Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Basquiat University

1.5k members • Free

5 contributions to Basquiat University

Is Bristol-Myers Squibb Company (BMY) worth investing in?

Bristol-Myers Squibb is a leading biopharmaceutical company known for its strong cash generation and robust product portfolio. The company focuses on innovative medicines for serious diseases, maintaining stable margins and significant cash flow. Profitability - Return On Equity(ROE): 33.7% - Return On Asset(ROA): 6.3% - Return On Invested Capital(ROIC): 15.3% Bristol-Myers Squibb efficiently converts its assets into profits, maintaining strong profitability metrics. Cash Flow Strength - Free Cash Flow Yield: 15.26%(15.30B) - Low CapEx: Allows for substantial free cash flow - Dividends: Supported by strong cash flow The company consistently generates cash, supporting its dividend payments and strategic investments. Balance Sheet Health - Debt Levels: Managed effectively - Liquidity: Strong, ensuring operational flexibility Bristol-Myers Squibb maintains a healthy balance sheet, providing stability and resilience. Dividends - Annual Dividend: $2.28 per share - Yield: Approximately 3.5% - Payout Ratio: (83.49%) Sustainable, backed by cash flow The company offers a reliable dividend, appealing to income-focused investors. Business Model & Revenue - Innovative Medicines: Focus on oncology, immunology, and cardiovascular diseases - Global Reach: Extensive distribution network - Research & Development: Significant investment in pipeline development Bristol-Myers Squibb leverages its strong R&D capabilities to drive growth and maintain competitive advantage. Growth & Future Plans - Pipeline Expansion: Focus on high-potential therapeutic areas - Strategic Partnerships: Enhancing product offerings and market reach - Operational Efficiency: Continuous improvement initiatives The company is poised for steady growth, driven by its robust pipeline and strategic initiatives. Valuation (Attractive) - PE Ratio: (16.58) Competitive within the industry - EV/EBITDA: Reflects strong operational performance - Market Position: Valued for its innovation and growth potential

0

0

ARE WIRE TRANSFERS TOO EXPENSIVE WHEN Funding IBKR FROM KENYA. WHATS THE ALTERNATIVE

Hello guys , my experience funding my ibkr account through bank wire transfer has left me in thinking of using alternative channels due to high transaction’s costs. Swift transfers are just expensive especially if you are using a local banks. While the banks just tell you about their internal swift facilitation cost which range between kes 1500 - 2500 , the don’t mention about the international settlement fees which could range from 10 - 30 dollars or even more. Total charges from my past international swift transfers were almost 30% of the amount being transferred. The math doesn’t make sense . I have come across the wise app option though I'm skeptical as i have not used it before. Anyone who has used it before from kenya for international transfers? Is it a good options ? What other cheaper options are there?

Cheaper Alternatives to SWIFT Bank Wires for Funding IBKR from Kenya

Wise: The Recommended Option Wise is the most reliable and cost-effective alternative for Kenyan investors funding IBKR accounts. Many Kenyan users have successfully used it, and IBKR has a direct integration with Wise that makes the process seamless. Key advantages of Wise: - Transparent fees: Approximately 1.4–1.9% of the transfer amount, with no hidden markups - Real mid-market exchange rate: Unlike banks that add 2–4% to the exchange rate, Wise uses the actual mid-market rate with zero markup - Direct IBKR integration: You can link your Wise account directly within the IBKR Client Portal and fund your brokerage account without leaving the platform - Speed: Transfers typically arrive within hours to one business day How to set it up: 1. Create a Wise account – Download the app or register at wise.com using your Kenyan phone number and national ID for verification 2. Fund your Wise account – Transfer KES from your local bank to Wise via M-Pesa or direct bank transfer 3. Link to IBKR – Log into IBKR Client Portal → Transfer & Pay → Transfer Funds → Make a Deposit → Select "Bank Transfer Via Wise" or "Transfer from Wise Balance" 4. Convert and transfer – Wise will convert your KES to USD at the mid-market rate and deposit directly into your IBKR account Estimated costs for a $500 transfer: - Wise: ~$7–9 (about 1.4–1.9%) - Bank SWIFT: $22–50+ (4–10% excluding FX markup) - Savings: $14–42 per transfer Practical Tips for Community Members For small transfers ($100–500), the fee percentages matter most. Wise is the clear winner here because its percentage-based fee structure scales appropriately, unlike flat SWIFT charges that devastate small transfers. For larger transfers ($1,000+), consider accumulating funds before transferring to minimize per-transfer costs. Even with Wise, batching transfers reduces the number of transactions and associated fees. Account verification: Wise registration from Kenya is straightforward – you'll need your national ID or passport, phone number for verification, and a valid Kenyan address. The verification process typically takes a few minutes.

