Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Retire On Margin

157 members • Free

6 contributions to Retire On Margin

Sold - $13,000 Profit!!!

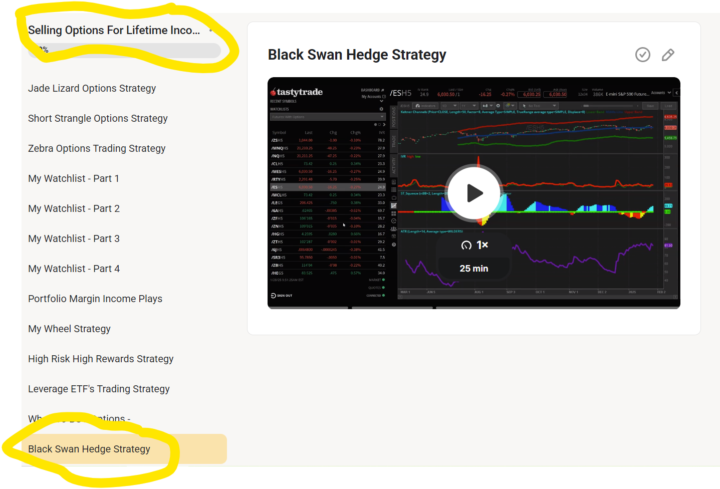

The feeling of winning in a bear market is much more intense than regular wins. The regular monthly hedge just closed. Black Swan Quarterly Hedge is open for 90 days which I teach you in the classroom course. If you don't have hedges, you are long only, and you won't survive long term. Take the course, watch the videos, and win. Ziv

My $10,000 Week Profit

Happy weekend, I have 2 hedge trades that are crushing it this past week. One is $555 SPY puts cost me around $500 and worth over $10,000 as of Friday's closing (2 contracts) I also have a black swan hedge trade and if $SPY breaks $500 in the next 85 I can seriously see this bet turn into $100,000 profits. Yes, I also have 7 open trades that don't look good but those 2 hedges cover everything and much more. If you don't know how to hedge, check the classroom area and take the course. That one video of 25 minutes could change your financial life. (plus all other trade strategies I do) Surviving long-term means you have to win during bear markets and this is my way. Now, I will close the $555 puts tomorrow morning because I think a small relief rally will come in once SPY touches $500 as many algo auto buys will kick in. This could fade real quick but just in case I'll lock in a 10k profit and be happy. The real money comes from the black swan hedge that happens every couple of years and it's better to be prepared than lose everything if your strategy is long only. Check the classroom area, take the $297 one-time-only course, and learn how to hedge for times like this. All the best, Ziv

I Made $8,000 This Month

Happy weekend, This 25-minute video saved me during 10% correction. I give you two trading strategies for market crashes in the options course. One will make a lot of money when SPY is under $500. The other made me all the losses and then some from this month. If you lost money this month and didn't know about this strategy you can join the course and be educated for next time. It's a simple strategy that makes up for all my monthly losses. This alone saved me from a big drawdown and I'm happy to share it with you. Join the classroom - selling options for a lifetime income course. I'll see you next week where we keep selling options for lifetime income. Ziv

🔥 02/26/2025 - $200 Trade Idea 🔥

How's everyone doing? I just posted a $200 income play with 12 days to expiration and 8K buying power. Theta decay was too good to ignore. I don't think we are in the clear by any means, I think there's tons of leverage that needs to be flushed out in crypto/yieldmax and stocks in general but markets don't go down nonstop, they also go sideways so this too will pass. Remember, I sell monthly options with 40-60 days to expiration for that reason. So if we do crash like we did the last couple of days there are still 3 plus weeks for the market to give us some up or sideways days and we should be good. Let me know your thoughts and check the trade idea in the classroom area. Ziv

Buying Puts for Protection: The Brutal Truth

Ever wondered what happens when you try to buy 10-delta SPY put options (45 DTE) for protection? This backtest tells the brutal truth: it's a money drain, causing horrible capital erosion. In my upcoming Black Swan Hedge post, I'll show you why traditional hedging is so expensive and inefficient, and why you need a smarter strategy to truly protect your portfolio.

1-6 of 6

Active 157d ago

Joined Feb 20, 2025

Powered by