Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Your Next Property in 90 Days

193 members • Free

The Property Plug

226 members • Free

The Trading Cafe

78.6k members • Free

The Trading Academy

2.4k members • Free

DE

DANA ELITE ACADEMY

68 members • $49/m

Trading Reframe

80 members • Free

DANA'S INNER CIRCLE

63 members • $9,997/y

20 contributions to Trading Reframe

Day 3 Reframe Games

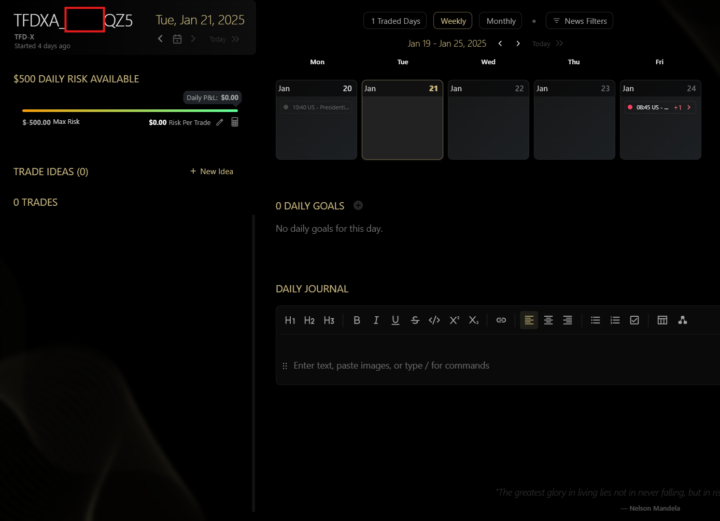

So yesterday I forgot to post my trading, because I did actually trade for a bit. It ended up being a not bad day, but I did incur losses on one account but reached profit target on the second account. I traded today and one account I lost just trading completely wild and I wound up resetting the account, trading and then hitting my daily goal. The second account I completely revenge traded and gave back all my profit, but did not lose the account thankfully. Some things I learned from the past 2 days, I need more time for preparation and to learn how to put together a daily "trade plan". I have a really bad habit of just getting the levels that I use and then kind of winging it. Instead of utilizing "if, then" statements or really formulating a plan based on what the data is telling me. I just look at the levels get a "feel" for where I think the market is heading and then just wing it if something different happens. As an example, this morning I should have sat out trading and waited for the market to pick a direction, instead I traded a lot of chop and got rightfully beat down by price action. Some things I need to work on: - formulating my trading plan for the morning after my analysis is done - write out my plan in the trade journal so that I can have it in front of me while trading - stopping before I reach the Daily Loss Limit, I have to set a Personal Daily Loss Limit and not remove it or change it (which I do quite often) I also need to develop a better routine around my preparation, currently it consists of basically getting my data, plotting that on the chart then waiting for my account(s) to unlock and start trading. Not much in the way of analysis which is hindering my decision making. In addition, I would like to start working on the mental preparation as well, such as visualization or meditation which probably would help improve my thought processes while trading.

No trading to start the week

I decided to not trade the first 2 days of this week, one due to the holiday on Monday and the resulting shortened trading hours, and second due to the inauguration and I figured there may be some rockiness to the market initially. I also instituted a new rule that I shall see how I like over the next 30 days, when I am done trading for the day, regardless of the time, I will lock my accounts until 7:15 AM the next morning. This will hopefully ensure that I am trading while working, that I am not trading overnight (although I love overnight trading, I am usually at work so I shouldn't be trading), and also allow some wiggle room to be ready prior to any new events at 7:30 while finalizing my analysis and preparing my trading plan for the day. My desire is to curb the need to feel like I have to be in a trade just because I am watching the market and also to ensure I am not over trading. I will work on my trading rules, etc. today so that I can post them here in the Reframe area and then look to build from that. I have my 2 main plays but have been working on a third play that I want to start implementing into my trading as well. So for now, no trades have been executed to start the week.

1

0

Let the games begin!

Excited to join the Reframe Games, looking forward to expanding and taking my trading to the next level! @Pietro Riccio will we have the opportunity to do the Reframe Games more than once, or after we complete the first round we would just continue privately with you? Let's get it!

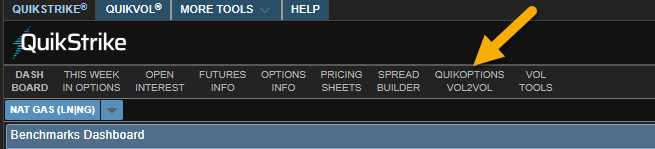

QuickStrike Tool from CME

So I mentioned that I get my levels that I use from CME. They have a tool called QuickStrike, which is free, they also have a paid version called Bantix. The free version is just fine for what I use it for. Basically I go out each morning and gather the data from the site (CME QuickStrike ). It does require an account to be created on the CME site and that is also free (register here - midway on the page to register or login). Okay once there I go to Vol2Vol at the top of the screen. Then I Open Interest and grab a screenshot of the graph that is there. I then use that graph to go to ChatGPT. I am looking at the 0DTE, which stands for Zero Days to Expiration, and I select my asset (in my case I use NQ). It automatically defaults to the current day expiration. Next, once I am on ChatGPT I begin to ask it to analyze the image and provide support/resistance levels for the day. I have included a screenshot of what the results look like. Now I have only been using this since Monday, and I have been just playing around with it and getting to refine my data results even better. Whenever I get the levels, I am always using current price at that exact moment. The earlier in the morning the better, the later in the day, the levels become more sparse because contracts are expired or expiring. A really solid time to gather the levels is right around 7:35 to 7:45 AM CST. This typically after any major morning news (NFP, PPI, CPI, etc.) and will usually set the tone for the day. Once I have my levels I plot them on the chart as my key levels. Now, like today for NQ, my levels are set and I can just trade "Level to Level" in accordance with the flow of the market. On heavy trend days, like today when NQ just kept going higher, I may have to adjust the levels to allow for the outlier levels. I will most likely consider doing that in the future, today I did not go back to get new levels.

Are we ready for the games??????

Hello everyone, and happy new year (I'm a little late I know but I disconnected from everything to reset the past 20 days). I am back in the US, ready to start trading again in the next couple weeks going into Trump's inauguration which I think is setting up to be a nice trade opportunity. You can now go ahead and register for the games by buying it in the Classroom section. We'll then setup the intro calls next week and then start the following Monday. ***Remember***: You need to show me your best setups and trading plan rules on the call so I can keep you on track during the 30 days.

1-10 of 20

@tammy-vickers-6164

LonewolfTrader. Trader seeking other avenues for investment and building long-term financial legacy for my daughter and my wife.

Active 7h ago

Joined Nov 30, 2024

Powered by