Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Automated Marketer

3.2k members • Free

Real Estate w/ Nick Chapman

403 members • Free

ScalingLEAN Community

633 members • Free

CashFlowPath

100 members • Free

Optimized Business Leaders

34 members • Free

Multifamily Wealth Skool

14.5k members • Free

Strategic Partnering Community

106 members • Free

Mid-Term Rental Savvy

590 members • Free

Apartment Investing Secrets

374 members • Free

15 contributions to multifamily

Understanding the Two-State Dynamic Playing Out in Kansas City Right Now

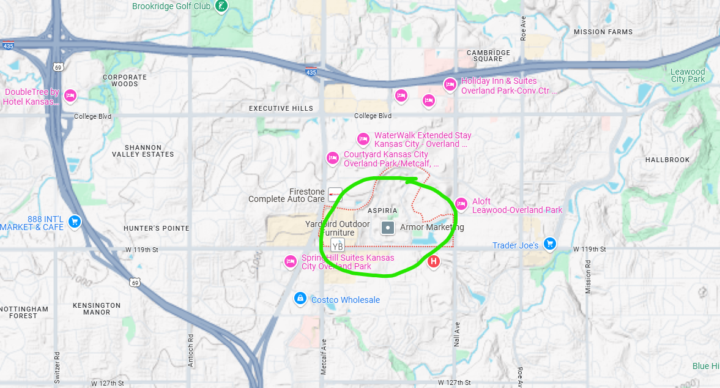

Kansas City operates as a single economic region, but it functions across two different state systems — each with its own tax structures, incentive tools, and development priorities. When those systems begin pulling in different directions, the effects don’t appear overnight. They show up through where employers commit, where capital flows, and how people reorganize their daily lives. That two-state dynamic is becoming relevant again. Why This Metro Behaves Differently In most cities, relocating a headquarters or major asset means crossing hundreds of miles and rebuilding a workforce. In Kansas City, it can mean crossing a street. That distinction matters. It allows: - Companies to reposition without disrupting their labor pool - Municipalities to compete aggressively without geographic friction - Employees to adapt incrementally rather than uprooting entirely As a result, movement inside this metro tends to be gradual, but durable. We’ve Seen This Before — and We’re Seeing It Again This isn’t hypothetical. Kansas City has already experienced meaningful internal repositioning. One of the most visible examples is Lockton, which committed to relocating its headquarters to the Kansas side. That decision wasn’t about leaving the metro — it was about optimizing within it. More recently, similar conversations are happening around large-scale anchor institutions, not just office users. There have been serious discussions around: - The Kansas City Royals potentially locating a new stadium and surrounding mixed-use development on the Kansas side, including sites tied to the Aspiria campus - The Kansas City Chiefs exploring the possibility of moving from Arrowhead Stadium to the Legends Outlets Kansas City area in Wyandotte County Whether or not every proposal materializes is less important than what these discussions signal. These are not fringe ideas — they are serious evaluations of incentives, infrastructure, and long-term alignment. What Happens When Incentives Start to Matter Again

Big Moves in Overland Park - KC Royals New Stadium?

🚨 Big Moves in Overland Park! 🚨 The Kansas City Royals are eyeing Overland Park for a potential new ballpark, creating a ripple of excitement across the area! This game-changing development signals explosive growth potential for multifamily real estate investors. Why does Overland Park and Johnson County stand out? 📈 ✅ Average Household Income: Over $100,000, making it one of the wealthiest counties in the Midwest. ✅ Top Employers: Sprint, Black & Veatch, Garmin, and other HQs provide strong job growth and economic stability. ✅ Job Market: Johnson County continues to outpace the national average in employment growth, especially in tech, finance, and healthcare. ✅ Population Growth: Steady increases driven by corporate relocations and suburban desirability. At Sharpline Equity, we recognized the potential early and have heavily invested in Johnson County over the past year—positioning ourselves to capture the wave of demand sparked by these big moves. 🏙️ Now’s the time to get in. Whether it’s a Royals stadium or the continued influx of talent and capital, this region is primed for multifamily investment success. #MultifamilyInvesting #JohnsonCounty #OverlandPark #KCRealEstate #SharplineEquity #RoyalsBallpark #GrowthMarkets #RealEstateInvesting

State of Multifamily 5/6/25 - Rent Growth - Construction Demand - Capital and more

🏘️ Multifamily Market Highlights 🔹 Rent Growth: National rent growth is projected to rise to 2.0%–2.5% in 2025 (up from 1.0% in 2024), fueled by job growth and strong demand from renters aged 20–34. 👉 Fannie Mae 🔹 Vacancy & Demand: Expected average vacancy rate for 2025: 4.9%. Rent growth projected at 2.6% with stronger demand and a shrinking construction pipeline. 👉 CBRE 2025 Multifamily Outlook 🔹 Supply Trends: Construction starts down 74% from 2021 peak and 30% below pre-pandemic average. This will support stronger rent growth into 2026. 👉 CBRE Construction Pipeline 💰 Macroeconomic Indicators 🔹 GDP Forecast: Fannie Mae revised 2025 GDP growth down to 1.7%, citing weak Q1 data and global trade policy shifts. 👉 Fannie Mae Economic Forecast 🔹 Labor Market: February saw 151,000 new jobs added. Unemployment rate: 4.1%, expected to average 4.2% for 2025. 👉 Fannie Mae Employment Data 🔹 Inflation & Rates: Core inflation now projected at 3.3% for 2025. Rates remain elevated, which continues to affect development and acquisitions. 👉 Bass Berry Multifamily Update 🏦 Capital Markets & Investment 🔹 Freddie Mac Forecast: $370–$380 billion in multifamily loan originations expected in 2025, as refinances and sidelined deals return. 👉 Freddie Mac 2025 Multifamily Outlook

