Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Options

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Memberships

Option4All

60 members • Free

Imperium Academy™

47.9k members • Free

Risk Management

9 members • Free

Skoolers

190k members • Free

University Of Traders

77 members • Free

PainlessTrader

378 members • $12/year

AI Stock Investing

675 members • Free

HYROS Ads Hall Of Justice

4.7k members • Free

Simple Option Trading

384 members • Free

34 contributions to Retire On Margin

Warren Buffett, Options Trader? What I Learned in Omaha

Just got back from Omaha. Warren Buffett officially announced his retirement after 60 years. It felt surreal to witness it in person, like the closing of a legendary chapter in investing history. I started out as a pure value investor, inspired by Buffett himself. But over time, I've evolved my strategy. I now combine value investing principles with strategic options trading to get better risk-adjusted returns. Not just theory either. Buffett used options himself. I actually wrote a detailed blog post digging into how Buffett traded options over the years: The Oracle of Omaha's Secret Strategy Curious, anyone else in Omaha last weekend? And more importantly, does anyone here also mix fundamentals/value investing with options strategies?

3

0

PepsiCo just handed dividend investors and options sellers a rare gift

I normally don't post about individual stocks, but PepsiCo (PEP) caught my attention. Right now: - Dividend yield is around 4.06%, one of the highest in the company's history. - Stock has pulled back from ~$190 to ~$130. - 53 straight years of dividend increases. - Fundamentals are still solid, no obvious collapse in the business. For options traders, it gets even more interesting: - IV Rank is 34.5, which makes options premiums elevated. - This could be a good setup for selling cash-secured puts, or even running the Wheel strategy if you want to build a position. I'm sketching out a few trade ideas now, but curious how are others approaching it? Would you consider starting a Wheel on PEP here, selling puts aggressively, or would you stay away given the broader market risks?

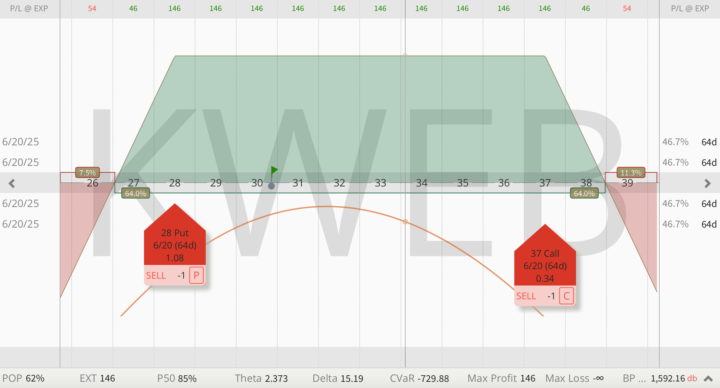

Trade Idea of the Day: Skewed Strangle on KWEB

Hey everyone! Just wanted to share my top trade idea from today, something that might be especially interesting for small accounts. I opened a skewed strangle on KWEB. With IV Rank at 44 (thanks to China tariff headlines), the implied volatility looks overpriced again, as it often is with this ETF when compared to its historically low realized vol (see my research). Here's the setup: Collected $150 in premium. 85% chance of keeping 50%. No earnings risk. Tons of flexibility if adjustment is needed. I love KWEB for short premium plays — underrated but juicy. Let me know if you want more details or how I might manage this going forward?

3

0

77% Returns in 2024 with Conservative Options Strategies

In 2024, I achieved 77% returns with a very conservative options portfolio, focusing on strategic setups and managing risk through asymmetric opportunities. No speculation, just disciplined and calculated trades. In my latest video, I break down: - My annual performance and how it compared to the market - The trades that worked (and the ones that didn't!) - Key lessons from navigating a volatile year You can watch the full breakdown and see how a strategic, conservative approach can deliver results: https://youtu.be/RJChiEsGClA?si=vaH2CRwZvCkHy1pS What's your biggest trading goal this year?

2 likes • Apr '25

Hey, the market took a brutal hit. S&P 500 and Nasdaq both got slammed, and volatility spiked. A lot of traders went quiet, but not here. I just dropped a new video where I break down what happened, how my portfolio handled the chaos, and why staying consistent really matters. I'm sharing it all for transparency. March 2025 Conservative Options Portfolio update:

Fun fact for April Fool's Day today

Fun fact for April Fool's Day today: When a storm approaches, cows try to run away from it. They end up staying in the storm longer. Buffaloes instinctively run into the storm, facing it head-on and getting through it faster. And that's exactly how short premium traders should face volatility. We don't avoid the storm. We charge through it. 🐃 Be the buffalo.

3

0

1-10 of 34