Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Duy

From zero to first $1k/month with AI automation in 30 days. Get the exact formula + templates that landed 100+ their first client.

Memberships

SW Automation

7.5k members • Free

N8nLab

5.7k members • Free

Automation Masters

3.7k members • Free

AI Masters Community with Ed

11.4k members • Free

The RoboNuggets Network (free)

28.3k members • Free

The AI Advantage

73.8k members • Free

Ai Automation Vault

15.5k members • Free

AI Workshop Lite

15k members • Free

Ai Titus

893 members • Free

205 contributions to AI Automation Society

Said No to 10% Equity - Took 3% Revenue Share - Made $168K Year One 🔥

Healthcare startup offered 10% equity valued at $300K on paper. Took 3% revenue share instead. Made $168,000 cash year one. Still collecting monthly. No vesting. No exit dependency. THE OFFER: Building clinic management platform. Needed patient intake automation built. Founder pitch: "We're raising Series A next quarter at $3M valuation. 10% equity for you. That's $300K value for the automation work." Sounded amazing. Until I did the math. THE EQUITY MATH: 10% of $3M = $300K valuation But: - IF they raise at $3M (valuations fluctuate) - IF I vest (2 year cliff, 4 year total) - IF they exit (5-7 years minimum, 50% of startups fail) - IF my shares aren't diluted (Series B, C will dilute heavily) My cash flow year 1-2: $0 My guarantee: Nothing THE ALTERNATIVE I PROPOSED: Me: "What if I take 3% of revenue from the intake automation feature instead?" Them: "Revenue share? That's unusual for contractors." Me: "Your intake volume is going to 10X this year as you add clinics. 3% of growing revenue beats static equity. Plus I need cash flow, not lottery tickets." THE DEAL STRUCTURE: Payment terms: - $10,000 upfront for initial build - 3% of monthly intake automation revenue (billed monthly) - Tiered scaling as volume increases - No equity, no vesting, no exit dependency YEAR ONE PERFORMANCE: Upfront payment: $10,000 Revenue share monthly: - Month 1-3: $4,200/month (initial rollout to 2 clinics) - Month 4-8: $12,400/month (expanded to 8 clinics) - Month 9-12: $18,600/month (full 15-clinic deployment) Total year one: $168,000 cash collected Their equity: Still private company. Still worth $0 in cash terms. YEAR TWO (CURRENT): Revenue share: $18,800-$19,000/month (at my cap, maintaining) Total collected over 2 years: $336,000+ That "small" revenue share already paid more than most equity would in 10 years. THE PROTECTION CLAUSES I NEGOTIATED: - Monthly payment (not annual lump sum - maintains steady cash flow) - Revenue-based calculation (not profit-based - can't hide in accounting)

