Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Aliea

Memberships

Skoolers

190k members • Free

13 contributions to SAFE

Income vs Assets

Everyone focuses on income… but the wealthy focus on assets. You can have a low reported income and still have high wealth. You can make $70K a year and control millions. You can also make $300K a year and still be broke. Income is what you earn. Assets are what you own and control. Here’s the strategy most people don’t understand: High-net-worth families don’t always want high taxable income. Why? Because high income = high taxes, higher student loan payments, reduced financial aid eligibility, and fewer planning advantages. Instead, they build assets that can be accessed without creating taxable income. Let’s talk about how in the comments.

0

0

What are you willing to sacrifice to get out of survival mode?

Survival costs more than people admit. It costs your time your energy your comfort your familiar relationships your old coping mechanisms Survival mode isn’t free. It just lets you pay in pieces instead of all at once. And at some point, you have to decide: Am I protecting myself… or preventing my own growth? Am I numbing or healing? ***Drop a line about something you’ve sacrificed or are willing to sacrifice to get to your next level!***

0

0

Fresh Off The Press!

This just in! Have y’all heard of the Trump Account? If you have a child under 18, I recommend starting a Trump Account. It’s like a savings account for children. For new babies, born between 2025-2028, the Government starts the account off with $1000 ($1250 if you’re within certain income limits) and you can add up to $5000 a year. This account can later be used by the child for school, homeownership, or entrepreneurship. Don’t let the name fool you! This is a good thing that they will not tell everyone about! For more information, visit https://www.trumpaccounts.gov

Being a Financial Advisor

‘I’m sorry I’m not a financial advisor with unlimited resources so I can’t make those kinds of statements or operate with that mindset.’ he said. Unlimited resources? Being an advisor is not about having unlimited resources or capital. It’s actually the opposite. Being an advisor means knowing how to utilize money in ways that create the most impact. It’s about buying whole wings for $2.92/lb and chopping them up, instead of party wings for $4.94/lb. It’s about buying 3 boxes of 10ct waffles for $1.98 instead 1 box of 24 for $5.99. It’s about buying 91 octane gas instead of 87 because even though it’s more at the pump, it gets more miles per gallon so you end up spending less for the month. It’s about monitoring cash flow. Income vs expenses. Save first, spend later. It’s about strategy. Can I afford the lifestyle I want with my current income? If not, do I need to decrease my expenses or make more money? Am I spending frivolously or impulsively? Am I saving? If not, why? Do my current spending habits align with my future goals? What are my future goals? Statements and questions like this is why I created SAFE. Let’s share with each other and with the community, tips and tricks we use to create a better lifestyles for ourselves. Closing the wealth gap starts with communication! Drop your comments below!!

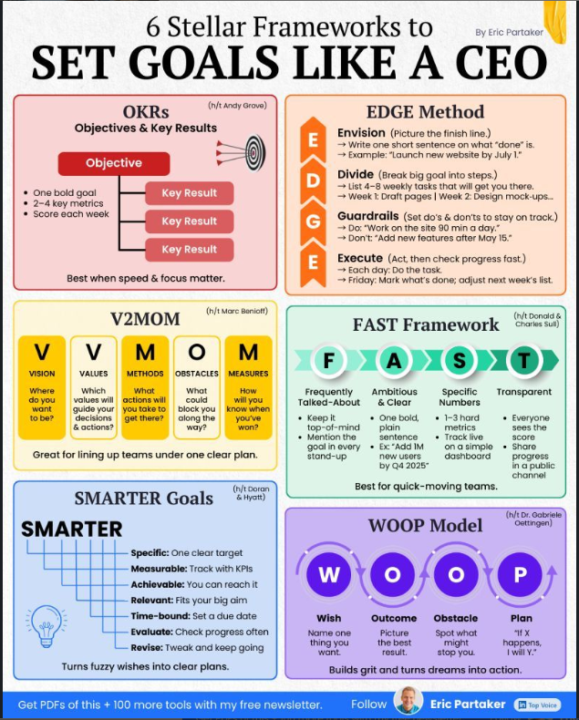

Set Goals like a CEO Pictogram

Which one stands out to you the most? For me it is the WOOP Model. I feel as though I tend to think a step ahead of the actionable task. So, in my mind, I am already processing inefficiencies, outcomes risks, before and during the actionable steps. I think outlining the plan for "If X happens , I will Y" on paper is a strong grounding step for myself. I tend to over plan before / during execution and do not mind a " pivot or two" during the process. I thrive off of finetuning the wish and all the learning that happens as the process unfolds.

1-10 of 13

@aliea-phillips-6973

Financial Advisor committed to closing America’s wealth gap.

Active 17m ago

Joined Oct 11, 2025