Write something

Are Trading Bots the future of passive income ?

Hi everyone, I stumbled across this article about a new trading bot; Meta Trader 5. Based on the reaserch and independent tests in this article, I think it could be an interesting thing to try. I'll link the article down below 👇, and let me know what you think about it. https://victoryvistafinance.com/private-article.php?utm_source=taboola&utm_medium=referral&utm_campaign=36456845&utm_content=3921604625&tblci=GiDWs22Udg3RUL-nQbswbfbWQ9-gXOrj6zaKS5zi1F0s8iCdyFsolciN6LCz4bk3MIbNPw#tblciGiDWs22Udg3RUL-nQbswbfbWQ9-gXOrj6zaKS5zi1F0s8iCdyFsolciN6LCz4bk3MIbNPw

Quick silver update for the crew 📉

Silver (XAGUSD) just dropped hard to $84 USD today. That means ETPMAG (ASX silver ETF) is likely to follow with a sharp dip shortly. Short-term: This looks like a solid buying opportunity for those sitting on cash or wanting to add. Long-term: Still very bullish my core plays are always 5–20+ years, and silver’s fundamentals (industrial demand, supply constraints, inflation hedge) remain strong. Not financial advice just sharing what I’m seeing. If you’re in for the long game, dips like this are where positions get built. Anyone adding today or watching for a bounce? Drop your thoughts 👇

URANIMOOM 🌕 🚀 Let’s Discuss it 🤝

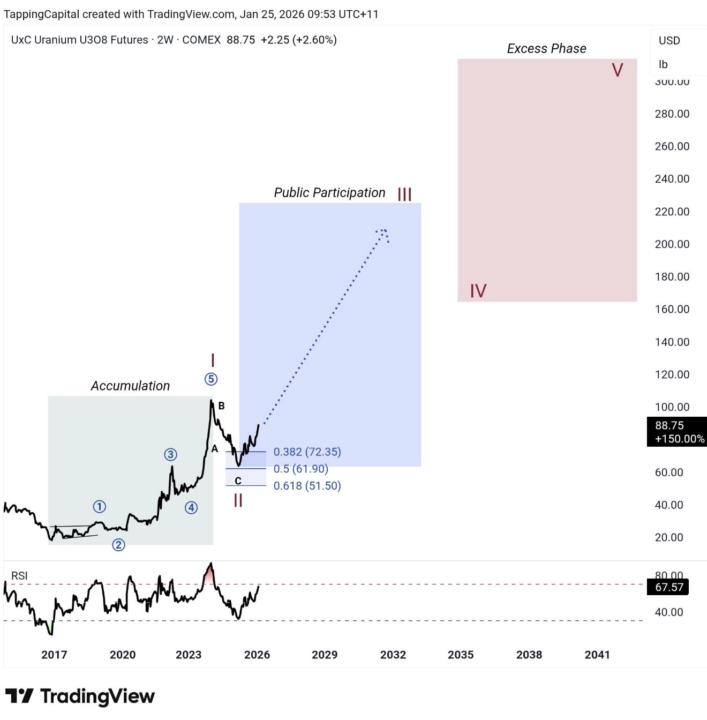

Hey everyone in the Investment Chat! 🚀 Loving this space it’s growth so far & the consistent participation let’s keep this going 🏎️💨 Just wanted to spark some discussion on these booming commodities we’ve all been watching: gold, silver, and especially uranium are on fire right now. Quick snapshot (as of late Jan 2026): • Gold hovering around ~$4,900–$5,000 USD/oz (~$7,100–$7,250 AUD/oz), with some big banks eyeing $5,400+ USD by year-end. • Silver just smashed into triple digits hitting over $99–$103 USD/oz (~$144–$150 AUD/oz) for the first time, up massively on industrial demand (solar, EVs, etc.). • Uranium spot price pushing ~$88 USD/lb (~$128 AUD/lb), up solidly in the last month and riding the nuclear renaissance wave. The graph I shared earlier shows how these are correlated in this macro environment—fiat worries, energy transition, AI power needs, supply squeezes, etc. Uranium feels particularly interesting because of the structural deficit: global reactor builds (China, restarts in the West), long-term utility contracts locking in, and new mines not coming online fast enough. Question for the group: Do you think uranium has real legs to keep running and become the next big multi-year play (maybe even outpacing gold/silver in relative gains over the next decade)? Or is this just another cyclical pump that’ll fade back to “normal” levels once supply catches up or hype dies? Moonshot potential 🌕 or more of a steady grind/stay range-bound? What’s your take bullish, cautious, or bearish on uranium specifically? (Feel free to factor in AUD pricing too if you’re thinking locally!) No financial advice here just macro speculation and curious what the community thinks! Drop your thoughts below 👇 Let’s discuss! 💬

SILVER BULLRUN! 🔥 Over $100 USD 👌

🚨 Sk00l crew SILVER just blasted through $148 AUD and over $101 USD per ounce today! 🔥 (Spot hitting record highs around $101–102 USD, translating to $148–153 AUD depending on the feed.) Told you all 3 months ago to start stacking when it was still in the $70–80 USD range. Whoever listened and loaded up? You’re sitting on massive unrealised gains as silver’s ripped +40% in the last month alone and doubled+ from late 2025 levels. This isn’t just a pump industrial demand (solar, EVs, electronics), chronic supply deficits, and safe-haven flows are all converging hard. But real talk: this rocket is only getting started. Gold’s pushing $5k territory $7200+ AUD, silver’s finally catching up with that insane gold/silver ratio compression, and macro uncertainty ain’t going anywhere in 2026. If you missed the first leg no stress, dips always come. But if you’re already in? Hold tight and maybe add on pullbacks. Who’s still stacking? Drop your average below 🤙💪

Tool I Use for Smarter Portfolio Tracking 📊

If you’re serious about investing, tracking properly is non-negotiable. One app I’ve been using and genuinely rate is Nevexa. It’s an all-in-one portfolio tracker that makes it easy to: • Track all your investments in one place • Automatically calculate capital gains & capital losses • Stay on top of tax-time reporting without the headaches • See real performance clearly (not just vibes 📈) • Make better adjustments based on actual data, not emotion What I like most is how clean and simple it is. You spend less time managing spreadsheets and more time focusing on strategy, growth, and decision-making. If you’re building long-term wealth, reviewing progress, or tightening up your systems this is a solid tool to have in your stack. 👉 If you want to check it out, you can get 3 months free using this link: [ www.navexa.com/r/224SJ4 ] 🤝🤝🤝 Not financial advice just sharing tools that help me invest with more clarity and confidence. Each week I adjust slightly & I’m going for “long term growth” not short wins

2

0

1-17 of 17

powered by

skool.com/matthew-alchins-1-dad-3441

Girl dad grinding for freedom real life vlogs, tech tips, family hacks, daily 1% wins. Positive, uplifting, no BS. Let’s level up together 💪🔥

Suggested communities

Powered by