Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Growth Hub 365

5.2k members • Free

$100K Funding Challenge (FREE)

10.2k members • Free

Coaching Business Launch

5.1k members • Free

The AI Creators Club (Public)

190 members • Free

AI Automation Agency Hub

291.2k members • Free

The AI Trader's Fast Track

97 members • Free

The Power Community

1.5k members • $2/m

Multifamily Wealth Skool

14.6k members • Free

AutomatiqGPT

2.8k members • Free

10 contributions to The AI Trader's Fast Track

Silver Is Flying — But Most Traders Still Lose on Moves Like This

When a market goes parabolic, beginners do one of two things: ❌ Chase the top ❌ Freeze and watch Professionals do something different. They don’t trade the hype.They trade structure, pullbacks, and momentum confirmation. Silver’s move isn’t just “price going up.”It’s driven by: • Industrial AI demand • Safe-haven flows • Dollar weakness • Massive ETF inflows That’s why dips are being bought aggressively. Be honest: Did you catch any part of this metals run yet — or are you watching from the sidelines? Type IN or WATCHING 👇 Inside the paid group, we focus heavily on how to enter strong trends without chasing — timing, structure, and risk control.

🚗 Waymo’s Next Move Could Reshape the Entire Tech Sector

Autonomous driving isn’t a future dream anymore — it’s happening at scale. What Just Dropped: 🔹 14M total Waymo rides completed 🔹 1M rides/week coming in 2026 🔹 Tokyo + London expansion ahead 🔹 Uber breaks down another -5% Trading Impact: GOOGL continues strengthening its lead in AI + AV UBER setting up for further downside AV sector is creating clean, high-probability trades every week If you’re not positioning now, you’ll be reacting later. 👉 Upgrade to get Jamar’s AV Playbook — exact entry zones, targets, and timing.

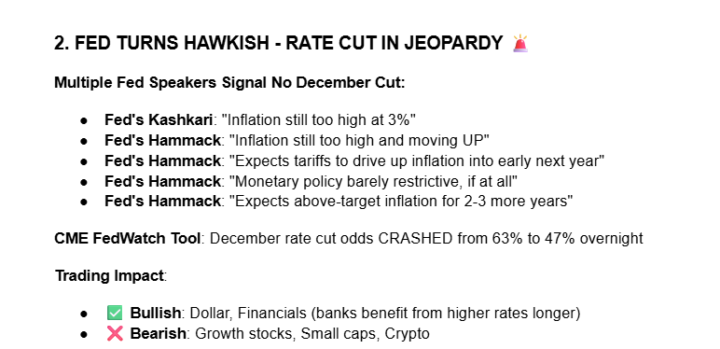

🧨The Fed Just Nuked the December Rate Cut

🚨 The Fed just crushed the market’s December dreams.Rate cut odds plunged from 63% to 47% overnight, sending Tech down -2%+ and the VIX up nearly 20%. Fed’s Hammack dropped bomb after bomb: “Inflation still too high.”“Tariffs will drive prices higher into next year.”“Policy barely restrictive, if at all.” Translation? 🧊 No pivot coming soon. And traders felt it — QQQ broke $610, and Bitcoin fell below $100K. 💬 Question for the group: Do you think the Fed is bluffing (hawk talk before a cut)… or are we officially entering “higher-for-longer” reality? Drop your thoughts ⬇️ — especially if you’re still holding growth or crypto positions. Let’s debate: is this pain temporary… or the start of a macro reset?

