Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

62 contributions to TGE

0 likes • Dec '24

Yes! But there is a lesson here. I knew between 607 and 608 was “drunken soldier” territory, but was trying to base my entry in anticipation of it pushing to and through 608. It did as planned, but then retraced back to almost 607. Below 607 was my stop, but it didn’t trigger it, so I stuck to my plan and stayed in. We’ll see what Monday brings us

Masterclass in 10 hours

Get ready to take your skills to the next level!

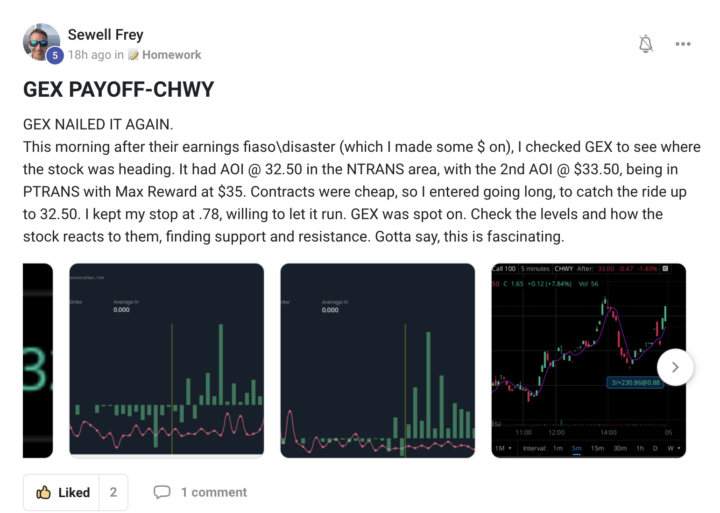

CHWY printing money for this Gextron member

Friends, Gextron makes it extremely easy for you. Find the big bars. Play the levels. Make money.

1 like • Dec '24

Yes it is. That little explanation of gamma gave me insight on something I've been trying to figure out for quite a while. I didn't realize that you add the delta and gamma together to get the option move after the first dollar gain. I was just estimating by strictly the delta. I realize the other greeks play a part also, especially theta, but this helps bring things into perspective. Thanks!

Fun Trading Test: What's Your Strategy Style?

Hey traders! Let’s take a fun quiz to see what kind of trading strategy fits your personality. Pick the answer that resonates most with you for each scenario. Share your results in the comments—let’s see how many scalpers, swingers, and hodlers we’ve got here! 1. The market opens with huge volatility. What’s your first thought? - A. “Perfect, let’s jump in for quick scalps and lock in profits!” - B. “I’ll wait for the dust to settle and see where the trend develops.” - C. “Let’s look at the weekly chart and stick to the plan.” 2. You notice SPY breaking out of a key resistance. What do you do? - A. “Breakout? I’m in and out before you even blink!” - B. “Ride the wave, but I’ll place a tight stop to protect gains.” - C. “Hold steady—it’s all part of the long-term game.” 3. You just had two consecutive losing trades. What’s your reaction? - A. “Brush it off. The next scalp will make it back.” - B. “Time to step back and reassess my plan.” - C. “Losing trades happen; it’s a long journey.” 4. When you look at a chart, what’s your favorite indicator? - A. “Give me the RSI, MACD, and anything fast-moving.” - B. “EMAs and Fibonacci levels help me find my setups.” - C. “Volume profiles and trendlines—I want the big picture.” 5. How do you manage your trades during the session? - A. “I’m glued to my screen, ready to react instantly.” - B. “I check every 15-30 minutes to ensure my trade is on track.” - C. “Set it and forget it—I’ll check back later.”

1-10 of 62

@gwen-scott-4799

I’m Gwen and I’m trying to be the best trader I can.

Active 31d ago

Joined Oct 16, 2024

Powered by