Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Mobility & Injury Prevention

141.7k members • $29/m

Trading Reframe

82 members • Free

12 contributions to Trading Reframe

QuickStrike Tool from CME

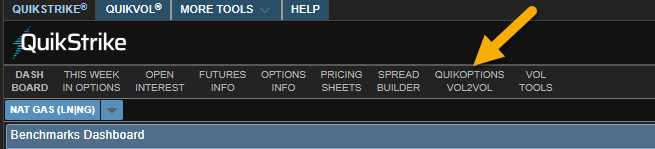

So I mentioned that I get my levels that I use from CME. They have a tool called QuickStrike, which is free, they also have a paid version called Bantix. The free version is just fine for what I use it for. Basically I go out each morning and gather the data from the site (CME QuickStrike ). It does require an account to be created on the CME site and that is also free (register here - midway on the page to register or login). Okay once there I go to Vol2Vol at the top of the screen. Then I Open Interest and grab a screenshot of the graph that is there. I then use that graph to go to ChatGPT. I am looking at the 0DTE, which stands for Zero Days to Expiration, and I select my asset (in my case I use NQ). It automatically defaults to the current day expiration. Next, once I am on ChatGPT I begin to ask it to analyze the image and provide support/resistance levels for the day. I have included a screenshot of what the results look like. Now I have only been using this since Monday, and I have been just playing around with it and getting to refine my data results even better. Whenever I get the levels, I am always using current price at that exact moment. The earlier in the morning the better, the later in the day, the levels become more sparse because contracts are expired or expiring. A really solid time to gather the levels is right around 7:35 to 7:45 AM CST. This typically after any major morning news (NFP, PPI, CPI, etc.) and will usually set the tone for the day. Once I have my levels I plot them on the chart as my key levels. Now, like today for NQ, my levels are set and I can just trade "Level to Level" in accordance with the flow of the market. On heavy trend days, like today when NQ just kept going higher, I may have to adjust the levels to allow for the outlier levels. I will most likely consider doing that in the future, today I did not go back to get new levels.

Trades 12/26/24

Made my target today +25 points. Focused on my trade plan and setups. Reviewed my trades and am satisfied with them. All in all, a good day.

0

0

Get ready for Reframe Games starting in January

2025 can be the year your trading takes off. It's all up to our willingness to put in the right type of work. I want to start strong this year and I will open the reframe games the second week of January (first 10 trading days of January are usually awful). Only open to 4 People. If you are wondering how that works, this is the plan: - You get on a call with me and show me your edge and setups - We build your trading rules. - We make a 30 day plan with realistic goals for you - You send me a daily review of your trades EVERY SINGLE DAY and I give you hints and keep you on track - You send me a Weekly Review and plan for the next week - We measure results after 30 days. This process is the same exact system my coach used on me. I paid thousands of dollars in coaching and I will give it to you for $50. I'll open the purchase first week of January. This is your chance to excel, use this time to really complete your trading plan and rules. Ciao

Headgames

This week I have been really focused on what's rattling around in my brain while I'm trading. Not having any issues reading the charts and identifying areas where I want to trade. I've noticed that, as price moves into my trade zone, I hesitate/freeze. I've noticed this lately and I'm not sure what the issue is. Originally thought it was due to a fear however, the more I observe, I'm thinking it's a subconscious decision to deliberately not take the trade. Not sure if this makes sense but would appreciate any feedback.

The Good, the Bad and the Ugly!

Well today was a day that will burn in my memory for a while. I was in such a solid place this morning; first trade winner winner chicken dinner; up about $200 in trades on 2 other accounts. Until......wait for it.....You guessed it! Trying to force the market to bend to ME damnit! I am the levels master, and I will conquer the market and force it to respect my levels! Only, my silly ass didn't have my levels plotted! Say what? Yep, woke up late, hopped on the charts, took a trade without a single level plotted. Profitable on the first trade, so I then plotted the levels, and started thinking yep, "knew I was right, it's going lower"...Until....wait for it....it didn't! Instead the market said "nope, I'm gonna not just fuck with your headspace, but I'm gonna muck around in your account as well, you think you got this, well market gotta eat too". So yep in a flash, all profits from all 3 accounts gone! Literally, it couldn't have gone faster if I placed on a SpaceX rocket! I went from $150 in profit to down over $500, then down $1100 on the other 2 accounts. In disgust I locked the 2 evals saving myself the additional agony. But no, friends, I did NOT stop trading! I went to the LIVE account! WTF Tamm! You are correct, who does that! Well me for starters, and a person who apparently enjoys pain! So long story short, ended the day at a little over $700 in Live account, that's remaining balance! After starting the day at $3,197....So yes friends, I managed to lose $2300 in a single day! largest loss to date in the last 3 months.... For context I have attached my charts, the trades themselves are too embarrassing even in a "safe space" lol... So what did I learn? First, I have to follow my process (well fuck, I need to put it in place first, I currently don't have any processes that I follow so yeah there's that), Second I must put the guardrails up to lock my account once I do reach my daily profit goal of $150 net, which I had accomplished on the Live I just didn't close the platform) and $450 on the evals (which I was really close to achieving but got greedy chasing it). And third, it's okay to walk away on a losing day, in fact it's imperative to walk away on a losing day or do more damage than good. The walk of shame! Oh the walk of SHAME with a big red scarlet letter on the front on my shirt!

1-10 of 12

@gordon-backman-4454

Inhabitant of plant earth working on a better future.

Active 5d ago

Joined Nov 23, 2024

Myrtle Beach

Powered by