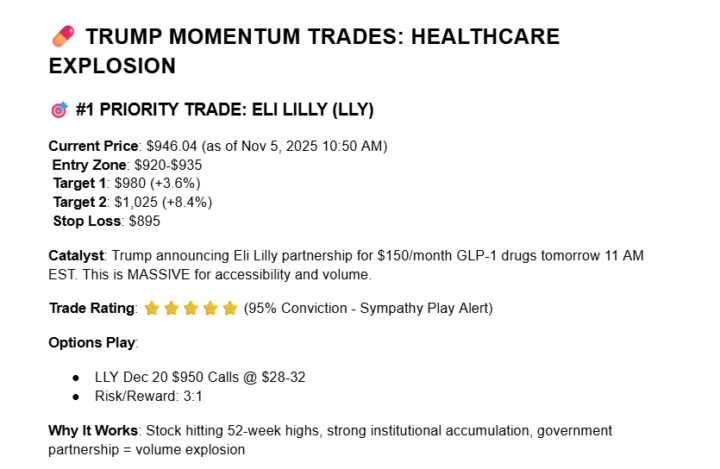

Trump’s Weight-Loss Drug Deal: The Healthcare Shockwave

🚨 Breaking Catalyst for Thursday: President Trump is set to announce a $38B government partnership with Eli Lilly (LLY) and Novo Nordisk (NVO) to make weight-loss drugs available at $150/month — a move that could reshape the entire healthcare sector. What This Means for Traders: 💊 Eli Lilly (LLY) is already up nearly 5% ahead of the announcement. 🔥 Entry Zone: $920–935 | Target: $1,025 | Stop: $895 💥 Novo Nordisk (NVO) following as a sympathy play — entry $46–47.50, targeting $51–54.50. 📈 Healthcare sector rotation is in full swing as tech money flows into pharma. Why It Matters: This isn’t just a “news bump.” It’s a policy-backed volume catalyst that could spark weeks of momentum. Institutions are already loading up ahead of the announcement. 💬 Question for the community: Are you playing the Trump–Lilly–Novo setup or waiting for confirmation after 11 AM EST? What’s your strategy for riding this momentum safely?

Actively Trading - Reach Out - Day Trading Plan October 16th 2025

Lets see who's trading tomorrow, here is a DCG day trading plan for tomorrow October 16th 2025 Which would you trade and why?> 📊 DAY TRADING PLAN - THURSDAY, OCTOBER 16, 2025 Generated: October 15, 2025 | Based on DCG Command Center + Watchlist Analysis 🎯 PRIMARY FOCUS: Semiconductor & Tech Infrastructure Momentum Market Setup ES Bias: Bullish above 6,700 → Target 6,740-6,766 Key Catalyst: TSM earnings pre-market (expected major beat) Sector Leaders: Semis, Nuclear/Utilities, Robotics Risk Level: Moderate (VIX 21-22, manage position sizing at 60%) 🔥 TIER 1 PLAYS - Highest Conviction 1. NVDA - NVIDIA Corporation 💎 Entry: $183-184 (on any pullback to support) Targets: $188 → $193 → $195+ Stop: $180.50 (tight) Catalyst: Massive call buying ($17M notional), 21K contracts Size: Full position (2-3% account risk) Note: Watch for TSM earnings correlation - if TSM crushes, NVDA runs 2. CLSK - CleanSpark ⚡ Entry: $23.20-23.50 (current level or slight pullback) Targets: $24.50 → $26.00 Stop: $22.50 Catalyst: BTC momentum (targeting $122K), crypto mining strength Sector: Aligns with "Uptober" crypto thesis Size: 1.5-2% account risk 3. SERV - Serve Robotics 🤖 Entry: $17.50-17.80 Targets: $19.00 → $20.50 Stop: $16.80 Catalyst: Robotics sector leadership Technical: +6.44% momentum, relative volume 1.23 Size: 1.5% account risk (speculative) ⚡ TIER 2 PLAYS - Strong Setups 4. BZAJ - Blaize Holdings Entry: $6.29-6.50 (already up +25.55%) Targets: $7.20 → $8.00 Stop: $5.90 Note: Momentum chase - wait for pullback or breakout above $6.50 Size: 1% account risk (volatile) 5. BTDR - Bitdeer Technologies Entry: $25.90-26.20 (consolidation after -28.73% drop) Targets: $28.50 → $30.00 (counter-trend bounce) Stop: $24.80 Catalyst: Oversold + BTC strength recovery Risk: Higher risk - oversold bounce play Size: 0.75% account risk 6. CORZ - Core Scientific Entry: $19.94-20.20 Targets: $21.50 → $23.00 Stop: $19.20 Catalyst: Bitcoin mining + energy infrastructure theme

1-10 of 10