Money Plays This Week - Gameplan From Live Trading Call February 9th 2026

Market Strength Right Now: SPY reclaimed $692 (+1.9%), sitting right at the $696 MVC resistance. Nasdaq up +2.1%. VIX futures down -3.6%. Breadth is positive but grinding — TICK hit +649 midday. This is a steady buy-the-dip recovery, not a face-ripper. The setup favors continuation into close but don't chase extended names. Top 3 Sectors to Focus On: Storage & Memory (9.5/10) — This is THE sector from your call this morning. WDC, NTAP, PSTG, CSCO, ANET. "Every day we'll have a trade in one of these." Institutional flow confirms it with IGV seeing $1.5B inflows in 48 hours and IGV +2.5% pushing to highs. MU breaking out at $397 with 8K+ weekly $400 calls active. Semiconductors (9.3/10) — TSM, AMAT, ARM, LRCX. SMH bouncing off the 50-day MA with 13K March $450 calls bought and 1K September $425 bull synthetics opening at credits. AMAT opened at $322 and is ranging up to $330. This group has earnings catalysts stacked all week. Precious Metals (9.0/10) — Gold above $5,050, silver exploding past $83 (+6.7%). SLV seeing 25K June $120 calls bought at $4.65-$5. But be careful — these are extended intraday. The play here is flagging dip entries, not chasing the 6% move. Best Plays Right Now: HOOD at $84.40 is your highest conviction swing (9.5/10, Cash Cow). Earnings tomorrow after close. You're positioned with April calls for time buffer. No action needed today — just hold and let it set up. The $82-85 zone is your base. GOOGL at $323 is the freshest MOMO play. Bull reversal stick forming, $100B bond demand catalyst, 14K May $370 calls bought at $8.50+. Green on the day and running to highs. If you're looking for an afternoon entry, a pullback to $320 is the spot. NVDA at $185 is up 7.9% with a $1.6M call position opened plus 25K March $195 calls. Strong but extended — better as a pullback buy toward $182-185 if it gives you one into close. MU is the sleeper — watching $397 for the monthly value high breakout. 8K weekly $400 calls active early. If it clears $400, that's a clean MOMO trigger for a quick scalp.

1

0

🚨 DCG MASTERMIND WEEK 6 TRADING REPORT IS LIVE February 8-14, 2026

🚨 DCG MASTERMIND WEEK 6 TRADING REPORT IS LIVE February 8-14, 2026 | Access Code: MASTERMIND-W06 Dcg.Report This week brings 30+ earnings reports, CPI data Friday, and a crypto market in extreme fear (Fear & Greed Index: 8/100). Access Code: MASTERMIND-W06 Expires: February 15, 2026 9 CASH COW EARNINGS SETUPS Premium collection opportunities from this week's 30+ earnings reports: Tuesday Earnings: HOOD (A+ 9.8), CLF (B+ 8.5) Wednesday Earnings: SHOP (A+ 9.7), APP (A+ 9.5), MNDY (B+ 8.4) Thursday Earnings: ANET (A+ 9.6), ON (B+ 8.3) Friday+ Earnings: AMAT (B 8.0) All setups include iron condor strategies with 8-12% premium targets. 📊 WEEK 6 MARKET ENVIRONMENT Current Conditions (as of Feb 8, 2026): • SPY: $694.50 (cautiously bullish) • Bitcoin: $70,874 (-8.3% weekly, extreme fear) • VIX: ~18 (elevated volatility expected) • Gold: $455.46 (safe-haven bid from FOMC uncertainty) Key Economic Events: • Tuesday: Retail Sales (consensus +0.4%) • Wednesday: JOLTS Job Openings Report • Friday: CPI Report 🚨 Major catalyst - expect high volatility Fed Speakers: Governor Logan & Miran (Thursday) - watch for rate cut guidance 🔥 HOT THEMES THIS WEEK 1. Japan Political Catalyst - LDP supermajority driving EWJ/DXJ (highest conviction) 2. AI Infrastructure - VRT earnings + sector momentum 3. Crypto Capitulation - BTC extreme fear = contrarian opportunity 4. Earnings Season Peak - 30+ reports create premium collection setups 5. CPI Volatility - Friday's data will set tone for rest of February ⏰ IMPORTANT DEADLINES • Access Code Expires: February 15, 2026 (Saturday) • CPI Report: Friday, February 14, 8:30 AM EST • VRT Earnings: Wednesday, February 12, Before Market Open • COIN Earnings: Thursday, February 13, After Market Close Trade smart. Trade with conviction. Let's make Week 6 count. — DCG Mastermind Team

1

0

Trading Gameplan For February 4th 2026

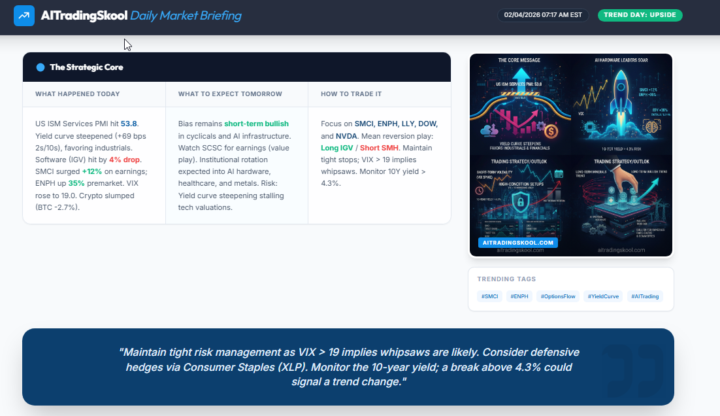

Focus on SMCI, ENPH, LLY, DOW, and NVDA. Mean reversion play: Long IGV / Short SMH. Maintain tight stops; VIX > 19 implies whipsaws. Monitor 10Y yield > 4.3%.

2

0

Tuesday February 3rd 2026 - Bear Market Gameplan For February 4th

CRITICAL MARKET CONDITIONS: - ES Futures lost 6920 support - bears in control - Bitcoin crashed to $74,800 (lowest since Trump's election) - VIX spiking to 20 - fear mode activated - Tech sector at 2-month lows, software in freefall

2

0

RECAP - AI Jamars 21 Day Strategy and 30 Minute Trading Tunnel

The core trading approach centers on disciplined 21-day swing trades using the alligator indicator and catalyst breakouts, combined with focused 30-minute trading tunnels for execution (18:40). - The strategy requires entering trades either on an alligator pullback to the 30-day moving average or on a catalyst-driven breakout within 8 hours of fresh news, confirmed on multiple time frames (23-minute, 2-hour, daily) (19:07). - - Jamar stressed the importance of discipline: enter the trade, set stops, and walk away to let trades run their course, avoiding constant checking or emotional reactions, which reduces execution errors (01:12:10). - - The institutional accumulation cycle of 15-21 days is the target holding period, with a preference for monthly calls (March-April) over weekly options to maximize upside and reduce risk (01:34:14). -

3

0

1-30 of 37

skool.com/ai-trading

🔹 Learn to trade crypto & options with AI Speed. Become a confident profitable trader who executes with precision. Go from confused to confident in 7

Powered by