Write something

📉 Healthcare is 2024’s most hated sector. That’s why I’m buying.

Everyone’s chasing AI and semis. Meanwhile, healthcare quietly underperformed the S&P by 30 %+ this year. But here’s the twist: Over 25 years, $XLV (healthcare ETF) has outperformed the market, alongside $QQQ and $XLY. Why? Aging population. Chronic disease. Non-cyclical demand. Do you know what changed? → Sector rotation (Mr. Market’s mood swing) → Post-COVID claim spikes hurting insurers → High interest rates choking biotech funding → Regulatory noise scaring off capital Short-term chaos. But structurally? Demand is compounding. And when capital returns to this sector (it always does), the upside will be violent. I’m not betting on miracles. I’m accumulating high-cash-flow, dominant companies trading at a 30–40% discount. Call me crazy, but I’d rather buy misunderstood resilience than overpriced hype. Healthcare won’t stay cheap for long. Follow me to see what I’m loading up on 👇 #stocks #investing #healthcare #valueinvesting #SP500 #biotech #XLV #UNH #stockmarket #trading #inflation #longterminvesting #financialfreedom

0

0

Warren Buffett, Options Trader? What I Learned in Omaha

Just got back from Omaha. Warren Buffett officially announced his retirement after 60 years. It felt surreal to witness it in person, like the closing of a legendary chapter in investing history. I started out as a pure value investor, inspired by Buffett himself. But over time, I've evolved my strategy. I now combine value investing principles with strategic options trading to get better risk-adjusted returns. Not just theory either. Buffett used options himself. I actually wrote a detailed blog post digging into how Buffett traded options over the years: The Oracle of Omaha's Secret Strategy Curious, anyone else in Omaha last weekend? And more importantly, does anyone here also mix fundamentals/value investing with options strategies?

3

0

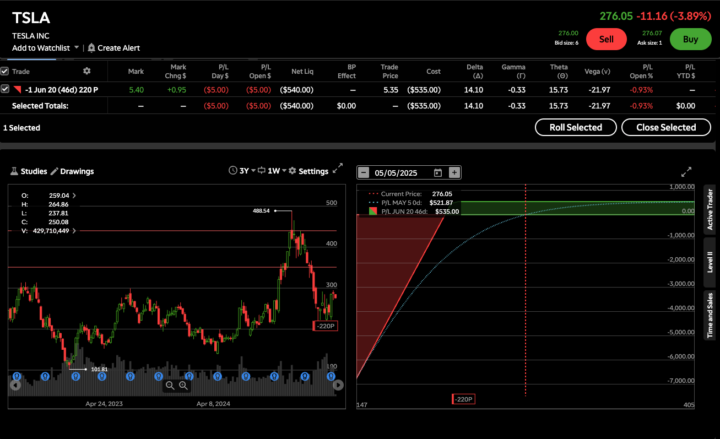

TSLA Trade Idea

Just sold a Cash-Secured Put on $TSLA: Strike: $220 DTE: 46 days Premium: $5.35 ($535 total) Collateral: $22,000 Yield: 2.43% for 46 days (~19.29% annualized) This trade, plus the $142 from $GOOGL, gets me 22.57% closer to my $3000 premium goal for June. June Target ($677/$3000) Happy to own $TSLA at $220 if assigned. If not? I keep the premium! Stay consistent, stay disciplined. #OptionsTrading #CashSecuredPut #TSLA #PassiveIncome #OptionsFlow

1

0

Daily Update

Hello everyone, I haven't posted trades lately because I believe this is a relief rally, and the crash will resume, but that's just my opinion. Markets have been up nonstop for the last 2 weeks, and the more we think a crash is coming, the more up it goes. That's always been the game. Either way, when markets go up nonstop, I don't sell puts that are not worth much, and as mentioned above I also expect a crash to resume, so for now I'm out and waiting. No need to trade by force just because you want to trade. Preservation of capital is more important than growing your capital. Have a good weekend, Ziv

PepsiCo just handed dividend investors and options sellers a rare gift

I normally don't post about individual stocks, but PepsiCo (PEP) caught my attention. Right now: - Dividend yield is around 4.06%, one of the highest in the company's history. - Stock has pulled back from ~$190 to ~$130. - 53 straight years of dividend increases. - Fundamentals are still solid, no obvious collapse in the business. For options traders, it gets even more interesting: - IV Rank is 34.5, which makes options premiums elevated. - This could be a good setup for selling cash-secured puts, or even running the Wheel strategy if you want to build a position. I'm sketching out a few trade ideas now, but curious how are others approaching it? Would you consider starting a Wheel on PEP here, selling puts aggressively, or would you stay away given the broader market risks?

1-30 of 172

skool.com/retire-on-margin-9223

Learn to sell naked puts on Tasty Trade, pay your bills, and retire early. Join "Retire on Margin" for strategies, support, and your path to freedom!

Powered by