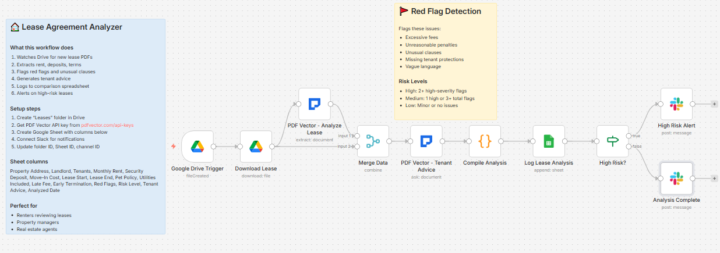

Lease Analyzer Found 4 Red Flags Before I Signed (9 Nodes) 🔥

New apartment. Landlord sends 23-page lease. Standard form, he says. Sign here. Built lease analyzer. Found 4 red flags. Including early termination penalty buried on page 17. THE RENTER'S BLIND SPOT: You need the apartment. You're excited. You sign what they give you. $2,400 early termination fee. 60-day notice requirement. Landlord can enter with 12-hour notice. All buried in legalese. THE DISCOVERY: Dual document extraction. First call pulls structured terms. Second call generates tenant advice. Same pattern as contract review. But optimized for renters. THE WORKFLOW: Google Drive trigger → Download lease → Document extraction pulls rent, deposit, terms, pet policy, termination clauses, red flags → Merge combines with binary → Second extraction generates tenant advice → Code calculates move-in costs and risk level → Sheets logs analysis → IF checks risk level → High risk: Alert channel → Normal: Completion notification. 9 nodes. Tenant protection automated. THE RED FLAG DETECTION: Extraction looks for concerning clauses. Returns array with severity: High, Medium, Low. Code determines overall risk: - 2+ high severity flags → High Risk - 1 high OR 3+ total flags → Medium Risk - Otherwise → Low Risk THE TENANT ADVICE: Second extraction prompt: "Summarize this lease for a tenant. What are the top 3 things to negotiate? Is this tenant-friendly, neutral, or landlord-friendly? What warnings should I know?" Natural language advice. Not just data extraction. THE MOVE-IN COST CALCULATION: Code adds: First month rent + security deposit + any fees = total move-in cost. No surprises on signing day. THE TRANSFORMATION: Before: Sign and hope. Discover problems when moving out. After: Every lease analyzed. Red flags surfaced. Negotiation points identified. THE NUMBERS: 23-page lease analyzed in 45 seconds 4 red flags identified $2,400 early termination fee discovered Move-in cost calculated automatically Template in n8n and All workflows in Github

Rejected 73 Prospects Year One - Built Business on the 10% 😱

Said yes to everyone year one. Any industry. Any problem. Any budget. Result: $27,600 revenue, burned out by month 6. Year two: Rejected 73 prospects. Focused on 10%. Revenue: $51,200. THE MISTAKE EVERYONE MAKES: Desperate for revenue. Said yes to everything: - Podcast workflow automation - Social media scheduling - E-commerce inventory - Newsletter tools - CRM setup - Random Zapier requests 11 different industries. 23 clients. Generic solutions. Price competition. Constant context switching. THE MOMENT THAT CHANGED EVERYTHING: Tuesday morning. Email: "Can you automate our podcast editing workflow?" Me internally: "I have zero experience with podcast production." Me externally: "Sure, I can figure it out." Spent 40 hours learning podcast tools. Built mediocre automation. Made $800. Got zero referrals (wasn't actually an expert). Same week: Turned down invoice processing inquiry. "Too busy with podcast project." That invoice inquiry went to competitor. Became $18,000 annual contract. I chose $800 podcast project over $18,000 invoice contract because I couldn't say no. THE NEW CRITERIA: I ONLY say yes to: - Document-heavy workflows (my actual expertise) - Recurring monthly volume (ongoing revenue, not one-time projects) - Industries with tight networks (healthcare, legal, accounting, real estate) - Budgets over $3,000 setup (serious buyers, not tire-kickers) Everything else: Polite decline + referral to better-fit consultant. THE RESULTS: YEAR 1 (saying yes to everything): - Clients: 23 - Average project value: $1,200 - Industries: 11 different - Referrals generated: 3 total - Revenue: $27,600 - Mental state: Burned out YEAR 2 (rejecting 90%): - Clients: 8 - Average project value: $6,400 - Industries: 3 focused (healthcare, legal, real estate) - Referrals generated: 19 total - Revenue: $51,200 - Mental state: Sustainable WHAT HAPPENED WHEN I SPECIALIZED: Referrals exploded: - Healthcare attorney → referred 3 other healthcare attorneys

