Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Hellen

💎 Build income online with Digital products, TikTok & eBay Dropshipping | $29/month Join Billionaire Queen Network today!!

Your step to unlocking multiple income streams and building real, lasting wealth from the comfort of your zone

Memberships

solosisterscommunity

33 members • Free

The Skool Hub

2.7k members • Free

Growth Squad Heroes

124 members • Free

Millionaire Women Collective

9.4k members • Free

Visionary Luxe Learning

79 members • Free

Matching Love Birds Academy

4 members • $20/m

Skool Boss Academy™

2.2k members • $1/month

Ultimate Branding Course

57k members • Free

Digital BOSS Academy!

37.5k members • Free

265 contributions to Billionaire Queen Network

Please read 📚

Here’s a straightforward breakdown of how much TikTok takes from sellers (especially on TikTok Shop): 🛍️ Commission Fees (Main Fee) TikTok takes a percentage of each sale you make through TikTok Shop — this is called the commission fee. It’s charged on the total order value, which often includes the product price plus shipping and platform discounts. In the UK (and many European countries), the standard commission rate is about 9% per order for most product categories. Some categories may have lower rates (e.g., electronics or other specific groups), and promotions or seller missions can reduce this rate temporarily. 💰 Other Possible Fees Transaction/process fees: Depending on payment processing and region, there can also be small transaction fees on top of the commission. If you use TikTok’s fulfilment services (like shipping/storage by TikTok), there are additional fulfilment fees. Introductory or promotional rates: Some sellers get reduced fees (e.g., ~1.8%–5%) when first joining or meeting certain goals — but standard is higher once those offers expire. 📊 Quick Summary (Typical UK TikTok Shop) Fee Type Typical Amount Commission Fee ~9% of sale price (standard) Introductory Discounted Commission lower rates available temporarily (e.g., for new sellers) Transaction Fees small additional fees depending on payment processing Fulfilment Fees (if used) varies by item size/weight 📌 Important TikTok doesn’t charge a monthly subscription just to have a shop — you pay basically only when you sell. Fees are subject to change and sometimes vary by country, product category, and promotional programs. Always check your Seller Centre dashboard for the exact current rates before pricing your products.

DIGITAL PRODUCTS

Day 13: You Don’t Need a Website to Start Selling digital products. You can sell using: WhatsApp TikTok Instagram PayPal or Stripe links Google Drive Start simple. Build as you grow.

1

0

PROMOTION PROMOTION PROMOTION

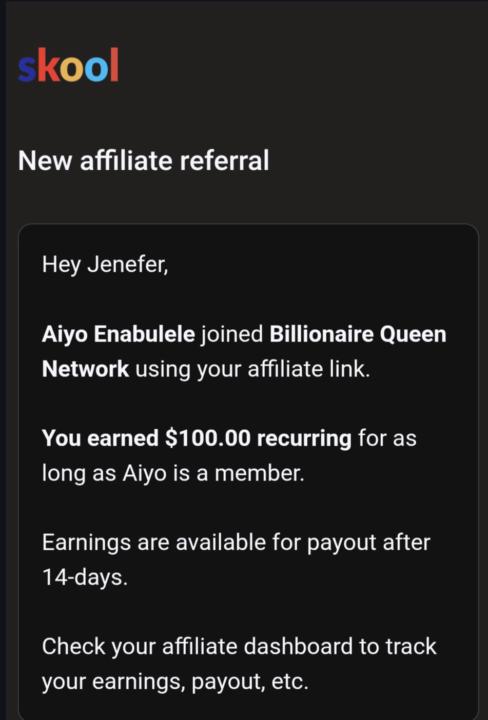

🚨 LIMITED-TIME OFFER – BILLIONAIRE QUEEN NETWORK 🚨 This is your moment to step into financial growth, digital skills, and a powerful women-led community 💎 💼 Billionaire Queen Network is officially on SPECIAL PROMO ✨ Original Price: 💲 $280 (≈ £212) ✨ PROMO PRICE (Now until 19th December): 💲 $200 only 🇬🇧 £150 in pounds 🔥 That’s a huge discount for a network that teaches you how to build income online AND earn as an affiliate. 💎 What you get inside: ✔️ Access to the Billionaire Queen Network community ✔️ Digital & financial education ✔️ Mentorship & accountability ✔️ Affiliate opportunity built in ✔️ Earn while you learn 💰 Affiliate Bonus: Once you join, you become an affiliate 👉 When someone joins using YOUR link, you earn 50% commission That’s $100 / £75 per referral 💸 📆 Offer ends: 19th December ⏳ After that, price goes back to $280 / £212

0

0

Please Read

🚨 IMPORTANT SECURITY NOTICE – PLEASE READ 🚨 Hi everyone, We want to alert you that some members are receiving a FAKE message in their eBay message inbox claiming their account is suspended and asking them to click a link to “verify” their account. ⚠️ PLEASE NOTE: THIS MESSAGE IS NOT FROM EBAY. It is a scam/phishing message designed to steal your personal and account information. ❌ DO NOT click any links ❌ DO NOT enter your login details ❌ DO NOT respond to the message ✅ What to do instead: Ignore and delete the message Report it directly to eBay through your official eBay account Always log in to eBay only by typing www.ebay.com directly into your browser, never through links in messages eBay will never threaten you with 24-hour deadlines or ask you to verify your account through suspicious links. Please stay safe and help protect one another by sharing this message with other members 🙏💙

1

0

1-10 of 265

@hellen-atim-1999

Film Maker | Motivational Speaker |Dropshipping &Digital Products Mentor, Business Coach & A Creator Of Billionaire Queen Network On Skool .

Active 9m ago

Joined Jul 10, 2025

United Kingdom 🇬🇧

Powered by