Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

5-Minute Futures

7.4k members • Free

25 contributions to 5-Minute Futures

The biggest mistake i see futures traders making

When I first started algotrading futures I'd watch my algos And I noticed that they'd trade about 5 times a week But sometimes algos would buy at the top, and go short at the bottom. I'd think to myself: "Man, these algos get in at the EXACT wrong time. I can trade better than THAT." So I'd load up a chart on the side, and when I saw an algo take a bad trade... I'd reverse the position. "wow I just avoided a -$1k loss by overriding the algos." I kept at it, glued to the screen for hours every day. Scalping little wins here and there. +$50, +$100 per win I kept my losses small, and as soon as I saw money on the table...I'd take it. "I'll never go broke by taking profits" I'd say to myself. This scalping style of trading was so time consuming though. I'd be out and about, and instead of being present with my friends and family...I'd be checking the markets on my phone. But by the end of the week, my 20+ hours of work had paid off. I had out performed the algos by +$2k! At 40 hours a week, thats $16k/mo! I can be a full time trader! I continued at this for months, but after 6 months of grinding away...I noticed that for some reason My account wasn't growing as fast as if I had just left the algos alone. But then I looked at the commissions & fees... My trade count: 6677 Algos trade count: 50 At $3 commission per trade, I had lost -$20k in FEES ALONE. My stomach dropped like a stone. All that hard work, 1000s of hours I sacrificed. All to just break even. No, actually I lost money because the algos were up on the year had I left them alone. I was kicking myself. How could I be so stupid. You see, scalping made sense to me when I was working as an employee in corporate America. I was used to a steady paycheck biweekly. But trading doesn't work this way. Its simple statistics. Most of the returns come from outlier days. I was seduced by the high win rates of scalping. But in reality, scalping strategies cost 100x more in fees. The win rate was a vanity metric, I didn't care about have a high win rate anymore..

Our short bots have been printing

S&P500 - ES Strategy Name: Dragon Short @ $5780 S&P500 dropped to $5624 156 point move $7,800.00 profit per contract

Gold Bot!

This is one of our algos that trades Gold futures. It has been CRUSHING on this recent move in Gold to $3,000+. Just one of the ways the portfolio is diversified.

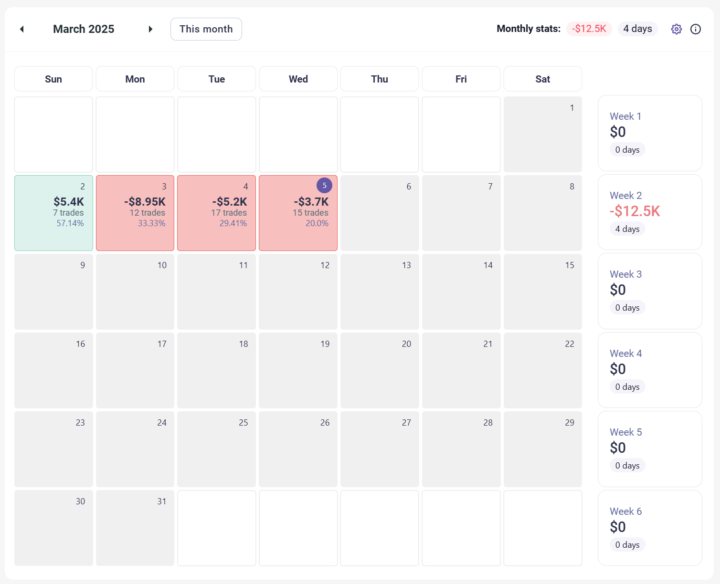

How March is going so far... (-$12,452.90)

Hey traders! Just sharing some real-world data from my algo's recent adventure in the markets. My algorithm has been on quite the rollercoaster this week - 41 trades executed with some seriously impressive swings - Current score: -$12,452.90 (just a temporary setback in the grand scheme) - Average winning trade: $1,404.47 (when it wins, it WINS) - Average losing trade: -$1,254.29 (notice winners are bigger than losers - that's actually textbook!) The highlight reel includes a MONSTER $4,705.20 win! Sure, there was that one outlier loss, but that's what makes the game interesting, right? Average hold time of nearly 12 hours - because my algo is playing chess while others are playing checkers. It's not about quick scalps; it's about strategic positioning! As of right now, the win rate is (34.15%) in March, but remember - even the best traders in history don't win every time. It's all about the long game and having those winners outpace the losers. Anyone else's trading bots (or trading accounts in general) going through their "character development" phase this March?! 🤖📈

1-10 of 25

Active 99d ago

Joined Oct 1, 2024

Powered by