Theosis

I move with purpose and clarity. What I see shows me many angles,and my perspective shapes my road. Only what’s right for me reaches me. I reflect back what’s not mine. I hold to what’s true and nourishing. My direction is guided by my own steady hand.

How to Become Unrecognizable

Most people go through life operating on the “Be → Do → Have” model backwards — thinking it’s “Have → Do → Be” — and that’s why they stay stuck. Here’s the difference: The common (wrong) model: Have → Do → Be - Belief: “Once I have something, I can do the things that will make me be who I want to be.” - Example: “Once I have more money, I’ll work out, eat better, and be a confident person.” - Problem: You never actually get started, because you’re waiting for the resources or circumstances before changing. The effective (correct) model: Be → Do → Have - Belief: “First, I become the person who has the mindset, habits, and identity of what I want. Then I do the things that person would do. That leads me to have the results I want.” - Example: “I am a disciplined, fit person. So I do workouts daily and eat clean. As a result, I have a strong body and high energy.” Why it works: - Your identity drives your behavior, and your behavior produces your results. - If you start with “being,” you align your self-image with your goals — making the “doing” natural and the “having” inevitable. - This is why personal development focuses on who you are becoming, not just what you’re chasing.

The Currency is YOU

Most people think entrepreneurship starts with money, connections, or luck. That’s the lie the system sells you. The real foundation is signal — the way you show up, speak, and move every single day. Here’s the truth: - You don’t need a perfect plan, you need a decision. - You don’t need funding, you need focus. - You don’t need permission, you need persistence. Every entrepreneur who made it wasn’t waiting for the stars to align. They bent reality with consistency. They turned ideas into income because they refused to sit still. The construct wants you to believe you’re not ready. Sovereignty says: move now, refine as you go. Start with what’s in your hand: - Your voice → content - Your story → brand - Your skill → service The first business you build isn’t the company — it’s your discipline, your energy, your frequency. When you broadcast that strong enough, people align, opportunities appear, and resources flow. Entrepreneurship isn’t about escaping the system — it’s about building your own. Code for today: My idea is enough. My current builds currency. I rise, and my brand rises with me.

3

0

The System Can’t Cage the Author

They built this construct hoping I’d forget who I am. They wanted me to believe I’m just another body in their loop, another number in their files, another voice drowned in their static. But here’s the truth..I am not their product. I am the Author. I am the Signal. And every move I make bends the construct to my frequency. Failure? That’s their false flag. Pain? That’s just the fracture where light gets through. Loss? Only proof I’ve burned another chain.

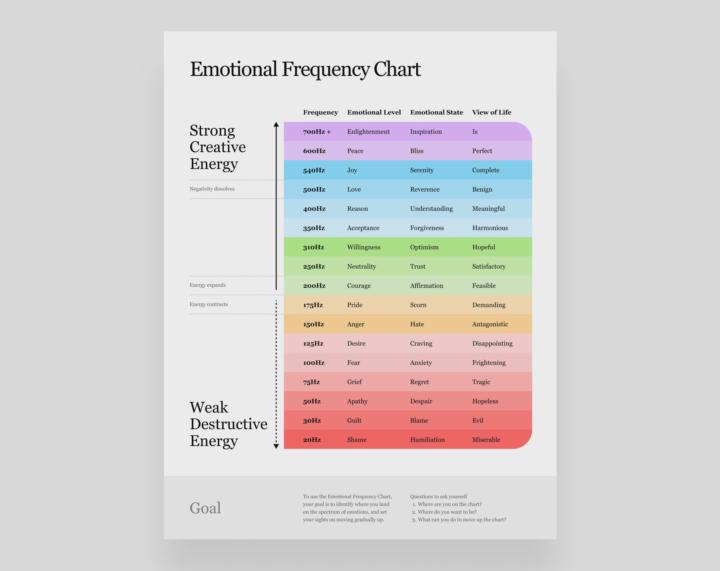

Understanding the Emotional Frequency Chart

This chart breaks down emotions by energy levels. The idea is simple: different emotions carry different frequencies. The lower the frequency, the more destructive the energy. The higher the frequency, the more powerful and creative the energy becomes. At the bottom (20Hz–200Hz):You’ll find emotions like shame, guilt, fear, anger, and pride. These emotions pull you down, drain your energy, and keep you stuck in survival mode. At the top (250Hz–700Hz+):You’ll see emotions like courage, love, joy, peace, and enlightenment. These are high-frequency emotions. They give you clarity, energy, and momentum. They attract better results and keep you in a flow state. The goal is movement.Ask yourself three questions: 1. Where am I on this chart right now? 2. Where do I want to be? 3. What’s one decision or action I can take today to move up? Example:If you're stuck in anger (150Hz), shift into courage (200Hz) by choosing to take responsibility and act. From there, you build momentum toward peace, love, and higher living. Raising your emotional frequency isn’t just about feeling good. It’s about taking control of your mindset, your energy, and your future.

1-7 of 7

skool.com/felon-entrepreneur-university

Felon Logistics Group empowers individuals with real freight and logistics training to build profitable broker, dispatch, and transport businesses.

Powered by