Write something

Waiting is not a waste

Compliment waiting with preparedness not anxiousness.

One spot left for the accountability month challenge

If you want to join in the reframe games we have one more spot left for the monthly accountability program where I will keep you on track for 30 days of trading. We are starting Monday the 20th. Purchase the reframe games in the classroom section to join and book a call with me.

3

0

Are we ready for the games??????

Hello everyone, and happy new year (I'm a little late I know but I disconnected from everything to reset the past 20 days). I am back in the US, ready to start trading again in the next couple weeks going into Trump's inauguration which I think is setting up to be a nice trade opportunity. You can now go ahead and register for the games by buying it in the Classroom section. We'll then setup the intro calls next week and then start the following Monday. ***Remember***: You need to show me your best setups and trading plan rules on the call so I can keep you on track during the 30 days.

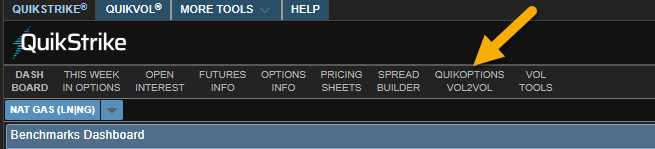

QuickStrike Tool from CME

So I mentioned that I get my levels that I use from CME. They have a tool called QuickStrike, which is free, they also have a paid version called Bantix. The free version is just fine for what I use it for. Basically I go out each morning and gather the data from the site (CME QuickStrike ). It does require an account to be created on the CME site and that is also free (register here - midway on the page to register or login). Okay once there I go to Vol2Vol at the top of the screen. Then I Open Interest and grab a screenshot of the graph that is there. I then use that graph to go to ChatGPT. I am looking at the 0DTE, which stands for Zero Days to Expiration, and I select my asset (in my case I use NQ). It automatically defaults to the current day expiration. Next, once I am on ChatGPT I begin to ask it to analyze the image and provide support/resistance levels for the day. I have included a screenshot of what the results look like. Now I have only been using this since Monday, and I have been just playing around with it and getting to refine my data results even better. Whenever I get the levels, I am always using current price at that exact moment. The earlier in the morning the better, the later in the day, the levels become more sparse because contracts are expired or expiring. A really solid time to gather the levels is right around 7:35 to 7:45 AM CST. This typically after any major morning news (NFP, PPI, CPI, etc.) and will usually set the tone for the day. Once I have my levels I plot them on the chart as my key levels. Now, like today for NQ, my levels are set and I can just trade "Level to Level" in accordance with the flow of the market. On heavy trend days, like today when NQ just kept going higher, I may have to adjust the levels to allow for the outlier levels. I will most likely consider doing that in the future, today I did not go back to get new levels.

Tilt Mode - Activate

So I haven't been in the group for a few weeks. Initially my plan was to stop trading the week of Christmas and not resume until 01.06.2025. That all went by the wayside since I had so much free time on my hands during the holidays. I traded and actually did quite well....until I didn't. I actually ended the year on a positive note, and was actually in profit on my 2 evaluations and was pretty close to reaching my profit target within about 10 more days of trading. Then I mucked up and traded on 01.03.2025 and lost about $1200 in a single day on both accounts, reaching my Daily Loss Limit. Oh well, I thought, just suck it up and get read for Monday! Monday, today rolled around, and I quickly found myself down again! Instead of just stopping and regrouping for the next day, I canceled the accounts and started 2 new accounts! I must literally be nuts at this point! I started the accounts with a much smaller profit target and much lower Daily Loss Limit as well, thinking "okay this will surely help me with my over-leveraging issu". Thankfully I reached my Daily Profit target, but now I feel completely ashamed and embarrassed that I canceled 2 accounts and started new ones when all I had to do was WAIT. The emotional side still gets me at times and I am struggling to control that little monster of greed and FOMO. I did really good for the entire month of December actually. But mentally, I still struggle with accepting a losing day, it's like my mind sees RED/ANGER seeing a net losing day and I find it really hard to just walk away from the charts. So I did sign up for the reframe and I am hoping that the 30 days will help me get this under control better so I am less impulsive in this manner. My other goal is to work on controlling my risk especially when I am in drawdown, that seems to be my other issue over-leveraging when in drawdown. I manage my risk pretty well when I am profitable but as soon as I see red, I start to just go tilt mode. At any rate, I am determined to overcome these issues and keep pushing forward. I made so much progress that now I know the final link is to get my emotions calmed down a bit and lean into my edge more. Looking forward to the Reframe 1x1 and digging into that more!

1-12 of 12

skool.com/trading-reframe-3077

Helping traders with accountability systems and mindset coaching

Powered by