Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Jarvis AI

133 members • Free

12 contributions to Jarvis AI

Candlestick Bible Study

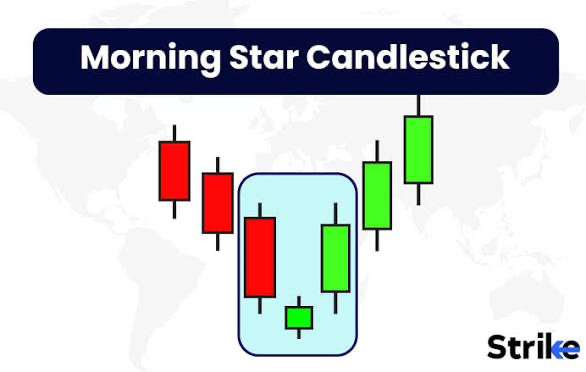

A Morning Star pattern is a bullish, three-candlestick formation indicating a potential trend reversal from bearish to bullish, appearing at the bottom of a downtrend. It consists of a large bearish (red) candle, followed by a small-bodied candle (doji or spinning top) showing indecision, and finally a large bullish (green) candle that closes significantly into the first candle, confirming buyers are taking control. This pattern signals sellers are losing power and buyers are gaining momentum, suggesting a potential upward price movement . Characteristics of the Pattern - First Candle: A long, red (bearish) candle showing strong selling pressure. - Second Candle (The Star): A small-bodied candle (like a doji or spinning top) that gaps below the first candle, indicating market indecision and reduced selling momentum. - Third Candle: A long, green (bullish) candle that opens higher (ideally gapping up) and closes well into the body of the first candle, confirming the bullish reversal. How Traders Use It - Bullish Reversal: It's a strong signal that a downtrend may be ending. - Confirmation: While a strong standalone signal, traders often look for confirmation from increased volume or the third candle's strength. - Entry/Exit: Traders might enter long positions after the third candle confirms the reversal and set stop-losses below the pattern.

Macro data 1.20.26

1. What are the key economic releases or central bank events today that could impact market sentiment? This sets the stage for the trading day and helps you anticipate volatility triggers. 2. How did the major global markets (Asia and Europe) perform overnight, and are there any notable moves in futures or forex that might influence the U.S. open? Understanding global sentiment gives you a broader context. 3. What is the pre-market movement of key stocks on my watchlist, like Tesla, and are there any notable gaps up or down? This helps you identify early opportunities or risks. 4. Are there any significant news headlines, earnings reports, or geopolitical developments that could affect my chosen assets? Being aware of news flow keeps you agile. 5. What are the key technical levels and indicators (like RSI, MACD) on the indices and stocks I’m trading today? This ensures you’re aware of potential entry or exit points. 6. Is there any unusual options activity or volume that might signal institutional interest or a potential big move? Tracking options flow can give you an edge. 7. What’s the overall market sentiment today—bullish, bearish, or neutral—and how are the VIX and other fear gauges behaving? Sentiment indicators help you align your strategy with the market mood. 8. Are there any notable sector rotations or shifts that could influence tech stocks like Tesla today? This helps you see if money is flowing into or out of specific sectors. 9. What risk management measures will I put in place to protect my capital today—stop-loss levels, position sizing adjustments, or hedges? This keeps your strategy disciplined and focused on capital protection. 10. Finally, what is my primary trading plan or thesis for the day, and how will I adapt if the market conditions shift? 11. Is trump speaking and If so about what and what time This ensures you start each day with a clear, adaptable game plan. 🧾 THE EXACT PROMPT TO GET THIS EVERY MORNING (Copy & Paste) Use this every morning before the bell — this will make me generate the same style, same format, updated with the top 5 A+ setups across the entire market:

