Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Real Momentum

120 members • $49/m

39 contributions to Real Momentum

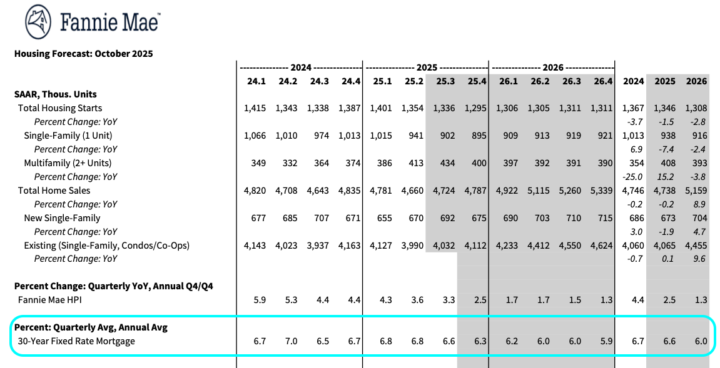

Fannie Mae - Current Forecast

See attached! Take it with a grain of salt, but it is interesting to see what these large institutions are projecting. In terms of interest rates, they expect 30-year rates to stay around 6% in 2026. Use this fact to help on-the-fence buyers or sellers understand that 3% rates are likely NOT right around the corner.

2

0

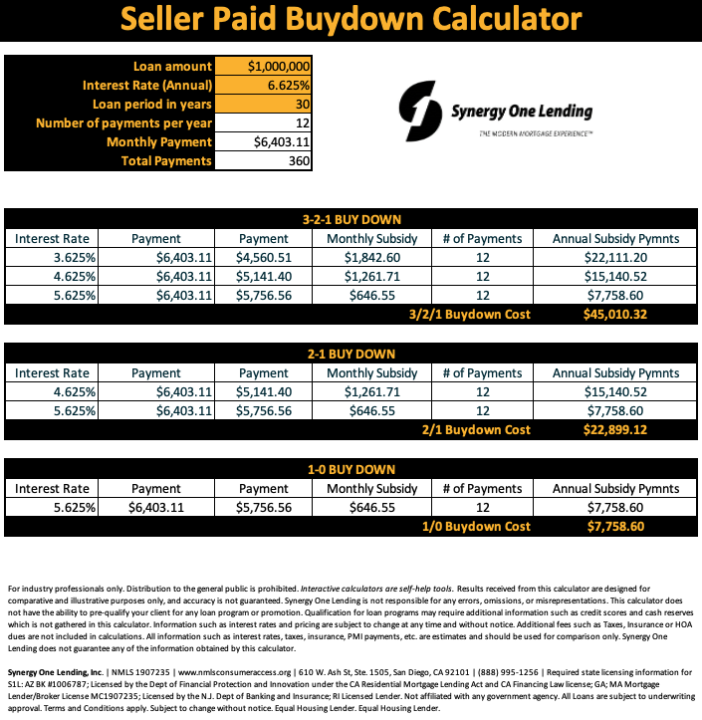

Seller-Paid Buydown

Attached is an estimated illustration of a seller-paid temporary rate buydown—examples include 3-2-1, 2-1, and 1-0 structures. As Ophir has mentioned, this can be a powerful tool for both buyers and sellers. Please reach out with any questions. NMLS #486122

3

0

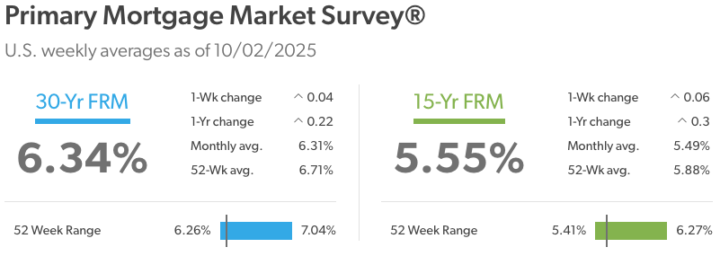

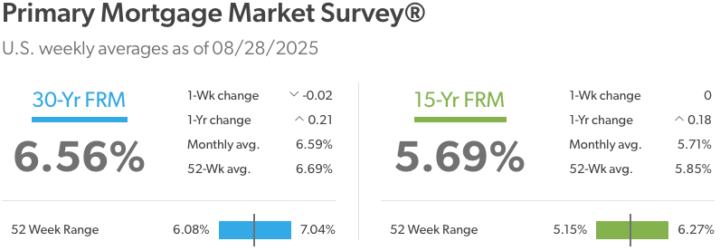

What Determines the Rate on a 30-year Mortgage?

This article from Fannie Mae aims to answer that exact question. If you don't have time to read the full article, below is an AI-generated summary: Mortgage rates are closely tied to the 10‑year U.S. Treasury yield, which reflects investor expectations about short‑term interest rates, inflation, economic growth, and fiscal policy. Even when the Federal Reserve cuts rates, mortgage rates can rise if economic data is strong or inflation remains persistent. Recently, resilient economic performance and inflationary pressures have pushed Treasury yields higher, leading to an increase in mortgage rates. Call me to discuss!

0

0

1-10 of 39

@james-guzik-5994

Not a commitment to lend.

NMLS 486122

https://s1l.com/licensing/

https://s1l.com/privacy-policy/

Licensed to work in: California (CA-DOC486122)

Active 100d ago

Joined Nov 8, 2024

Powered by