Traders Real talk : how well do you know yourself ?

If you want to make it in this game, you’ve got to learn how to read PA like a boss. Get a grip on R:R, sharpen your skills in spotting opportunities, predict those wild trend shifts, track the whales, and make moves based on connecting the dots—*not on feelings*. The timeframe you choose to play in? It’s all about the skill. This mindset is why most people got wrecked again. Now they’re just hanging out as “believers,” waiting for the market to moon so they can finally break even on their investments. It’s not just about slapping on stop-losses. A lot of folks don’t even know who they are as traders. They lack a solid strategy, with their whole plan being the classic “I’m a hodler.” Everyone in this game is a trader—some are scalpers, some are day traders, some swing traders. But then there’s the majority who call themselves “long-term investors,” yet they’ve got nothing to show for it, just dreams. When you ask about their wins, they don’t share their own success stories. Instead, they drop names of famous investors, hoping that somehow makes their choices legit. And let’s be real: “Hodl” strategies often mean DCA-ing at random points, usually during those epic rises when everyone’s convinced the ultimate altseason is about to kick off. So, it’s no wonder that getting wrecked is basically the only outcome!

1-30 of 46

skool.com/noble-traders-club-5881

Make More Progress in 30 Days Than You Ever Have—Guaranteed!

Powered by