You missed it. It's Official. Apartment Sales Rise First Time in 3 Years,

Apartment sales rise first time in 3 years. Int rates lowered. Recession looming. “Multifamily is bad” “Syndicators are worse” It’s time to get in the game again for those that sat on the sidelines. We are self managed and team is stronger than ever ready to continue to take advantage of this dislodgement in the market. We have been getting access to newer product more than we have ever before. Because we stayed in the game we are getting the first call. The tailwind has begun. https://www.multifamilydive.com/news/apartment-transaction-multifamily-property-vales-cap-rates/741397/?blaid=7150630&fbclid=IwY2xjawI1NsNleHRuA2FlbQIxMQABHb1voXjiOLNmcAokJ5Y0yOFI1l84sXUCMPlgWfsl3hZTA53wkryj_ioM5Q_aem_1wi_NCm8Yf5521JrXV96-g

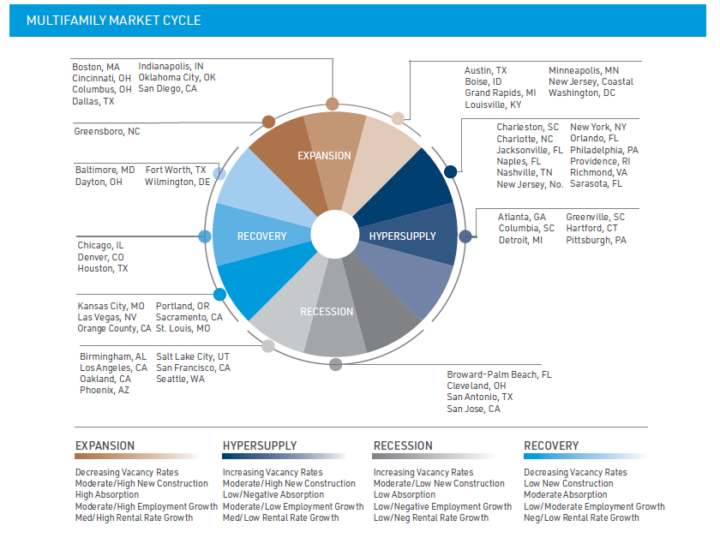

Viewpoint IRR 2025 Outlook

Summary of Overall Message for All Asset Classes The commercial real estate market in 2025 is on a path to greater stability and long-term growth. Despite past challenges, the outlook remains positive as market fundamentals strengthen across asset classes. Investors are shifting their focus to sustainable growth, strategic opportunities, and value-driven investments. With inflation moderating and interest rates finding equilibrium, the real estate sector is well-positioned for a period of steady progress and resilience. Main Points for Multifamily Focus 1. Continued Stability and Growth: Multifamily housing is moving into a balanced phase, with rent growth steadily climbing and vacancy rates gradually adjusting to healthy levels. 2. Sustained Demand: Demand remains strong nationwide, driven by steady job growth, urban migration, and evolving lifestyle preferences. 3. Expansion in Emerging Markets: While Sunbelt states remain a focal point, regions like the Midwest are experiencing newfound momentum due to affordability and quality of life. 4. Affordability Trends: With rent-to-income ratios improving, multifamily housing continues to present attractive options for tenants and strong returns for investors. 5. Investor Confidence: Capital is flowing into well-positioned markets, with a clear preference for stable, long-term investments. 6. Positive Outlook: As construction pipelines adjust and demand stays resilient, multifamily real estate is poised for a period of healthy and sustainable growth. Midwest and Kansas City Multifamily Market 1. Midwest on the Rise: The Midwest, particularly Kansas City, is experiencing a wave of positive momentum, with strong demand for housing fueled by population growth, a thriving job market, and an attractive cost of living. 2. Declining Vacancy Rates: With steady demand and a more measured pace of new developments, vacancy rates are expected to decline, creating a favorable environment for property owners and investors. 3. Affordable and Desirable: Kansas City and other Midwest cities offer an unbeatable combination of affordability, high quality of life, and economic opportunity—making them increasingly attractive to renters and businesses alike. 4. Economic Resilience: With diverse industries, solid employment figures, and ongoing infrastructure investments, Kansas City is proving to be a resilient and growing hub for multifamily investment. 5. Attractive Investment Environment: Compared to coastal markets, Kansas City presents excellent value with competitive pricing, strong rental demand, and promising returns for forward-thinking investors. 6. Positioned for Long-Term Growth: As companies and individuals continue to seek affordability and lifestyle benefits, Kansas City is set to shine as a top-tier market with ample opportunities for growth and innovation. 7. Vibrant Community Development: New developments in Kansas City focus on creating dynamic, thriving communities that attract both residents and businesses, ensuring a bright future for the multifamily sector.

1-10 of 15

@kristine-flook-6806

Commercial Real Estate in Florida 🌴

Real Estate Enthusiast since 2004 | You Win or You Learn | AI is Exciting | Assets over Liabilities| Blessed

Active 2h ago

Joined Oct 8, 2024

Miami Fl

Powered by