Write something

Why is Comparable Credit Important?

Good and Even Great Credit Scores May Not Be Enough Even if you have great credit scores, both personal and business, you still want to make sure you “build those credit files out”. What do I mean by this? An often-overlooked aspect of obtaining cash credit lines is something called “Comparable Credit”. As I said you can have great personal credit scores and great business credit scores but when seeking larger cash credit lines comparable credit comes into play. If you and/or business has credit lines of $500, $2500, $5,000 etc. and you are asking for $35,000+ you most likely won’t get that. Banks routinely provide you 1.5X to 3X your current personal limit in business credit lines if your file look good. So before going after the truly larger business credit lines, make sure your personal credit files have a few larger credit lines already reporting. Ask your vendors and credit card companies to increase your credit lines every 6-months or so as long as you are using them and paying them in a timely fashion. This is how you take $500 vendor lines and $5,000 personal credit card lines and make them $1,500 and $15,000 credit lines. Banks want to see you have handled those larger credit lines successfully before extending your business super-sized credit lines of $35K+. If you have successfully had large credit lines and paid aggressively, they are more than happy to grant you these larger credit lines. But first they want to see you or your business has had a history of making payments on time with larger credit lines. It takes time to do this right. But it’s worth it and frankly the only legit way to do so. Build out your personal credit file and business credit file before seeking that homerun credit line. Always be increasing your credit lines whether you need it now or not. One day you may!

0

0

NAV Membership

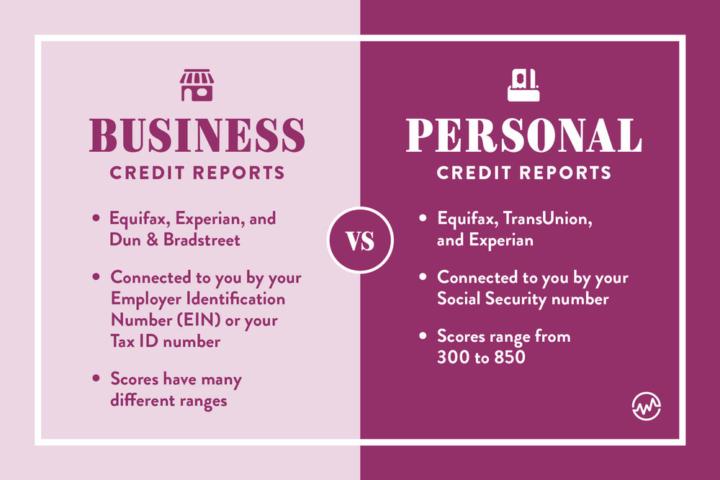

As a business owner, before applying for any financing, you should know what your personal credit reports and business credit reports contain. You want to “see” what the lenders will see before you apply. You will also want to have your financials updated (i.e., profit & loss statement, balance sheet, income statement, etc.). Are you interested in monitoring your personal credit and business credit reports and scores? If so, please consider NAV. What is Nav? Nav brings a new approach to how a small business owner deals with credit by combining the power of seeing multiple credit reporting bureaus for both personal and business credit in one place. Their credit monitoring service has been featured on Fox Business News, CNN Money, TechCrunch and more. NAV is the only online provider that provides you access to your personal credit reports and scores from Experian and TransUnion and your full business credit reports from Dun & Bradstreet, Experian, and Equifax. Typically, you must pay $50.00-$150.00 to Dun & Bradstreet, Experian, or Equifax for a single business credit report. NAV is the only website you can obtain your FICO Small Business Scoring System (SBSS) Score. The score used to pre-screen applicants for the SBA's largest loan program, the FICO SBSS combines both personal and business credit data and can help unlock some of the largest-dollar, lowest-rate financing options lenders offer. We highly recommend the Business Loan Builder! Business Loan Builder ($49.99 mo.)What’s included: Full Experian and TransUnion personal credit reports and scores Full business credit reports from Dun & Bradstreet, Experian, and Equifax. MatchFactor powered financing marketplace (They use your business credit and personal credit to match you with lending programs and credit cards you have a good chance to qualify for) Cash Flow alerts 1-on-1 access to Credit & Lending Specialists Dispute errors on business credit reports Full service identity restoration w/dedicated identity specialist*

