Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Wydell

Memberships

Making Money With Harlan & AI

656 members • Free

Creator Profits

16.3k members • Free

Make Money Online with Maria

328 members • Free

Radikal Marketer (FREE GROUP)

412 members • Free

Multifamily Wealth Skool

12.9k members • Free

Autopilot Passive Trading

1.1k members • Free

Million-Dollar Trading Trial

331 members • Free

Radikal Mentorship

1k members • $1,497

Sean Mize

331 members • Free

11 contributions to Retirement CASH FLOW

Flipping Houses vs The Note Business

I just spent 3 days (7 hours a day) at a big real estate event and here’s what hit me. They broke the whole game down into 3 roles: Finder The dog on the bone. Calling homeowners, chasing FSBOs, digging through every crack in the market trying to find real deals at 60 cents on the dollar. Their job is to feed the Operator. Operator The flipper. The one in the chaos. Hiring contractors, buying materials, lining up the money, paying everybody, dealing with inspectors, buyers, lenders, drama, delays, all the shit that has to be handled just to get one house sold. Funder The money. Private lender comes in, looks at the numbers, decides yes or no, wires the funds, and then goes back to their life while the Operator sweats it out. When the deal closes, they get paid and look for the next one. Everyone in that room—attendees and coaches—kept pointing to the same “endgame”: 👉 Be the Funder Be the Funder Be the Funder And I’m sitting there thinking: I’ve been doing a version of this for 20 years… but louder. Because the note business is the Funder on steroids. We’re not funding one or two flips, getting cashed out, then letting our money sit around hoping for the next “good deal” to come along. It's also a race to the bottom. The operator is always looking for the cheapest money. Why borrow at 12% when I can get it for 7 or 8 or 6. Those are crap numbers. As note investors, we buy the paper. We buy groups of deals. We control the income stream. We work them out, restructure, modify, foreclose when we have to, and get paid from multiple directions. Some notes pay my retirement accounts for 20 years tax free! My family business can comfortably work 5–6 deals at the same time. Any more than that and yeah, we start to go a little bonkers—but in a good way. That’s leverage. That’s control. That’s being the Funder with way more options than a one-off flip. If you’re tired of only swinging a hammer or chasing leads and you want to see how the “Funder on steroids” side really works, drop a 🔥 in the comments or message me “NOTES” and I’ll walk you through how this model actually builds long-term cash flow.

Before I ever had an “investment portfolio” 👇

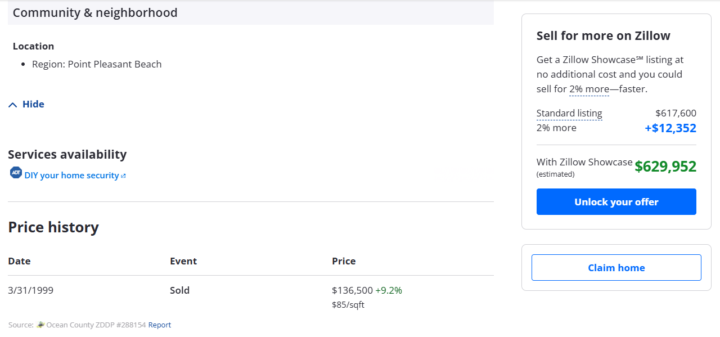

I didn’t even know what that phrase meant. Portfolio was a word rich Wall Street people used on TV. I was just trying to keep the lights on and be happy I could at least make enough salary to allow my wife to be a stay at home Mom. Here’s what actually changed for me 1️⃣ I started looking for things that made sense to me. I bought a study course on late night Infomercial How to buy your first Investment Property with No Money Down Carlton Sheets. 4 Payments of $74.99 2️⃣ That was it I poured over this material and did what he said. I got my team together and looked at as many properties as my Realtor would take me to. I still have that Study course and in that book I wrote April 1 1999 I bought my first rental income property following the magic 1% rule. Rents must be greater than 1% of the purchase price. Rent = $1,400 and the purchase price was $136,500 💬 Your turn:Where are you right now? - “No portfolio, no clue (that was me).” - “Just getting started.” - “Already building, want to go bigger.” Does this get you excited? Let's jump on a call Use this link https://calendly.com/mike-2347/30min Drop it in the comments so I know who I’m talking to 👇

Lack of education from our Government!

Let me know if you are interested!

I don't have that kind of money to invest

I have been hearing that since time began! I not only hear it- I used to say it! You get into a mindset of "I dont have the big bucks to invest" and that will always be the first words out of your mouth. I want you to picture yourself finding a cash flowing 4 family house, and you negotiating with the owner a sweet no interest loan with a 7 year balloon payment and low monthly payments during those 7 years. You getting 50% ownership of the property and you also getting to live in this property essentially rent free! You don't think that could happen? It just happened! I am 50/50 partners with the guy that did this exact deal! My partner not only came into this deal with no money, he gets $5K at closing! Why would I give up 50% ownership? The deal is 1,600 miles away from me and this guy is going to live in the property with the tenants that he picks because his family is going to live there and I have every confidence that he will be very selective of his new neighbors!

1-10 of 11

@wydell-conley-4952

Real Estate Investor, Affiliate marketer & Future Trader.

Active 24h ago

Joined Nov 21, 2024

Powered by