Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Clay

Welcome to the Land Flipping Network. 🚀 Free Community to help you start, build and scale a highly profitable land investment business.

The Landman Community is a private, operator-level environment for land investors who want to scale with capital, systems, and real execution support.

Memberships

Land Flipping (Wiener Bros)

4.3k members • Free

Dirt To Dollars

1.8k members • Free

AI Automation Agency Hub

291.1k members • Free

Coaching Inc.

160 members • Free

Results Driven® Community

5.1k members • Free

Billion Dollar CEO

126 members • Free

Land Closers Academy

1.2k members • Free

Land Conquest - Land Investing

5.9k members • Free

Sagan Passport

646 members • Free

221 contributions to Land Flipping Network

Most people bringing in $1MIL+ in land are in a prison, here is the ideal business:

- 4 to10 total team members - $500K–$1.5M/year from flips - 4 high-quality subdivides/year ($250K–$1M) - One core channel + one secondary - 90–120 day cash cycles - <10% dependency on the founder Gets you to $2Mil+ with 60%+ margins and a life.

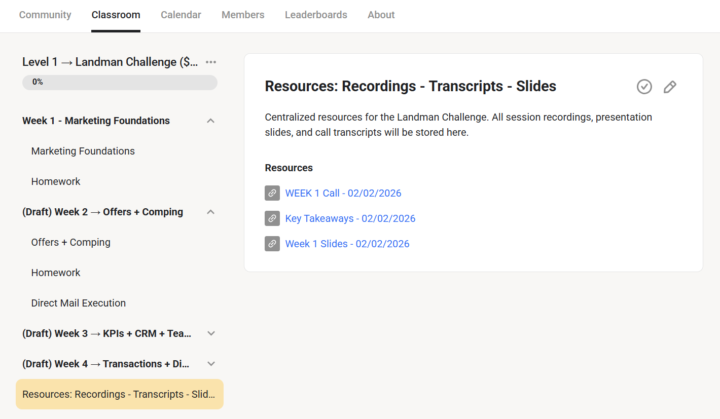

Challenge Members: 🎥 Call Recording Is Now Available!

The recording from yesterday’s session is now available. You’ll also find: - ✅ A document with all the key takeaways and highlights from the call - 📊 The slides that were used during the class If you missed the live session or want to revisit the most important concepts, this will help you quickly catch up and reinforce what matters most. We recommend reviewing the highlights first, then watching the recording with the slides open.

📣 For all Landman Challenge members

Please check all of your email inboxes (including spam and promotions) — you should have received a direct invitation to join our Slack channel. If you need any support or didn’t receive the invite, leave a comment below and we’ll help you out.

1-10 of 221