Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

AI Trading Hub: Learn & Profit

92 members • $9/m

OfferLab

9.5k members • Free

202 contributions to AI Trading Hub: Learn & Profit

MLK Day Is Setting a Volatility Trap

Markets are closed today —but positioning never stops. Three-day weekends often lead to: • Compressed volatility • Option imbalances • Violent Tuesday openings Add in: • Small-cap leadership • Software weakness • January barometer signals …and you get a setup most traders miss. DCG maps these volatility windows in advance — not in hindsight. 👇 Do you expect continuation… or a shakeout after the open?

0

0

AI Isn’t the Only Game Anymore

Defense and space names are catching aggressive bids: • ONDS closes a $1B raise • Autonomous systems accelerating • SpaceX IPO chatter igniting sector momentum This isn’t speculation —it’s policy-driven capital responding to: • Rising global tensions • Increased U.S. defense spending • AI-powered autonomy adoption Smart money moves ahead of legislation — not after it passes. DCG members saw this rotation forming weeks ago. 👇 Are you watching defense, space… or ignoring it completely?

0

0

Small Caps Are Sending a Message the Market Can’t Ignore

The Russell 2000 has outperformed for 11 straight sessions — something we haven’t seen since 1990. That’s not luck.That’s institutional rotation. While large-cap tech consolidates, capital is quietly moving into: • Small caps • Regionals • Defense & autonomy • Space & infrastructure This is how early-cycle expansions start — not with headlines, but with money flow. DCG tracks these rotations live — before they show up on CNBC . 👇 Are you positioned for small-caps… or still stuck in mega-caps?

0

0

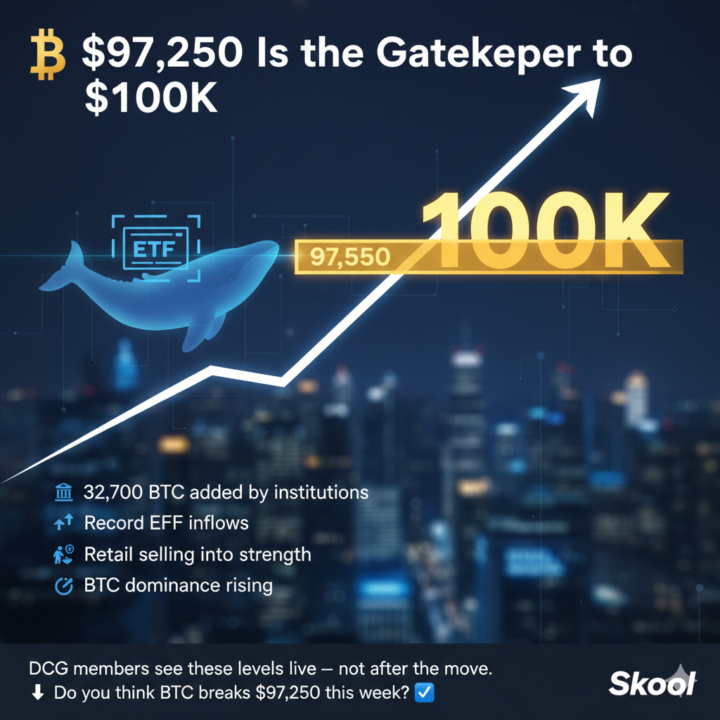

$97,250 Is the Gatekeeper to $100K

Bitcoin isn’t moving on hype. It’s moving on whales and ETFs. • 32,700 BTC added by institutions • Record ETF inflows • Retail selling into strength • BTC dominance rising That’s a classic late-stage accumulation pattern. If BTC breaks $97,250, the door opens to $100K–$105K faster than most expect. DCG members see these levels live — not after the move. 👇 Do you think BTC breaks $97,250 this week?

0

0

One Earnings Report Just Repriced the Entire Market

TSMC didn’t just beat earnings. It validated the entire AI economy. Revenue +21% YoY Profits +35% CapEx up to $56BQ1 guidance +38% YoY This means: NVDA, ASML, AMD, AVGO, MRVL are not in bubbles —they’re in a supply-constrained supercycle. This is why institutions are piling into semis. DCG doesn’t trade stories —we trade capital flows. 👇 Which AI stock are you holding right now?

0

0

1-10 of 202