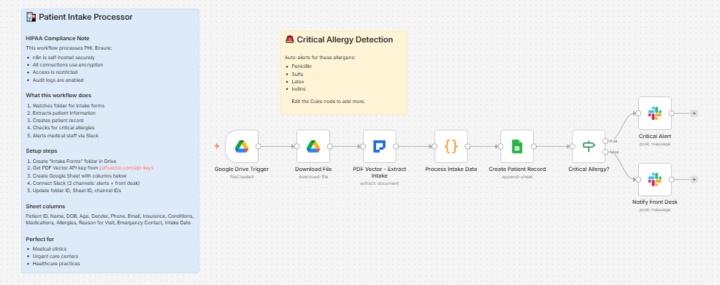

Patient Intake Processor Alerts on Critical Allergies Instantly (8 Nodes) 🔥

Medical clinic. Patient fills intake form. Someone types it all into system. Allergy information buried on page 3. Built intake processor. Critical allergies trigger instant alert. Different Slack channel. Staff knows immediately. THE HEALTHCARE DOCUMENTATION RISK: Penicillin allergy on form. Nurse doesn't see it until patient is in room. Doctor almost prescribes it. Near miss. Documentation existed. Wasn't surfaced fast enough. THE DISCOVERY: Document extraction pulls complete patient information. Code checks allergies against critical list. Different routing based on severity. Critical allergies go to urgent channel. Everyone sees it. THE WORKFLOW: Google Drive trigger watches intake forms → Download PDF → Document extraction pulls patient info, insurance, medical history, medications, allergies → Code processes and checks for critical allergens → Sheets creates patient record → IF checks critical allergy → TRUE: Slack urgent channel alert → FALSE: Slack routine intake notification. 8 nodes. HIPAA-aware design. THE CRITICAL ALLERGY DETECTION: Code maintains critical allergen array: penicillin, sulfa, latex, iodine, aspirin, nsaids. Patient allergy list checked against array. Any match triggers urgent routing. Different Slack channels: #critical-alerts vs #patient-intake. Staff knows the difference. THE DATA EXTRACTION: JSON Schema captures: Patient info (name, DOB, contact), insurance details, medical history, current medications with dosages, allergies with reaction severity, emergency contact, reason for visit. Code calculates age from DOB. Formats medications list. Flags "NKDA" if no allergies. THE TRANSFORMATION: Before: Manual data entry. Allergy information buried. Near misses happen. After: Automatic extraction. Critical allergies surfaced instantly. Staff prepared. THE NUMBERS: 200 intake forms monthly 6 critical allergens monitored Instant alert on match Data entry: 15 minutes → 2 minutes review HIPAA NOTE: Self-hosted n8n recommended for PHI.

50% of B2B Invoices Automated by 2025 - Are You Early or Late? 🔥

Industry research shows 50%+ of B2B companies will have automated invoice processing by 2025. You're either positioning early or scrambling late. No "on time" anymore. THE ADOPTION CURVE: 2020: 12% of B2B automated 2022: 23% automated 2024: 38% automated 2025: 50%+ projected We crossed the chasm. Early majority is implementing NOW. THE CLIENT WHO WAITED TOO LONG: Met them in 2023: "We'll consider automation next year. Not a priority right now." Their competitors automated in 2023. By late 2024: - Lost 2 major accounts (competitors processed orders 3X faster) - Couldn't hire qualified AP staff (nobody wants manual data entry jobs) - Vendor relationships damaged (consistent late payments) - Scaling impossible (hiring couldn't keep up with growth) Finally implemented December 2024. 18 months behind competitors. Market share already lost to faster processors. THE POSITIONING THAT WINS: Before: "Would you like to automate your invoice processing?" Response: "We'll think about it." After: "50% of your industry will have automated invoices by end of 2025. Your competitors are implementing now. Want to be ahead of the curve or behind it?" Response: "Let's discuss implementation timeline." USING INEVITABILITY IN SALES: Don't sell automation as optional upgrade. Position as inevitable industry shift they must navigate. "The market is moving to automated invoice processing. I help companies implement before their competitors close the gap, not after." CURRENT PIPELINE: - Prospects actively evaluating: 8 - Primary buying trigger: Competitor pressure (5), Staff retention crisis (2), Scaling requirements (1) - Average deal: $5,800 setup + $480/month - Close rate with inevitability positioning: 62% - Close rate with features/benefits positioning: 38% WHAT HAPPENS TO LATE ADOPTERS: Competitive disadvantage: - Slower order processing - Higher error rates - Can't scale without hiring Talent retention crisis: - Can't attract qualified staff - High turnover in AP roles

1-10 of 205

@duy-bui-6828

Built automation systems doing 20K+/mo. Now helping automation builders get first clients FREE at https://bit.ly/skool-first-client

Active 4h ago

Joined Aug 2, 2025

Ho Chi Minh City

Powered by