Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The Trading Cafe

81.6k members • Free

ESCAPE: For the Fed Up!

202 members • $37/month

fundusi

3.3k members • $1/month

Wholesaling Real Estate

67k members • Free

Results Driven® Community

5.1k members • Free

Commercial Real Estate 101

4.9k members • Free

Commercial Deal Academy

337 members • $10,000/year

5 contributions to Commercial Real Estate 101

Apartment building in Chicago

I am talking to the owner of an apartment building in Chicago. Please reach out to me if you are interested. Asking 5.5 Million Total 31 units 25 units: 2 bed 1 bath (700 sqft) 6 units: 1 bed 1 bath (700 sqft) ~3 years tenant cycle with long-term tenants. Appraised 175k a unit two years ago. 29/31 currently rented $1400-$1750 rent a month owned 20 years Getting old, trying to sell. Existing mortgage but not much compared to 5.5 million Has to be one time payment.

Sent Two LOI's Today

Sent out two Letters of Intent today. One is a 41 unit the other is a 12 unit apartment building. Waiting to get response from broker.

Have you borrowed EMD before⁉️

💥I've had multiple people contact me about EMD on commercial deals, with inspection periods from 3 to 6 months. ❓What do you think? Have you done this before? Would you consider it?

1 like • Apr '25

Ok, I got you. The reason I asked is because I have a transactional funding company that is telling me that they would like to do the EMD for me also. Just trying to see what is the best way to go. One EMD would be $11,200.00 which is 1% of asking price. The second EMD would be $23,975.00 which is also 1% of the asking price.

1 like • Apr '25

I have owned commercial property in the pass. I have owned a 24 unit, 12 unit, 6 unit apartment buildings in the pass. Along with single family dwellings. I been in the Real Estate business since 1975. I am a older young man LOL. I have been around the block many times. If I had known about wholesaling Commercial Property years ago I would been doing this method of Investing. I like it very much. I see such great potential.

Need explaination on how to handle sizable EMD

Paul, I have done the financial analysis on one of the deals that I have and filled out the Triple Pro Play form. The LOI came back with a EMD of $8,000.00 up front and $32,000.00 on the back end after the inspection period is over. Any Ideas on how to handle these funds for a person who is just starting out in commercial wholesaling?

Received Financial Documents on 2 properties

Paul, I received two financial packages today on two apartment buildings. I need to know what is my next step in the process. I know the financials have to be analyzed but is there a specific process. Need to know step by step. Thanks

0 likes • Apr '25

Paul, I have another question for you. I filled out the Triple Play Pro form. I received my LOI. My question is concerning the EMD. The up front EMD is $8,000.00 and the second EMD after the due diligence period or inspection is $32,000.00. What is the best way to handle those sizeable down payments when you are just starting out?

1-5 of 5

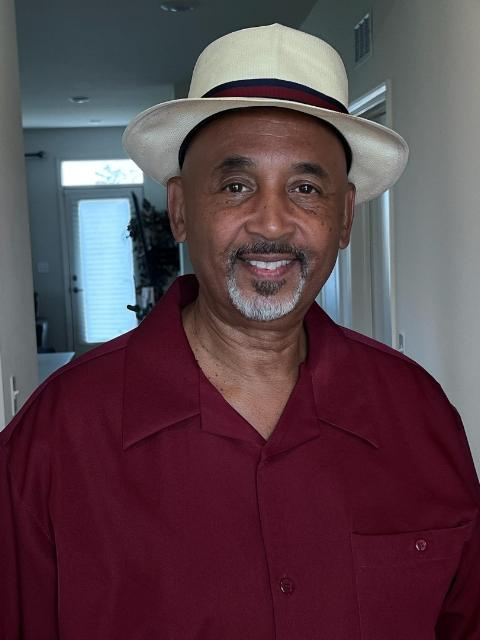

@keith-harris-1312

Hi, My name is Keith. I am a Real Estate investor. I am Just starting in wholesaling Real Estate as a career.

Active 50d ago

Joined Mar 19, 2025

Powered by