💎 EXCLUSIVE: Become a Basquiat Elite Founding Member

☄️ This is the moment we've all been building toward! After 10 years of turning my own $217 into a $150K+ portfolio and helping hundreds of everyday people build life-changing wealth, I'm ready to share everything that got me here. While other "gurus" charge $2,000+ for generic advice, we are doing something revolutionary. I'm opening my EXACT GARP methodology — the same system I use to manage $1M+ in separately managed accounts — to a small group of serious members. 🎯 Why We are Doing This Now You've seen the results. If not look at my current results as of Friday the 26th of September 2025. You can see the winners like: - Royal Caribbean Cruises at $160.06 (now $324.53) - United Airlines at $48.11 (now $99.15) - Trip.com at $48.90 (now $75.71) - Sterling Infrastructure at $208.77 (now $338.44) But what you haven't seen is the **systematic process** behind these picks. The GARP framework that turns gut feelings into calculated wealth-building decisions. The research methodology that separates winners from hype traps. 💎 What Founding Members Get (Worth $3,600+ Value) ✅ 2 high quality stock pick recommendations every month($997 value) ✅ Weekly live market analysis calls ($200/month value) ✅ My real-time portfolio updates (priceless transparency) ✅ Direct access to me in exclusive member calls ✅ Priority email responses within 24 hours And there's more! ✅ Monthly stock deep-dives with buy/sell recommendations ✅ Market crash playbook (how I made money in 2022) ✅ Global opportunities across US, Europe & emerging markets ✅ Tax-efficient portfolio strategies for international investors ✅ Annual in-person meetup (first one: Nairobi 2026) ⚡️The Founding Member Opportunity **Regular Price:** $499.99/year **Founding Member Price:** $29.99/month *(locked in for life)* 🔥 What My Track Record Says - 10+ years of documented investing experience - $140K+ personal portfolio starting from $217 - $1M+ in assets under management - 361 community members in just 3 weeks

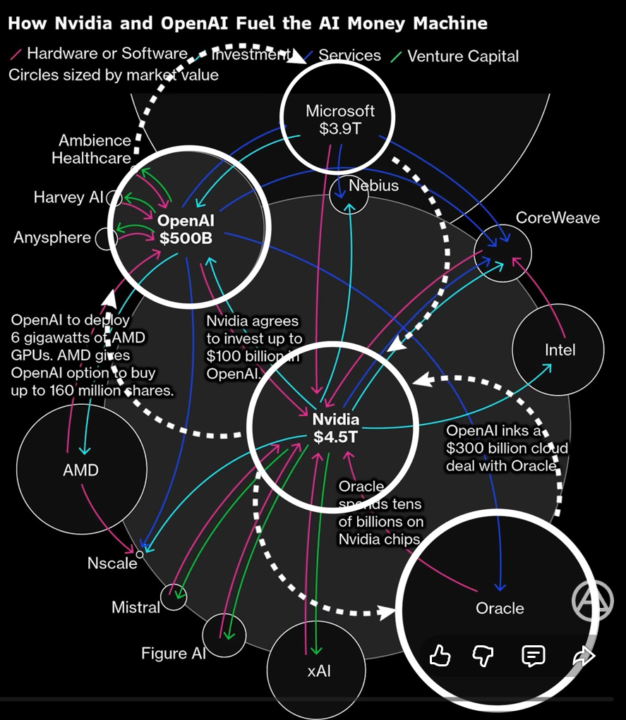

🚨 Is the AI Sector Entering Bubble Territory?

The AI boom has created massive excitement — and massive concentration — in today’s markets. But beneath the surface, we’re seeing signs that resemble previous speculative bubbles. Here are key points to be paying attention to: 📌 1. Extreme Concentration in the S&P 500 Today, the top 5 companies in the S&P 500 make up nearly 30% of the entire index, an unprecedented level of dominance: - Nvidia — 7.6% - Apple — 6.6% - Alphabet — 4.9% - Amazon — 3.6% - Microsoft — ~7% This means the performance of just a handful of companies is driving the entire market. 📌 2. Circular Funding With Little Real Value Generated The recent flow of money between major AI players looks less like innovation and more like a closed-loop money machine: - Big tech companies invest in AI startups. - Startups spend billions buying Nvidia chips. - Nvidia invests back into AI companies. - Cloud providers sign huge compute deals with AI labs. - Valuations skyrocket without clear long-term profitability. This circular flow creates the illusion of value, but in reality, much of the money simply moves in circles — not into real economic output. 📌 3. Multi-trillion Dollar Valuations Built on Future Hopes Nvidia at $4.5T, Microsoft nearing $4T, and OpenAI rumored around $500B — these valuations assume: - AI adoption will be immediate - Monetization will be massive - The tech will deliver exponential productivity gains But actual AI revenue today is still tiny compared to the hype. 📌 4. Historical Parallels: Dot-Com Bubble 2.0? We’ve seen this movie before: - Money chasing promises - Rapid capital recycling - Sky-high valuations detached from fundamentals - Investors afraid to miss out When too much capital chases too few proven ideas, corrections become inevitable. 🔥 Bottom Line: AI will shape the future — but the investments driving today’s prices may be moving faster than real-world value creation. Stay informed. Stay grounded. And stay disciplined.

1-5 of 5

Active 23d ago

Joined Nov 18, 2025