🧠 JARVIS A+ DAILY SETUPS

Theme: News, rotation, momentum Method: Gap → Hold or Gap → Fail 🚀 A+ CALL SETUPS (Bullish) 🛡️ RTX — Raytheon Technologies 📈 Type: Gap-Up | News-Driven 🎯 Breakout: Above 192 🛑 Support: 180 📊 Why A+: • Defense spending narrative • Strong sector rotation • Clean reclaim of prior resistance • Institutional accumulation evident 🛡️ LMT — Lockheed Martin 📈 Type: Gap-Up | Momentum 🎯 Breakout: Above 530 🛑 Support: 500 📊 Why A+: • Sympathetic strength with defense peers • Tight consolidation after gap • High-liquidity, clean structure 🛡️ NOC — Northrop Grumman 📈 Type: Gap-Up | Trend Expansion 🎯 Breakout: Above 620 🛑 Support: 595 📊 Why A+: • Bloomberg mover • Strongest relative strength in defense • Clean air above resistance 🤖 NVDA — Nvidia 📈 Type: Momentum Continuation 🎯 Breakout: Above 200 🛑 Support: 182 📊 Why A+: • Market leader • Controls overall tech sentiment • Best liquidity for options 🏦 XLF — Financials ETF 📈 Type: Rotation | Momentum 🎯 Breakout: Above 41.50 🛑 Support: 40.50 📊 Why A+: • Capital rotating into financials • Clean ETF structure • Lower volatility, steady trend 🩸 A+ PUT SETUPS (Bearish) ⚠️ NVDA — Nvidia 📉 Type: Momentum Breakdown 🎯 Breakdown: Below 182 🛑 Resistance: 190 📊 Why A+: • Breakdown triggers index pressure • High gamma sensitivity • Fast downside when trend fails ⚠️ QQQ — Nasdaq ETF 📉 Type: Index Weakness 🎯 Breakdown: Below 402 🛑 Resistance: 408 📊 Why A+: • Clean exposure to tech risk • Confirms broader market weakness ⚠️ GOOGL — Alphabet 📉 Type: Relative Weakness 🎯 Breakdown: Below 310 🛑 Resistance: 330 📊 Why A+: • Lagging mega-cap peers • Break of base opens downside ⚠️ IWM — Russell 2000 📉 Type: Risk-Off Signal 🎯 Breakdown: Below 195 🛑 Resistance: 200 📊 Why A+: • Small caps crack first • Confirms risk-off environment 🧭 JARVIS EXECUTION NOTE 🟢 Above key levels → trade CALLS 🔴 Below key levels → trade PUTS ⚪ No confirmation → no trade Jarvis doesn’t predict direction. Jarvis reacts to structure, flow, and confirmation.

Jarvis A+ setups 12.22

🚀 1) 📌 $ORCL – Oracle Corp. Why A+: Oracle is gapping up strongly pre‑market as markets react to renewed tech optimism and sector rotation, pushing sentiment higher today. ORCL is one of the biggest pre‑market gainers with real flow behind it. Key Breakout Zone: $185–$190 Support Levels: $175–$180 Setup Thesis: Strong gap shows early buyer conviction — great for momentum entries. ⚡ 2) 💾 $MU – Micron Technology Why A+: Continues momentum from its recent powerhouse earnings and bullish AI memory demand narrative. Micron is showing pre‑market strength after positive reactions in the chip space. Key Breakout Zone: $248–$255 Support Levels: $235–$242 Setup Thesis: Earnings + AI narrative = institutional interest and momentum continuation. 🛠️ 3) 📊 $HOOD – Robinhood Markets Why A+: Attracting rotation in the fintech/retail trading space with solid pre‑market gains and extended participation. Robinhood is trending up on current data as retail engagement remains elevated. Key Breakout Zone: $118–$122 Support Levels: $110–$115 Setup Thesis: A combination of volatility and volume makes this a momentum setup early. 📈 4) 📦 $NWS – News Corp Class B Why A+: Showing notable pre‑market gains among top movers — a smaller cap news/entertainment name with sharp gap and real flow behind it. Key Breakout Zone: $29–$31 Support Levels: $26–$28 Setup Thesis: Smaller name with real gap and volume — ideal for swing and momentum play. 🔄 5) 🔋 $ALB – Albemarle Corp. Why A+: Materials and battery metals names like Albemarle are catching pre‑market rotation as commodities and risk assets gain strength early. Key Breakout Zone: $140–$145 Support Levels: $130–$135 Setup Thesis: Macro rotation into cyclicals and materials puts ALB on watch for continuation. 💡 Why These Are A+ Today • Gap‑Up Strength: All names are showing real pre‑market upside, not rumor‑driven feelers. • Momentum & Volume: Pre‑open movement with volume or notable gains signals early conviction. • News / Flow Drivers: Semiconductors with earnings follow‑through, fintech rotation, and market breadth support these setups.

Tesla, Friday’s!

Tesla 🏎️🏎️🏎️🏎️ 52 508 502 $495 $188.53 🚨 we must close above those. If we don’t close above this, swinging is risky. But there’s always a chance of us gapping up on Monday. Jeep watch if we open above this area. 💨 👀👀 $486. Pivot point. $482 472

1-10 of 12

Active 13h ago

Joined Nov 5, 2025

Powered by