0

0

Business Credit vs. Personal Credit

Using personal credit for everything keeps your limits small and your utilization high. Building true business credit means: ✅ Bigger approvals without hurting your score ✅ Space to grow without maxing personal cards ✅ Safer profile while lenders see you as fundable

0

0

The Business Credit Strategy That Gets You the $$$ Bag

Let’s talk about what separates the hustlers and wannabes from the real business owners. Because when it comes to funding, lenders do NOT care how passionate you are. They care how positioned you are. Here’s the part most new entrepreneurs miss: You can’t just file for an LLC and think you’re ready for $50K in business credit lines. You need to build the foundation of a real, fundable business. One that looks the way lenders want you to look like. Let me clarify this for you… 📌 THE FUNDABILITY CHECKLIST This is what bank underwriters are looking for — not vibes, but verification! ✅ Business Name that doesn’t trigger a “high-risk” alert (words containing credit, real estate, or investments can flag you) ✅ EIN + LLC properly filed with matching data across all documents (don’t skip this. A mismatch of info will get you denied before they even pull your credit file) ✅ Professional Email Address (use a domain — no Gmail, Yahoo, or Hotmail) ✅ Business Phone Line that matches your business name and location (use RingCentral or Grasshopper — just don’t use your personal cell phone) ✅ Business Address that’s NOT a P.O. box. Use a shared office like iPostal1 or Alliance if you don’t have a brick and mortar location. ✅ 411 Directory Listing — go to listyourself.net and get your business listed. This is how banks verify you exist. ✅ Website that matches your business, looks legit, and includes all the basics: About, Contact, Services, etc. ✅ Business Bank Account in your business name, with activity (don’t open and let it sit — move some money through it monthly, even if it’s a small amount) 🎯 WHY ALL OF THIS MATTERS When underwriters review your application, they’re looking at your business and determining risk; Does this person look like they can handle the credit line requested? When you apply for a $20,000 business line with a Gmail address and no website, and mismatching information it’s giving lenders a side hustle vibe. You don’t need to be perfect. You need to be positioned with a business that checks all the verification boxes.

0

0

How to establish an American Express relationship for just $1

That is correct business credit builders. You did not read that title wrong. If you don't already have a relationship with American Express you can get in with them for as little as $1. All you have to do is open a high yield savings account with them! Here is the beauty of these accounts: NO MINIMUM BALANCE to open the account. (I do recommend at least $100.00 though) NO MINIMUM BALANCE to maintain the account. Get up to 3.60% APY on your money Build a strong relationship with Amex even BEFORE you get your credit established and/or cleaned up. For as little as $1.00 you get in with one of the biggest providers of personal credit and business credit lines (One of the big dogs). Please take my advice and put as much money as you can afford into the account. Remember it’s your money you can pull out at any time. This is a forward-looking plan to obtain larger credit lines down the road when you are ready to apply. I would also set up some automatic deposits to go to the account. This way you are making a good impression on Amex every time they see money coming into your account. Click the Link to set one up today! It's quick, and easy, and it’s the perfect strategy to operate while you're getting your personal and/or business credit together. This way you are in an even a better position when it comes time to getting funding. Banks operate with and love depository relationships. This sets you up with one of the largest credit line issuers in America. P.S. – This works with any bank you want to obtain credit from “down the line”.

1-6 of 6

skool.com/fast-track-capital-academy-1577

Designed for serious entrepreneurs who want capital now. Real strategies & real cash funding. 1-on-1 sessions with a 20-Year Credit & Funding Expert.

Powered by