Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Luminary Trading

149 members • Free

6 contributions to Luminary Trading

By Popular Demand...

Don't say I never did anything for you guys! 😉😉 Leave your questions & Comments below!

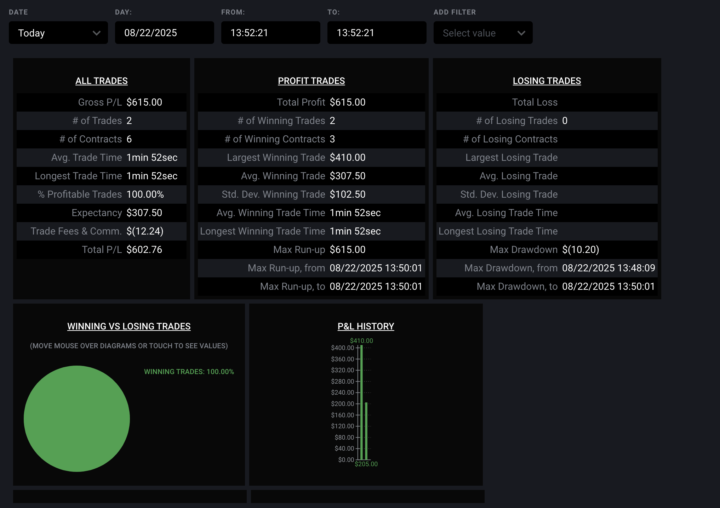

One and Done for the day(Fat-Finger Win)

Had a seconds timeframe zone with a first tap, risked 5 pts for 10 pts.(yes I am supposed to be not doing seconds but i was on 1min whole time lol) Also this seconds TF zone was kind of the SNDR for taking the high on the left On the left we had a zone (not really origin but where the down move started) and its 50 hadn’t been touched yet, so I was looking for higher prices. price was really bullish and so i was looking at those highs(around 23252) to go but 1:2 was the goal But a big F up here -> trading 3 minis instead of micros... Got lucky this time, worked out in my favor(rare occurence) but calling it a day right here.

Levels 1-4 SAY HELLO

Levels 1 to 4? Say hello :-) This post is for everyone who's still on levels 1 to 4. Say hello :-) I have so many DMs and replies to get back to. My rewind technique unlocks at level 4 and my paid course unlocks at level 6. Interact, say Hi I will comment back to get this community ball rolling. Let’s go! Next week will be huge for you!

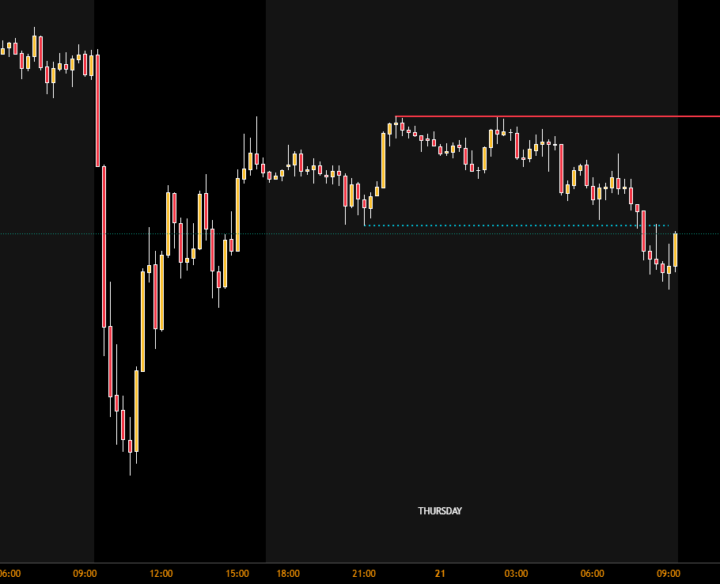

Chart Study - August 21st, 2025

Greetings! This week was immense for many of you, passing evaluations and some of you even earning payouts and beyond. Yes, looking at you @Standard Practice ! 🚀 Coming into the day, we were inside of the HTF area on the daily chart (not shown, as the key level was hit on the Wednesday. This is important for Wednesday, but we will bear in mind that we are in an area of POTENTIAL HTF movement in this zone, but not bullish just yet). We start with our 15min for immediate bias, showing a break of internal structure to the downside (the dotted line), and we note that the low is infact, not a credible low. Therefore our thesis is that we expect a trade back into the above zone, and if we should get a violent 2nd distribution movement away from it, then we would be targeting the prior days low (this coincides with our next day model bias). It's worth mentioning two things as well, from a higher timeframe standpoint. The fact that we disrespected the midpoint of the current swing on the way up, along with the climactic nature of the movement down yesterday, leads us to believe IF we do take the low of yesterday, that we are likely in a range or nearing a major reversal. Our first major point of interest comes in after the 1st 15min candle finishes up, as price creates a SNDR, causing not only a flip (yellow line) but a break in structure as well. Our new expectation is that ONLY IF this area is broken on the retest, that we should be able to risk off of it on the inverse. We also expect any LTF flip to retest this area as well. Our main concern with a rally is that we left lunchtime lows from the prior day untested, a key and main objective. So the main idea, would be a retest of the SNDR, failure, a flip (hopefully, or an inversion), then continuation for the lunch lows of yesterday. It's worth noting in the following 10 minutes of price action that: -We had no flip -The SNDR area is not structural, so there is no structure break here

START HERE:

🎥 Welcome to the Skool.Inside this free community, we’re not just teaching trading—we’re rewiring your identity to become the trader who actually wins. In this video, I’ll walk you through:✅ What this community will do for you✅ What to expect from the course✅ How to get the most out of Skool✅ And a hidden surprise (let’s just say your unconscious will thank you 😉) 👀 Watch all the way to the end—Then head to the intro section and tell us who you are, what you’re working on, and what you’re here to master. 🚨 Reminder: The more you engage, the more you unlock.Let’s make this the place where it finally clicks.

1-6 of 6

@mark-baker-2393

Discipline first, don't pull the trigger too often, don't not pull the trigger at all, pull the trigger at the right time. Focus!

Active 10d ago

Joined Aug 23, 2025