Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Retire On Margin

157 members • Free

13 contributions to Retire On Margin

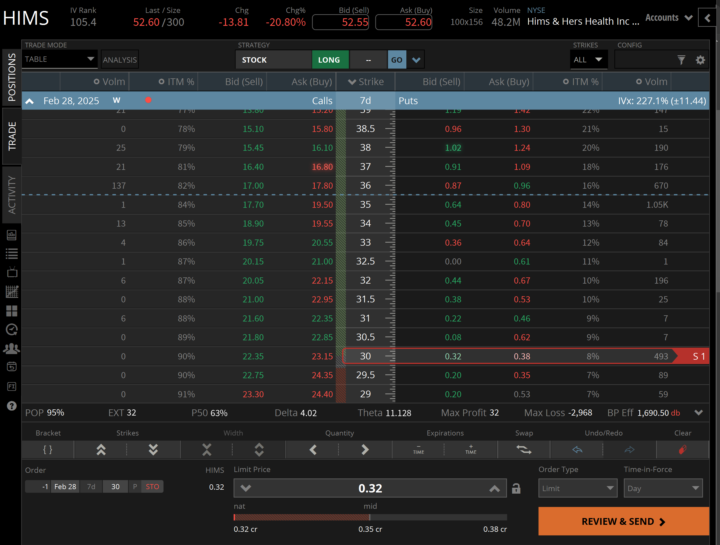

HIMS making $32 in 7DTE at 30 strike 3 ATR.

Hims is down today 20% with earning coming next week. The stock needs to drop 50% to be ITM.

NVDA 110 PUT DTE 44 generating $148 income.

would you have picked a higher strike price?

0-DTE = Just an Engagement Tool?

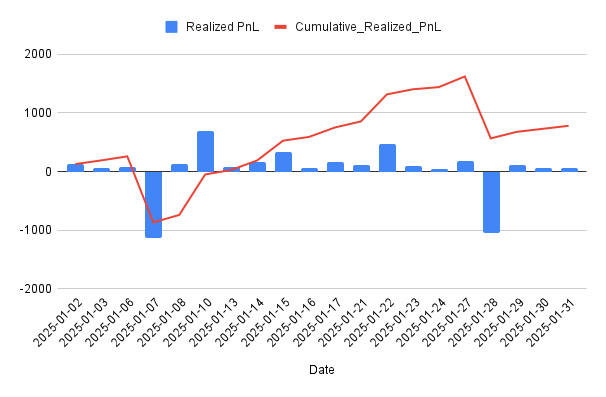

I trade 0DTE SPX options every day, but this isn't where the real edge is. It's just a high-probability tool to stay engaged and collect premium. I took 2 losses on SPX 0DTE in January… but zoom out, and the bigger picture is clear. Selling premium is all about the numbers game. Curious, how do you trade 0DTE here? Are you scalping, holding till EOD, or staying out completely?

1 like • Feb '25

Hi, I don’t do 0DTE, its too unpredictable for me and needs continuous monitoring. Looking at the your P&L and overlaying S&P for the same time duration… I Feel like the loss on 1/7 and 1/28 could have been minimized with narrow stop loss, Direction gauged was also opposite to the trend. Impressive work on 1/10,1/13, 1/24. I occasionally sell puts on SPY Fridays expiring Monday for my weekend booze :)

🔥 02/12/2025 Trade Idea 🔥

Hello everyone, I love panic days. It means volatility is up and I sell options for high income. $475 income on 2 trades in the classroom area as well. Join Us. Today's trade idea - $TSLA - $335.27 - selling $240 puts - $143 income - $9,600 BP - Mar 21st The squeeze is over so theoretically stock will go nowhere and crush all option buyers on both sides for the near future. I take advantage by selling options in that scenario

1-10 of 13