Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The Jupiter Career Community

243 members • Free

GovTech Blueprint Community

2.1k members • $997

6 contributions to SAFE

Being a Financial Advisor

‘I’m sorry I’m not a financial advisor with unlimited resources so I can’t make those kinds of statements or operate with that mindset.’ he said. Unlimited resources? Being an advisor is not about having unlimited resources or capital. It’s actually the opposite. Being an advisor means knowing how to utilize money in ways that create the most impact. It’s about buying whole wings for $2.92/lb and chopping them up, instead of party wings for $4.94/lb. It’s about buying 3 boxes of 10ct waffles for $1.98 instead 1 box of 24 for $5.99. It’s about buying 91 octane gas instead of 87 because even though it’s more at the pump, it gets more miles per gallon so you end up spending less for the month. It’s about monitoring cash flow. Income vs expenses. Save first, spend later. It’s about strategy. Can I afford the lifestyle I want with my current income? If not, do I need to decrease my expenses or make more money? Am I spending frivolously or impulsively? Am I saving? If not, why? Do my current spending habits align with my future goals? What are my future goals? Statements and questions like this is why I created SAFE. Let’s share with each other and with the community, tips and tricks we use to create a better lifestyles for ourselves. Closing the wealth gap starts with communication! Drop your comments below!!

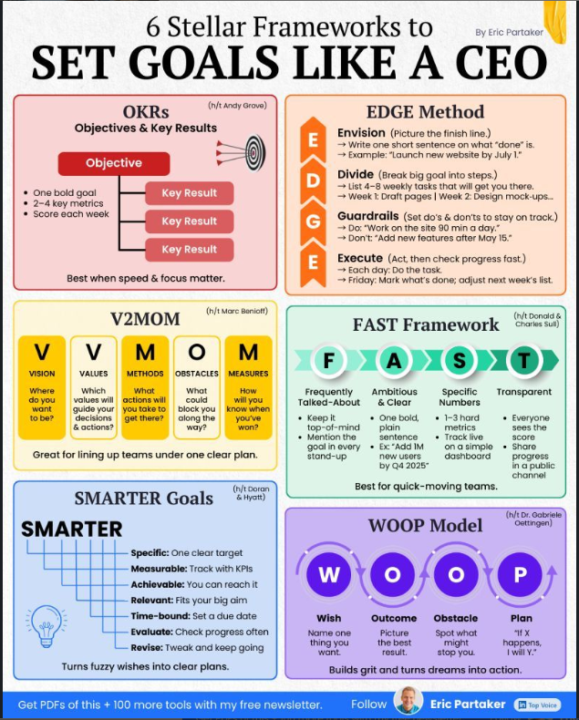

Set Goals like a CEO Pictogram

Which one stands out to you the most? For me it is the WOOP Model. I feel as though I tend to think a step ahead of the actionable task. So, in my mind, I am already processing inefficiencies, outcomes risks, before and during the actionable steps. I think outlining the plan for "If X happens , I will Y" on paper is a strong grounding step for myself. I tend to over plan before / during execution and do not mind a " pivot or two" during the process. I thrive off of finetuning the wish and all the learning that happens as the process unfolds.

NFL Star Quarterback Jameis Winston on Generational Wealth & His Success

Sometimes the algorithm on my phone brings me to the “school of hard knocks” interviews. I loved this quick interview with Jameis Winston. We all are here “for a very unique” purpose. Hopefully that encourages someone today! https://youtube.com/shorts/Ztm_x2UWNSg?si=SxhwreTb8PRl2gIe

1

0

“Richest Black Neighborhoods in America Vlog”

Hi everyone! Watching this today on YT. A lot of the neighborhoods have a minimum HH income of 100K -200k. Even though this HH income range is above the nat’nl avg - I believe it is a bit alarming, while at the same time motivating to view and learn about. https://youtu.be/dNIXaiS9BaQ?si=Ldrma9QzzhR5zk1O

Let talk about it!

$1000 a week $4000 a month $48,000 a year Can you live comfortably? Why or why not?

1 like • Dec '25

I think you can live but comfortably depends on one’s personal definition of “comfortable” and whether or not someone carries high debt. Debt is one of largest barriers & doesn’t get enough credit / spotlight(no pun intended ). When you REALLY think abt it mismanaging debt or having debt most times relates to a lack of strong money management habits/ socioeconomic & cultural factors alike.

1-6 of 6

@salena-dioubate-1118

Background in Fintech, non - technical roles. Eager to level up in a technical career role.

Active 9d ago

Joined Dec 9, 2025