MARKET IS BLEEDING. SOMEONE SAW IT COMING 24 HOURS AGO

Everything is selling at once. Stocks, gold, silver, crypto — this is a liquidity event, not a normal pullback. The S&P broke its 6,954 range floor and the sellers haven't stopped. Tech is getting destroyed — every Mag-7 name is red, software is in freefall, and Cisco's -12% drop set the tone. Gold crashed below $5,000 for the first time in weeks. Silver lost 10% in 30 minutes. The NY Fed just confirmed 90% of tariff costs are hitting U.S. consumers. And CPI drops tomorrow morning. The VIX is at 20. The SPY flow is -11% net bearish. This is the market telling you to pay attention.

0

0

Crypto at Extreme Fear (But That’s Not the Trade Yet)

Bitcoin: $67K Fear & Greed: 11/100 -47% from highs Extreme fear doesn’t mean “buy.” It means “wait for structure.” $60K is the real test. $70K is failed resistance. Meanwhile, Energy and Gold are already trending. This is what separates amateur traders from disciplined ones: • Patience •Confirmation • Capital protection Inside the paid DCG membership, we walk through: • Exact key levels • Entry frameworks • Risk sizing in volatile markets • Real-time trade discussions If you’re still in free access, you’re seeing the surface. If you want the execution edge — upgrade now!

0

0

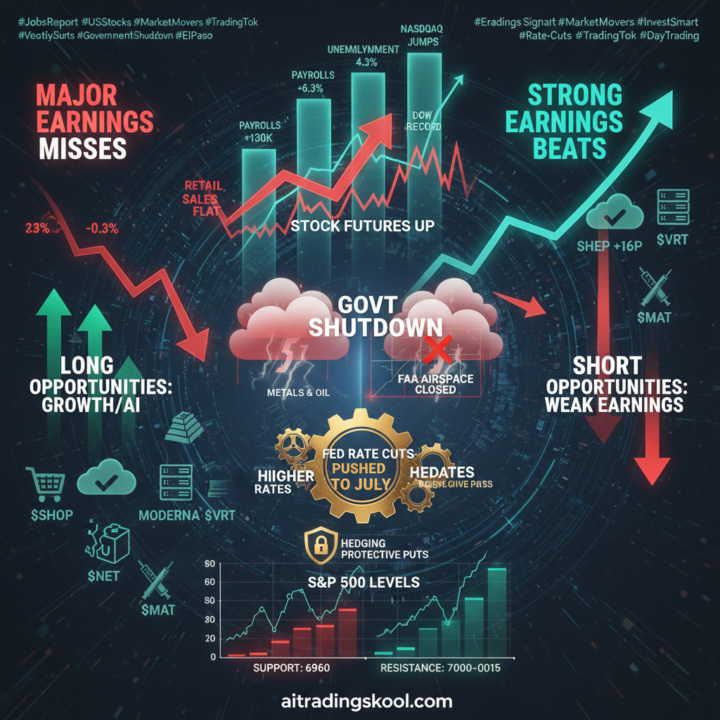

Jobs Beat = Growth Reset

NFP: +130K vs 55K expected Unemployment: 4.3% Sounds bullish… but growth stocks disagreed. Stronger labor = Fed delays cuts Delayed cuts = pressure on high-valuation tech That’s why: • Energy led • Gold broke higher • Staples outperformed • Growth got sold The index may look “fine” — but underneath, capital is rotating aggressively. Free content shows you what happened. Paid membership shows you: • Where money is flowing next • What levels matter • How to position before the crowd reacts If you want structure instead of reaction, step into the room where execution gets mapped daily. 👉 Upgrade inside aitradingskool.com

0

0

Energy & Gold Just Sent a Loud Message

This is not a growth-led market anymore. 13/13 Energy stocks green. 14/14 Gold stocks green. Growth tech? Complete washout mid-session. That’s not random.That’s rotation. Strong jobs data pushed rate cuts further out → long-duration growth loses appeal → capital flows into hard assets and cash-flow sectors. If you’re still trading like this is a smooth uptrend environment, you’re trading the wrong regime. Rotation markets reward: • Sector awareness • Relative strength • Faster execution • Controlled sizing Inside the paid DCG membership, we break down sector leadership daily and map the actual execution plan — not just headlines. If you’re serious about trading this environment properly, it’s time to move beyond free content. 👉 Upgrade your membership at aitradingskool.com

0

0

TRUTH ENGINE REPORT FEB 11th 2026

TSM just printed $110M+ in call sweeps — the biggest single-name flow of the session. Vertiv exploded +23.7% on data-center demand. Gold cracked $5,000. Jobs beat expectations but the market faded the rally. The Fed's Schmid came out hawkish. CBO is projecting record deficits. And somebody is loading up on OTM SPY puts. The surface looks bullish — underneath, there's a war happening between the AI trade and macro gravity. Check the truth engine report below

0

0

1-30 of 398

skool.com/ai-trading

🔹 Learn to trade crypto & options with AI Speed. Become a confident profitable trader who executes with precision. Go from confused to confident in 7

Powered by