Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Auction Property Academy

353 members • Free

6 contributions to Auction Property Academy

🚨BIG WIN — I Just Bought a Flip House in Sarasota!

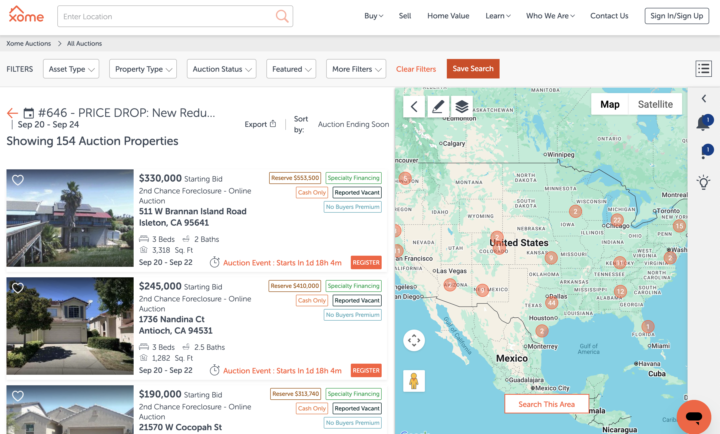

I just closed, rehabbed, and listed my next flip in Sarasota in… 3 days. Yep, you read that right. This was an auction property I had been following on Auction.com for months. Nobody was bidding on it at auction, but the listing agent kept telling me there was a ton of interest. The “auction” label was actually scaring most buyers away… which to me just screamed opportunity. So, after months of back-and-forth with the bank — them trying to cover their foreclosure expenses and me holding strong for a deal — they finally dropped their reserve to line up with my max bid. We locked it in. 🔑 Here are a few key lessons I took away from this one: 1️⃣ Pending ≠ Sold.This property went “pending” twice before falling out and going back to auction. Don’t assume a pending status means you’ve missed the deal. 2️⃣ “Cash Only” ≠ Cash Only. A lot of auction properties are listed this way, but that doesn’t mean you can’t use financing. I picked this one up using a DSCR loan (you can also use fix & flip loans). 3️⃣ Flips Don’t Always Mean Gut Jobs.This property was practically turnkey. All I did was change the locks, clean it, add a little paint, and swap out a bathroom vanity — and it was ready to list. Nearly a six-figure profit without swinging a hammer. 👉 Should we break down the numbers together in a live lesson?

🚨 FHA Just Slashed Reserve Bids Nationwide 🚨

After yesterday’s Fed meeting, FHA dropped the reserve amounts across their auction inventory — and y’all, this is big. 👉 Over 75% of their properties just had reserves cut. 👉 Some dropped by as much as 13%. 👉 That means real opportunities for anyone ready to step in. Now, here’s the thing… a lower reserve doesn’t automatically mean it’s a deal. Some of these properties will make you serious money. Others? Straight headaches if you don’t know what to look for. 💡 This is exactly where investors get stuck — knowing which properties are worth your time and money. Inside my 1:1 program, I walk you through: ✅ How to run numbers on properties before you bid. ✅ How to spot hidden red flags in the data. ✅ How to build a game plan so you’re not just bidding — you’re winning. So if you’re serious about making plays while reserves are at rock-bottom, now is the time to jump in. 👉 Drop a 🔑 in the comments if you want details on working with me directly, and I’ll reach out. Because here’s the truth: these opportunities don’t come around often — and when they do, they don’t last long.

Q&A Time ✅

Happy Monday! Hope everyone is starting the week off strong 💪🏽 It’s Q&A time!! This is your chance to ask me anything about auction properties, foreclosures, or real estate investing in general. No question is too big or too small — whether you’re just trying to figure out how auctions even work, or you’ve got a specific deal you want a second opinion on, I’ve got you. 👉 Drop your question in the comments and I’ll be answering them all later today. Let’s get it! 🚀

Have Questions?

Hey Investors! Im creating a tab for the community to be able to ask questions as i've been getting a ton of questions in my messages & think we can all benefit from Q&As. Just remember, no question is too small so drop them as a post on here👇🏼

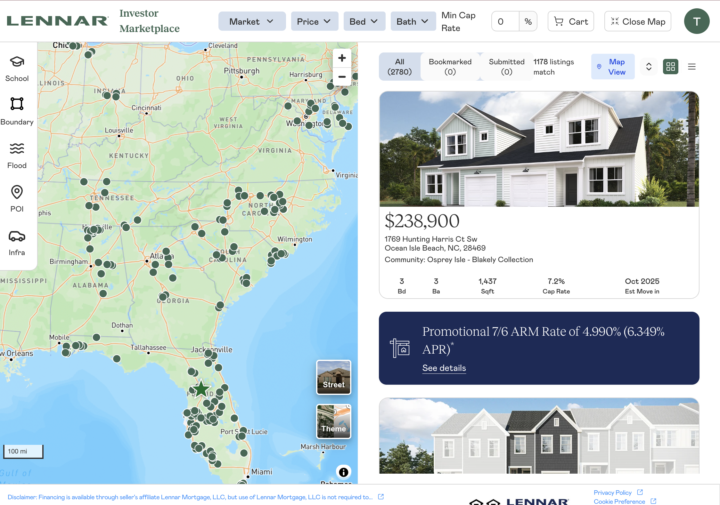

New Resource for Finding Deals: Lennar Investor Marketplace

This morning I came across a brand-new platform from Lennar (one of the largest homebuilders in the U.S.) that’s designed specifically for real estate investors. With all the new construction happening across the country, Lennar has launched a dedicated portal where investors can directly purchase properties from them. 🔑 Why this matters for us as investors: - You get direct access to builder inventory without having to go through the traditional MLS process. - Builders are often motivated to move properties quickly (especially standing inventory), which can lead to discounts or incentives. - The marketplace includes duplexes, condos, and single-family homes — meaning opportunities for both buy-and-hold investors and those looking for cash-flowing rentals. 👉 How to Get Started (Action Steps): 1. Visit the Marketplace: Lennar Investor Marketplace 2. Create an Investor Account: Registration is quick and gives you access to browse full listings. 3. Filter Properties: Search by property type (duplex, condo, SFR), location, and pricing that fits your investing strategy. 4. Run the Numbers: Don’t just look at purchase price—calculate potential rent, cap rate, or flip margins. Builders may have bulk or cash-flow opportunities depending on the market. 5. Compare Markets: Look at multiple states/regions—new construction in fast-growing areas can lead to strong appreciation and stable tenant demand. 💡 Pro Tip: Keep an eye out for inventory homes (new builds already completed or near completion). Builders are more motivated to offload these quickly, which could mean negotiating power and better ROI. 📢 Community Question:Would you use a platform like this to source deals? Or do you prefer sticking to auctions, MLS, or off-market leads?

1-6 of 6