Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Checkmate The Matrix

554 members • $25/month

9 contributions to Checkmate The Matrix

Sovereign Debt Negotiator path of liberation updates

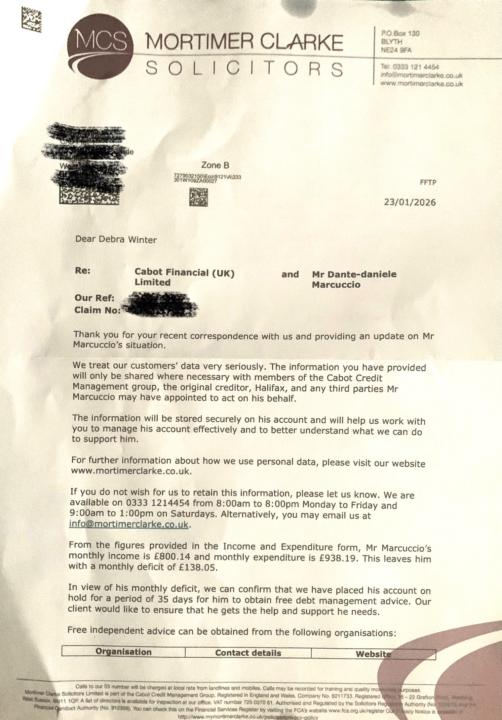

Having sent the letters to Cabot and their associated Solicitors Mortimer Clark the following response received from them. I am preparing to respond with a letter backing up the authority of the sovereign debt negotiator path and possible amend the income expenditures details. Process is successfully working with other companies.

Andrew Bridgen on the total corruption of Westminster

https://youtu.be/mpRqxxqZVeI?si=QRVmoY1mV3DDsUoa

2

0

Nearly broke my arm

I dug up the old pond at the allotment, caught my arm between the fence and the pond base when I threw it over the fence,😭🦴ouch

Why Using a Private Financial Advocate Is 100% Lawful

And Often Better Than IVAs or Debt Management Plans In a world where debt relief often comes with hidden costs, fear-based tactics, and long-term damage to creditworthiness, many people wrongly assume that their only options are: - Signing up to a regulated IVA or DMP, - Dealing with their creditors alone, - Or simply avoiding the pressure altogether. But there is another option — and it is completely lawful, effective, and backed by the Financial Conduct Authority (FCA): Appointing a Private Financial Advocate under a Limited Power of Attorney (LPOA) to represent you, freeze interest, stop harassment, and negotiate fair, affordable terms. This model is not "debt avoidance" or deception — it is lawful delegation, used widely in many settings.

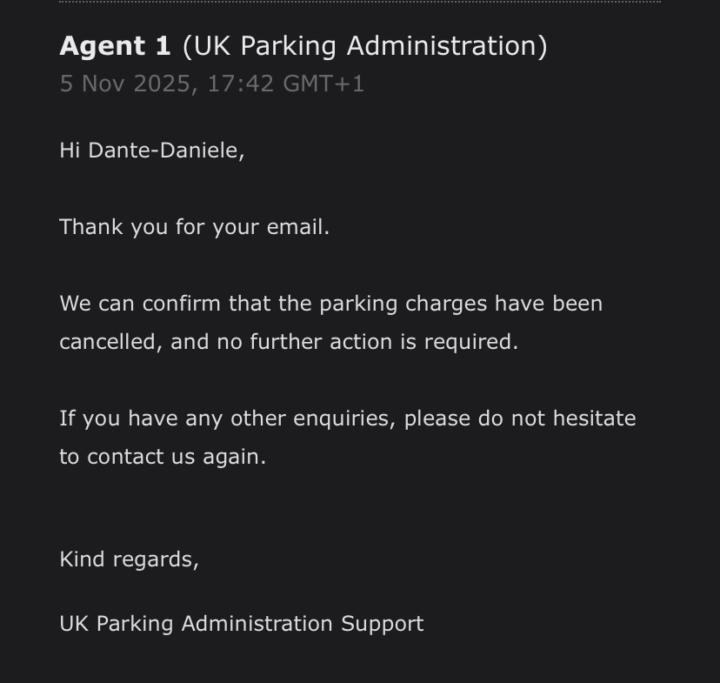

PCN FINES, THEN FINAL NOTICE OF £100

A new parking administration company took over the parking of a commercial area near my flat and started issuing parking fines for unauthorised access to the area. I made an appeal and explained I was a resident and had been for three years! I explained that I had exemption with the previous company, and had sought to get on an exemption list via the local businesses. They ignored the appeal and issued two more fines, these went to final notice before action. Thanks to this group/community and the tools here I sent them an email initiating a SAR request. Upon receiving the email, they replied revoking the total of £300 over three fines in their entirety. Gratitude to the team, and thanks for the support.

1-9 of 9

@dante-daniele-marcuccio-7301

"HUNA MA NI KAI" KUMARA DRAGON MASTER OF LEMURIA

Active 5d ago

Joined Apr 19, 2025

Yorkshire

Powered by