TAX INFORMATION FOR UK 🇬🇧

✅ For those who are asking if you need to register to pay tax if you made £1,000 on eBay? If your total income from eBay sales is £1,000 or less in a tax year → NO, you does NOT need to register or pay tax. This is because of the UK Trading Allowance (£1,000 tax-free allowance). For those in uk 🇬🇧 ✅ If your sales are over £1,000 Then you must register for Self-Assessment with HMRC and report to report your income. About the eBay money — if you made up to £1,000 in total sales within the tax year, you don’t need to pay tax or register with HMRC. This is because of the UK’s £1,000 Trading Allowance, which lets you earn up to £1,000 from side income tax-free. But if your eBay sales go over £1,000, even by a little, then you will need to and they don't really take much or nothing sometimes depending on what you will answer on the form. 1️⃣ Register for Self-Assessment with HMRC 2️⃣ Report your earnings 3️⃣ Pay tax only on the amount above £1,000 It’s simple and nothing to worry about — I can help you check your total or guide you step-by-step if you need to register. For those in the uk 🇬🇧

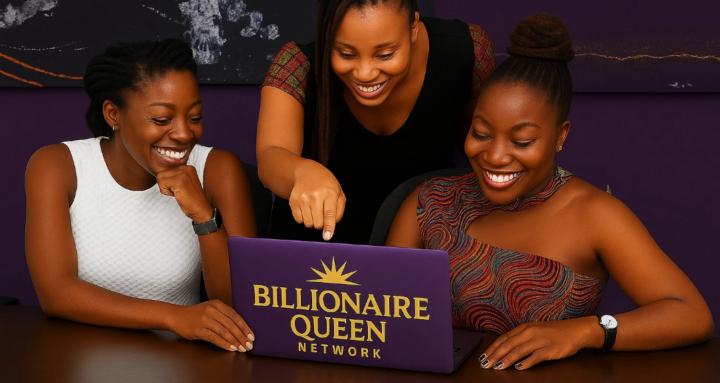

Massive Appreciation to My Amazing

We just wrapped up our weekly Wednesday Q&A Zoom session, and WOW — my heart is so full! ❤️ Thank you to the 17 incredible ladies who showed up today. Your energy, your support for one another, and the way you all worked together as a true team is exactly what makes this community so powerful. Every week you remind me why this space is special — women lifting women, learning together, growing together, and showing up for their goals. 🌱💪 I’m so proud of each of you. Here’s to our amazing community and everything we’re building together! ❤️🔥 ( Billionaire Queen Network community)

Happy Sunday.

Happy Sunday, Billionaire Queens Network Members 👑✨ As we step into a new week, may your mind be calm, your heart be aligned, and your vision be clearer than ever. Remember: God didn’t give you a dream you are not equipped to manifest. This week, walk boldly, speak confidently, and execute purposefully. Your breakthrough is attached to your consistency — keep showing up, Have a restful and blessed Sunday! ❤️

appreciation

Thank Helen Atim for your continuous mentorship. I truly appreciate.

1-30 of 63

skool.com/billionaire-rich-connection-5762

💎 Build income online with Digital products, TikTok & eBay Dropshipping | $29/month Join Billionaire Queen Network today!!

Powered by