Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Checkmate The Matrix

552 members • $25/month

15 contributions to Checkmate The Matrix

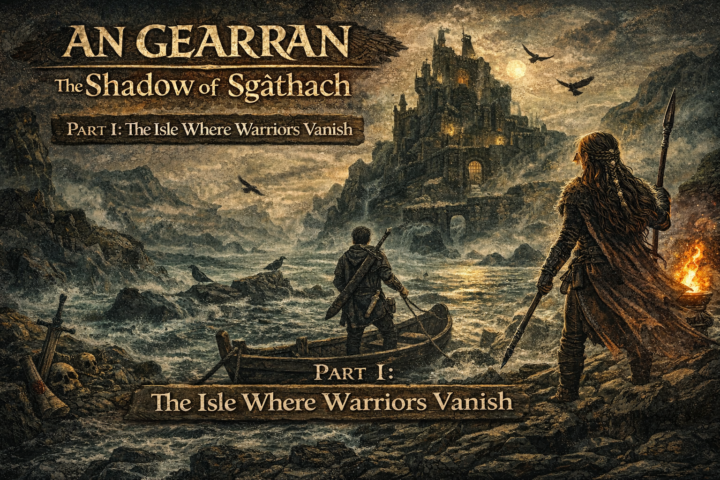

AN GEARRAN – “The Shadow of Sgàthach”

Month 2 of the 13 Lunar Cycles. i hope you enjoy it

A Blessing for Faoilleach

May the coming moon find you ready, and Faoilleach hold you steady. May the Wolf Moon guard your journey ahead, and the frost carry wisdom, not dread. May winter strip away what no longer serves,and temper your spirit as iron is forged. May the silence teach what words cannot, and the long night leave you stronger for its passing. Walk gently through the cold. The old ways are watching. Peter

TV Licence Removal Notice

This is the notice that i sent to the bbc, i got a letter back saying thank you for letting us know that you don't watch bbc or words along those lines, they never mentioned the other points i raised🤣 But i have never had a tv licence for many years now, however we do not wact tv anyway, we have no tv ariel, nor any satelite dish (not even the type that spins around chasing the sataloons at 2000 mph around the spinning ball that somehow breached the firmament🤪)

9 likes • Dec '25

Brilliant letter. I've not paid for over 10 yrs, still get a letter every 2 yrs asking if I need one. I just withhold my phone number and ring them saying NO and only give them their ref number, and no details of me. They usually send another letter a week or so later, saying I don't need a licence and they will check again in 2 years !!

2 likes • Dec '25

Congratulations on becoming a castle 💪, with all the messages on this thread, I'm catching up fast 😉😁. I had my first experience in a court a few days ago (supporting a fellow team member), and I'm so NOT a court demon slayer, most of it went over my head. There is brilliant info in the group, and I am learning a lot, although I haven't heard of Dave's banker bot (I need to find out about that), I will have to message him.

Unbankfreedom

Just come off phone with Trustfy https://app.trustyfy.com?by=101iia set up a business account which takes payments from all over the world and converts to ££ take the middle man out and overreach by gov bodies go have a look 😊

1-10 of 15

@carole-gimson-8078

I went into nursing and midwifery from leaving school, then woke up to the problems with allopathy 30 years ago and trained as a registered homeopath

Active 32m ago

Joined Sep 11, 2025

Powered by