Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The AI Trader's Fast Track

97 members • Free

Flippin' Empire [free]

3.8k members • Free

4 contributions to The AI Trader's Fast Track

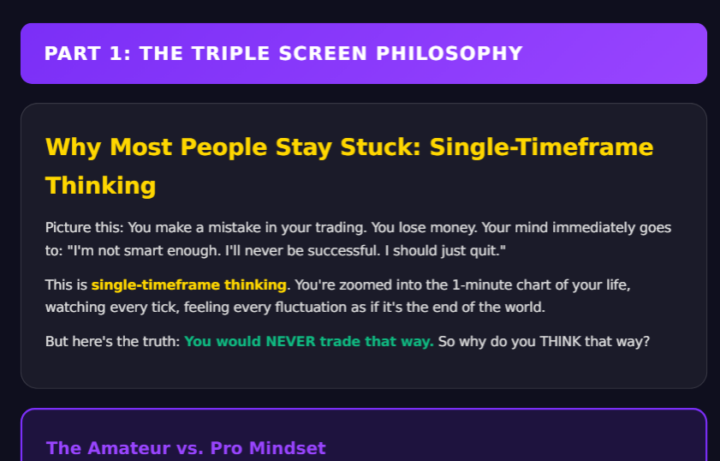

TRIPLE SCREEN PHILOSPHY - MINDSET TOPIC 2-4-2026 In DCG

The 3D Philosophy (why single-timeframe thinking keeps people stuck)

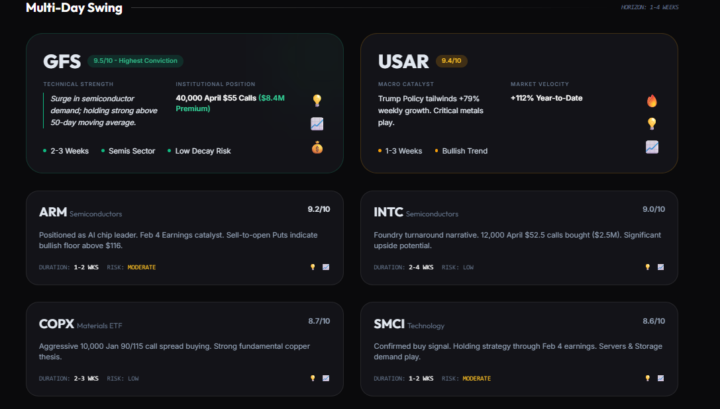

Whats Your Favorite Play On This List For January 28th 2026

Let me know who likes money, which one is your favorite play to take today?

FEB TRADE -

The U.S. is reportedly considering $HOOD as a platform for proposed “Trump Accounts” aimed at investing on behalf of children.

Timing: IMMEDIATE — Breaking news energy

Timing: IMMEDIATE — Breaking news energy Gold just had its worst day in 40 years. Silver's worst day since 1980. Not a typo. Not fear-mongering. Just the market doing what it always does when everyone forgets it can. For months, I watched traders pile into precious metals like it was free money. "Safe haven." "Can't lose." "Protection against chaos." Sound familiar? It's the same thing they said about tech in 2000. Housing in 2007. Crypto in 2021. When something "never crashes," it becomes the most fragile trade of all. Here's what most people won't tell you: This wasn't random. The leverage was visible. The overcrowding was obvious. The warning signs were screaming. But when prices only go up, nobody wants to hear it. Now margin calls are cascading. Forced selling into thin liquidity. The same mechanics that crater Bitcoin—except this time it's hitting what people thought was "safe." The Warsh nomination broke the spell. Dollar ripped higher. And every overleveraged gold and silver position got liquidated simultaneously. This is how systemic unwinds begin. Not with a single crash everyone remembers. With a crack that spreads. We detailed exactly why this setup was dangerous in our 2026 Cycle Forecast. 📍 survivingthecycle.com 9 years of calling the turns nobody sees coming. What did YOU see this morning—opportunity or panic? #TradingPsychology #GoldCrash

1-4 of 4

Active 23h ago

Joined Jan 26, 2026

Powered by